Investment Strategies

What Might Be In Store For 2023?

The authors of this article look at what 2023 might have in store, and reflect where surprises might come from. This is part of a series of articles we will be carrying that look at the investment field as the new year gets underway.

This is a time of year when firms try to work out the

possible shape of the investment world in the coming 12 months.

The following commentary comes from WELREX investment director

Stephen Ashworth and director John Longo. London-based WELREX, is

a digital investment management platform. The editors are pleased

to share these insights and invite responses. The usual

disclaimers apply. Email tom.burroughes@wealthbriefing.com

The headlines – We may be seeing peak uncertainty heading into

2023.

-- Stocks will retest lows in 2023 and volatility will he

high – be ready;

-- Bonds and cash can now offer some real yield

opportunities;

-- Inflation will be stickier than expected as it falls back

to more normal levels;

-- Interest rates may be close to their peak but will stay

higher for longer; and

-- Alternative strategies are key to positive returns in

2023.

As we end a tumultuous year for investments, we can look forward

to what 2023 might bring. There remains much uncertainty around

the macro environment and how asset prices might respond. With

uncertainty comes risk but also opportunity. Last year

saw the worst collective performance for bond and equity

portfolios since the 1930s.

Traditional 60/40 portfolios failed to deliver, and whilst bonds are now at arguably more attractive levels, it is far from clear whether bond pricing will exhibit any real decorrelation from equities. Overall, uncertainties mean higher volatility and alternative thinking is more likely to deliver positive risk adjusted returns.

Alternative thinking means seeking out investments whose returns

are properly decorrelated from each other. Traditionally

investors might consider private assets which, on paper, can

deliver some decorrelation in returns, but there is a huge

valuation gap between publicly traded and private assets right

now and this gap will have to correct – so private assets should

be off limits for a while.

WELREX prefers alternative strategies using listed instruments,

hedged, trend-following and systematic strategies that are

designed to deliver absolute returns. These should make up a

larger allocation in portfolios than usual.

One of the key drivers of asset prices in 2022 was the rapid and

material adjustment in the expectations for interest rates. Real

rates jumped up to positive territory driving a negative knock-on

effect for valuations. Fundamentally, the rate adjustment upwards

and away from the artificially low rates post the global

financial crisis was always going to happen. Post-Covid supply

chain problems and geopolitical tensions following the Ukrainian

conflict created the catalyst for a return to inflation,

necessitating the start of higher interest rates. Whilst rates

and inflation may have peaked, there is still real uncertainly

about these areas for 2023.

Alternatives – increasing allocations to trend-following,

systematic and hedged strategies

With so much macro uncertainty the challenging investment

environment will continue. With ever-changing forecasts for key

investment variables such as interest rates and inflation,

it is critical to monitor the trends within forecasts as much as

the reported numbers. Investment markets will follow these

trends, and this will tend to drive positive returns from

trend-following strategies. 2023 should be a strong environment

for trend-following strategies.

Value vs growth – expect value to continue to outperform growth

but don’t overlook solid growth names that now trade as value.

Stock selection and active management are key as volatility will

remain elevated

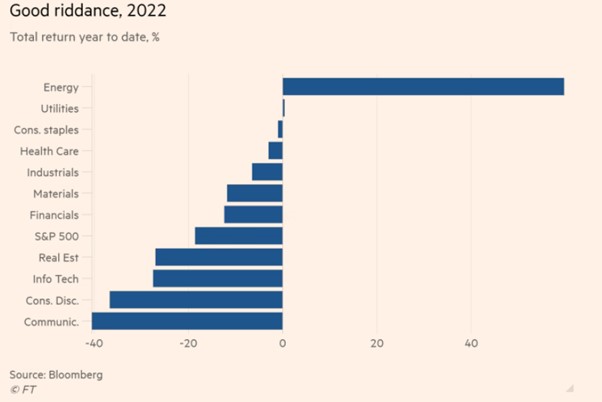

Investment returns from equities have for the most part been very

negative in 2022. Only the energy sector has escaped.

The aggressive rises in rates – with the Fed leading the way, up 4.5 per cent over the calendar year – have reset valuation points. Companies without earnings or those with uncertain future earnings or growth have been disproportionally punished. In the US the Russell 1000 Growth index (“Growth”) has fallen 20 per cent, and the Russell 1000 Value index (“Value”) is down 5 per cent. Interestingly the value sector looks as though it has some juice left in it to outperform growth.

Some names which were growth names – Meta, Alphabet and PayPal

for example – are now value names. Companies like this, which

have sustainable earnings, present opportunities for stock

selection and inclusion in portfolios. As and when markets have

periods of risk-off price action, these names should fall less

and rebound more.

Key to equities performance are earnings and the big risk to

earnings in 2023 will be a recession. In the US, UK and Europe

recession is certainly the consensus view, as indicated by the US

yield curve which is heavily inverted. The key uncertainty is

around the length, depth, and overall impact of the recession. It

can be argued that the 2022 equity price adjustments have already

priced in the higher rate environment but not the impact on

earnings. It is certainly the case that US earnings have held up

so far and shown some resilience to economic pressures. At the

S&P 500 index level earnings' expectations have not been

reduced significantly; indeed for 2023 industry forecasts still

show some expected growth. We will need to watch consumer

behaviour – so far consumers have not reduced spending

significantly, perhaps linked to high savings from lockdown and

an ongoing tight labour market. Any downward trend in expected or

realised earnings will likely see some significant weakness in

stock prices.

Usually, recession occurs after tightening has completed. Equity

markets do not bottom until the rate cycle has really peaked.

This time inflation is also sufficiently high that it will take

time to fall and may well be sticky on the way down, given the

ongoing tightness in the labour market which is itself sustained

by an ageing population. This increases the risk of rates going

higher and certainly indicates that they might be held

higher for longer than the market currently thinks.

Inflation rate linked to employment

Fundamentally, inflation can’t be expected to fall back to

acceptable levels without employment falling. This outcome is

tied directly to earnings; earnings won’t fall unless

companies fear falling profits and subsequently lay off

staff.

Inflation will be sticky as it falls too, so we might expect some

discussions to evolve about adjusting the inflation target

higher. This might be an explicitly higher rate target, or the

target might be maintained at 2 per cent with the central banks

taking a more relaxed approach to missing it. It is worth

remembering that originally the 2 per cent target was chosen as a

somewhat arbitrary target. The key question is what is the

inflation rate that causes real problems with the public? Clearly

right now inflation is causing a problem, but perhaps 3 to 4 per

cent can be lived with more easily. Critically, whatever the rate

of inflation, it will need to be assimilated within asset prices

via valuation multiples and return expectations.

2023 will see some significant volatility across all asset

classes. When you have an environment where the risk-free rate is

uncertain and volatile, the risk rate will be even more

volatile and when the risk rate experiences higher

volatility, so do the asset prices that are driven by it.

Cash now pays a reasonable return with higher rates – keep

dry powder, and when opportunities arise switch to the equity

exposures that present themselves

Equity indices are likely to have some way to go before they

bottom. However, some sectors are also poised with stronger

performance drivers, and these should feature in portfolios, with

allocations increased into future price weakness.

The defence sector should benefit from increases in budgets

considering the Ukraine conflict, and more specifically with

orders to replenish the ammunition stocks sent to Ukraine. The

financial sector, and specifically the banks, should see some

benefit from higher rates feeding through to margins – even with

some expected uptick in provision for loan losses arising from a

recession. Stocks linked to commodities stand poised to benefit

generally as China changes tack on its zero-Covid approach, and

copper should benefit from the huge demand for green energy and

electric vehicle demand with restriction in the supply and

increased marginal cost of production. Finally, don’t overlook

small-cap stocks which have seen and are likely to continue to

see disproportionate price pressure in sell offs.

Real assets – can provide some degree of protection from

inflation that stays higher than expected

Real assets are a good diversifier and with high inflation, they

can deliver returns that track real rates. Real estate is a

classic example. Implied rebuild costs increase in line with

labour and parts inflation. Rental income returns are also often

contractually linked to inflation and increase accordingly. Some

care is needed with real estate as interest-rate driven valuation

falls can erode any inflation linked benefits.

Recent news about redemption demand and liquidity restrictions in

Blackstone’s large open-ended real estate income trust (BREIT)

underscore the significant valuation gap between the listed and

private sector for real estate. It should not be surprising that

investors are selling BREIT to reinvest in listed real estate

instruments (usually traded as closed ended real estate

investment trusts, better known as REITs) which can be bought at

30 to 40 per cent discounts to the implied value of similar

physical buildings.

Commercial real estate does have some specific challenges,

especially getting staff back to offices, but for the right

buildings demand in the form of rents paid remains strong.

Understanding the valuation entry point is key to getting the

right exposure at the right time. However bad the economy gets,

the sector is less leveraged than it was in 2008 and the

recession would have to be exceptionally painful for asset values

to fall at an asset class level by 30 to 40 per cent.

Crypto – cheaper but remember it’s a long

game

The chasm of knowledge between those in the crypto industry and

the central banks remains as wide as ever. At a recent conference

the ECB speaker implied an understanding of the potential for

blockchain but at the same time exhibited a lack of understanding

of the nature of how crypto/digital assets can change the

financial system – or at best, they do understand and are very

scared of it. The jury is still out on whether to regulate and

legitimise crypto or not regulate and hope it goes away. This

debate will certainly continue in 2023 but it seems likely to us

that regulation will be forthcoming.

2022 was certainly not a good year for crypto. Weakness and

volatility in prices drove business failures in centralised

businesses involved with stable coins, lending and perhaps most

spectacularly the FTX exchange run by Sam Bankman-Fried, now

facing fraud charges. For all the shocking losses at FTX, it is

crucial to be aware that these losses arose not from some

fundamental flaw in blockchain, wallets or hacking, but from

simple basic good business practices not being

followed.

The remaining centralised exchanges should stand to benefit from

the failure of their peers. Whilst the crypto asset class

is likely to keep trading as a risk-on asset, the wider

digital asset ecosystem will see more development and mainstream

adoption.

Finally – where might surprises come

from?

-- Some form of resolution to the conflict in

Ukraine;

-- The impact of China’s change in approach to zero Covid;

-- Breakthrough technologies such as ML/AI and nuclear

fusion;

-- Unexpected increases in credit defaults, perhaps as a

consequence of a liquidity squeeze as private equity asset values

are reset downwards;

-- Potential for long-end yield curve control by central

banks as the pressures to reduce rates increase when recession

hits; and

-- The next bull market might be already running, earnings

growth at an index level maintained through resilience in the US

economy and lower energy prices. Plus, there is a lot of cash on

the sidelines.