ESG

ESG Phenomenon: Investors, Advisors Get Greenwashing Jitters

Greenwashing concerns are on the rise as two-thirds of advisors in a latest poll fear a backlash may damage their reputation.

Boring Money

Research from financial website Boring Money shows that

more than two-thirds of advisors are worried about the

reputational risks of greenwashing if they recommend products

that go on to be accused of such behaviour.

As the popularity of ESG-related investments soars, Boring Money’s Sustainable Investing 2021 report found that one in five advisors were saying they were "very concerned" about the risk, and one in two saying they were "somewhat concerned."

The report, supported by Morningstar, also shows stronger retail investor appetite for excluding controversial holdings, with many willing to remove funds if they discover they are linked to sectors they oppose.

Awareness about the practice of allegedly making investments appear more environmentally sound than they really are was jolted a few days ago when media reports said that US regulators are probing Deutsche Bank's asset management business, DWS Group. The firm’s former head of sustainability reportedly said it exaggerated how it used sustainability measures to manage assets. DWS has denied such claims. The affair highlights how the business of objectively proving ESG credentials remains a work in progress.

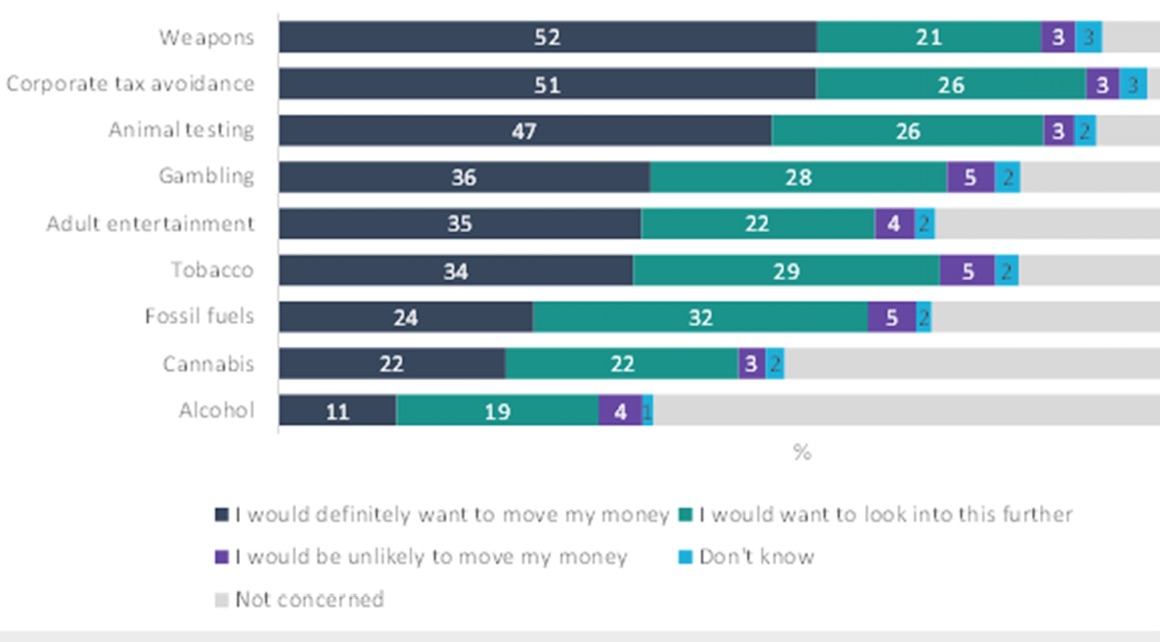

The survey found that respondents' top concerns are weapons, tax avoidance and animal testing. The survey found that attitudes on fossil fuels more nuanced, with more investors than in previous polls open to engagement rather than exclusion. Only a quarter of investors said they would definitely want to move money if they knew it was exposed to fossil fuels. The chart below shows how investment exclusions stack up.

Capco voiced similar greenwashing concerns this week and the spectre of mis-sellling as more than half of European investments piled into sustainable products last year topping €1.4 trillion.

In a report titled Climate Conduct & Financial Services: Tomorrow’s Mis-selling Scandal?, the investment firm warned that “the potential risk of mis-selling cannot be understated as firms look to enhance perceptions of their environmental credentials and products,” and raised past mis-selling scandals such as the Volkswagen ‘dieselgate’ and UK Green Deal as examples not to be repeated.

The amped-up concern runs parallel to any market experiencing explosive growth.

Boring Money’s review found investors and advisors alike wanting more details about a fund’s credentials in order to have fruitful conversations.

“Appetite for positive global change has not diminished but trust in the sector to be the agents of this change has fallen as consumers struggle to find the proof points they require,” Boring Money CEO, Holly Mackay, said.

The report, based on a survey of more than 4,000 UK adults, 1,500 retail investors, and roughly 200 financial advisors, revealed that a third of advisors feel that current ESG communications from fund managers are falling short of supporting their client conversations.

Mackay added: “The sector needs to put more effort, resource and time into thinking about how to communicate ESG credentials to clients. Simply using the same old broken factsheet template isn’t helping anyone. Lengthy annual PDFs are a good start but are too hard to find and digest for the majority.”