This is a time of year when firms try to work out the possible shape of the investment world in the coming 12 months. The following commentary comes from investment director Stephen Ashworth and director John Longo. London-based WELREX, is a digital investment management platform. The editors are pleased to share these insights and invite responses. The usual disclaimers apply. Email tom.burroughes@wealthbriefing.com

The headlines – We may be seeing peak uncertainty heading into 2023.

-- Stocks will retest lows in 2023 and volatility will he high – be ready;

-- Bonds and cash can now offer some real yield opportunities;

-- Inflation will be stickier than expected as it falls back to more normal levels;

-- Interest rates may be close to their peak but will stay higher for longer; and

-- Alternative strategies are key to positive returns in 2023.

As we end a tumultuous year for investments, we can look forward to what 2023 might bring. There remains much uncertainty around the macro environment and how asset prices might respond. With uncertainty comes risk but also opportunity. Last year saw the worst collective performance for bond and equity portfolios since the 1930s.

Traditional 60/40 portfolios failed to deliver, and whilst bonds are now at arguably more attractive levels, it is far from clear whether bond pricing will exhibit any real decorrelation from equities. Overall, uncertainties mean higher volatility and alternative thinking is more likely to deliver positive risk adjusted returns.

Alternative thinking means seeking out investments whose returns are properly decorrelated from each other. Traditionally investors might consider private assets which, on paper, can deliver some decorrelation in returns, but there is a huge valuation gap between publicly traded and private assets right now and this gap will have to correct – so private assets should be off limits for a while.

WELREX prefers alternative strategies using listed instruments, hedged, trend-following and systematic strategies that are designed to deliver absolute returns. These should make up a larger allocation in portfolios than usual.

One of the key drivers of asset prices in 2022 was the rapid and material adjustment in the expectations for interest rates. Real rates jumped up to positive territory driving a negative knock-on effect for valuations. Fundamentally, the rate adjustment upwards and away from the artificially low rates post the global financial crisis was always going to happen. Post-Covid supply chain problems and geopolitical tensions following the Ukrainian conflict created the catalyst for a return to inflation, necessitating the start of higher interest rates. Whilst rates and inflation may have peaked, there is still real uncertainly about these areas for 2023.

Alternatives – increasing allocations to trend-following, systematic and hedged strategies

With so much macro uncertainty the challenging investment environment will continue. With ever-changing forecasts for key investment variables such as interest rates and inflation, it is critical to monitor the trends within forecasts as much as the reported numbers. Investment markets will follow these trends, and this will tend to drive positive returns from trend-following strategies. 2023 should be a strong environment for trend-following strategies.

Value vs growth – expect value to continue to outperform growth but don’t overlook solid growth names that now trade as value. Stock selection and active management are key as volatility will remain elevated

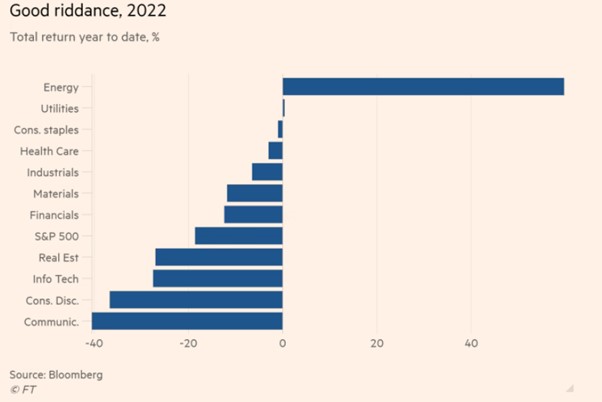

Investment returns from equities have for the most part been very negative in 2022. Only the energy sector has escaped.

The aggressive rises in rates – with the Fed leading the way, up 4.5 per cent over the calendar year – have reset valuation points. Companies without earnings or those with uncertain future earnings or growth have been disproportionally punished. In the US the Russell 1000 Growth index (“Growth”) has fallen 20 per cent, and the Russell 1000 Value index (“Value”) is down 5 per cent. Interestingly the value sector looks as though it has some juice left in it to outperform growth.

Some names which were growth names – Meta, Alphabet and PayPal for example – are now value names. Companies like this, which have sustainable earnings, present opportunities for stock selection and inclusion in portfolios. As and when markets have periods of risk-off price action, these names should fall less and rebound more.

Key to equities performance are earnings and the big risk to earnings in 2023 will be a recession. In the US, UK and Europe recession is certainly the consensus view, as indicated by the US yield curve which is heavily inverted. The key uncertainty is around the length, depth, and overall impact of the recession. It can be argued that the 2022 equity price adjustments have already priced in the higher rate environment but not the impact on earnings. It is certainly the case that US earnings have held up so far and shown some resilience to economic pressures. At the S&P 500 index level earnings' expectations have not been reduced significantly; indeed for 2023 industry forecasts still show some expected growth. We will need to watch consumer behaviour – so far consumers have not reduced spending significantly, perhaps linked to high savings from lockdown and an ongoing tight labour market. Any downward trend in expected or realised earnings will likely see some significant weakness in stock prices.

Usually, recession occurs after tightening has completed. Equity markets do not bottom until the rate cycle has really peaked. This time inflation is also sufficiently high that it will take time to fall and may well be sticky on the way down, given the ongoing tightness in the labour market which is itself sustained by an ageing population. This increases the risk of rates going higher and certainly indicates that they might be held higher for longer than the market currently thinks.

Inflation rate linked to employment

Fundamentally, inflation can’t be expected to fall back to acceptable levels without employment falling. This outcome is tied directly to earnings; earnings won’t fall unless companies fear falling profits and subsequently lay off staff.

Inflation will be sticky as it falls too, so we might expect some discussions to evolve about adjusting the inflation target higher. This might be an explicitly higher rate target, or the target might be maintained at 2 per cent with the central banks taking a more relaxed approach to missing it. It is worth remembering that originally the 2 per cent target was chosen as a somewhat arbitrary target. The key question is what is the inflation rate that causes real problems with the public? Clearly right now inflation is causing a problem, but perhaps 3 to 4 per cent can be lived with more easily. Critically, whatever the rate of inflation, it will need to be assimilated within asset prices via valuation multiples and return expectations.

2023 will see some significant volatility across all asset classes. When you have an environment where the risk-free rate is uncertain and volatile, the risk rate will be even more volatile and when the risk rate experiences higher volatility, so do the asset prices that are driven by it.

Cash now pays a reasonable return with higher rates – keep dry powder, and when opportunities arise switch to the equity exposures that present themselves

Equity indices are likely to have some way to go before they bottom. However, some sectors are also poised with stronger performance drivers, and these should feature in portfolios, with allocations increased into future price weakness.

The defence sector should benefit from increases in budgets considering the Ukraine conflict, and more specifically with orders to replenish the ammunition stocks sent to Ukraine. The financial sector, and specifically the banks, should see some benefit from higher rates feeding through to margins – even with some expected uptick in provision for loan losses arising from a recession. Stocks linked to commodities stand poised to benefit generally as China changes tack on its zero-Covid approach, and copper should benefit from the huge demand for green energy and electric vehicle demand with restriction in the supply and increased marginal cost of production. Finally, don’t overlook small-cap stocks which have seen and are likely to continue to see disproportionate price pressure in sell offs.

Real assets – can provide some degree of protection from inflation that stays higher than expected

Real assets are a good diversifier and with high inflation, they can deliver returns that track real rates. Real estate is a classic example. Implied rebuild costs increase in line with labour and parts inflation. Rental income returns are also often contractually linked to inflation and increase accordingly. Some care is needed with real estate as interest-rate driven valuation falls can erode any inflation linked benefits.

Recent news about redemption demand and liquidity restrictions in Blackstone’s large open-ended real estate income trust (BREIT) underscore the significant valuation gap between the listed and private sector for real estate. It should not be surprising that investors are selling BREIT to reinvest in listed real estate instruments (usually traded as closed ended real estate investment trusts, better known as REITs) which can be bought at 30 to 40 per cent discounts to the implied value of similar physical buildings.

Commercial real estate does have some specific challenges, especially getting staff back to offices, but for the right buildings demand in the form of rents paid remains strong. Understanding the valuation entry point is key to getting the right exposure at the right time. However bad the economy gets, the sector is less leveraged than it was in 2008 and the recession would have to be exceptionally painful for asset values to fall at an asset class level by 30 to 40 per cent.

Crypto – cheaper but remember it’s a long game

The chasm of knowledge between those in the crypto industry and the central banks remains as wide as ever. At a recent conference the ECB speaker implied an understanding of the potential for blockchain but at the same time exhibited a lack of understanding of the nature of how crypto/digital assets can change the financial system – or at best, they do understand and are very scared of it. The jury is still out on whether to regulate and legitimise crypto or not regulate and hope it goes away. This debate will certainly continue in 2023 but it seems likely to us that regulation will be forthcoming.

2022 was certainly not a good year for crypto. Weakness and volatility in prices drove business failures in centralised businesses involved with stable coins, lending and perhaps most spectacularly the FTX exchange run by Sam Bankman-Fried, now facing fraud charges. For all the shocking losses at FTX, it is crucial to be aware that these losses arose not from some fundamental flaw in blockchain, wallets or hacking, but from simple basic good business practices not being followed.

The remaining centralised exchanges should stand to benefit from the failure of their peers. Whilst the crypto asset class is likely to keep trading as a risk-on asset, the wider digital asset ecosystem will see more development and mainstream adoption.

Finally – where might surprises come from?

-- Some form of resolution to the conflict in Ukraine;

-- The impact of China’s change in approach to zero Covid;

-- Breakthrough technologies such as ML/AI and nuclear fusion;

-- Unexpected increases in credit defaults, perhaps as a consequence of a liquidity squeeze as private equity asset values are reset downwards;

-- Potential for long-end yield curve control by central banks as the pressures to reduce rates increase when recession hits; and

-- The next bull market might be already running, earnings growth at an index level maintained through resilience in the US economy and lower energy prices. Plus, there is a lot of cash on the sidelines.