Wealth Strategies

OPINION OF THE WEEK: Reflections On Singapore's Strong Dollar

A new paper explaining the story of the Singaporean dollar and its current strength prompts the editor to consider what it says about the Asian city-state.

The Swiss franc might often be considered the developed world’s

hardest currency, and for good reason. So strong has it

been in fact, that a decade ago, the Swiss National Bank

sought to cap the “Swissie” against the euro (when the eurozone

was weighed by the Greek financial drama).

That cap was lifted in January 2015 and the franc shot up; it

reportedly clattered hedge funds and others in the process. A few

years ago, Zurich-listed UBS decided to switch from announcing

its results in the domestic currency, switching to the dollar

instead. It reflected how dominant the US currency was in global

trade for services and goods. But it also showed how having a

strong currency like the Swiss franc was not always easy to live

with.

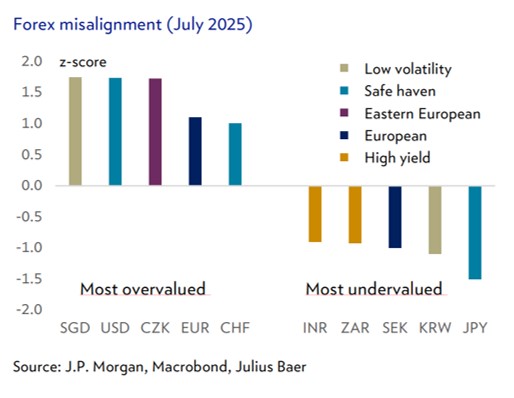

Could a similar story apply to the Singapore dollar? Such has

been the success of Singapore’s economy and financial market that

the Singapore currency has, according to a July paper from

Julius Baer,

become the world’s most overvalued major currency. Others in that

bracket include the dollar, Czech Koruna (or crown), the euro,

and Swiss franc (see the chart). On the other side of the ledger,

the world’s most undervalued currencies are the Japanese yen,

South Korean won, Swedish crown, South African rand, and Indian

rupee.

The Singapore currency exchange rate is managed against a basket

of currencies by the Monetary Authority of Singapore. The system,

which is called Basket, Band and Crawl, has

operated since the early 1980s.

Steady and strong

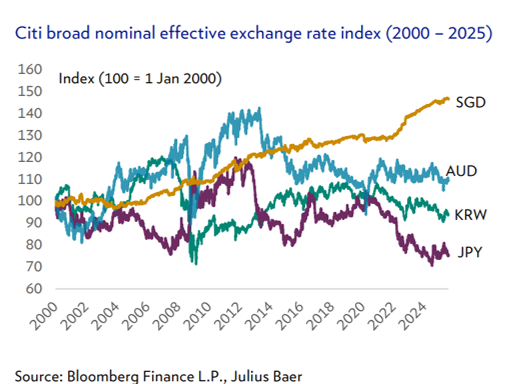

The path of the Singapore dollar over the past quarter century

has been, in its own somewhat understated way,

remarkable.

As Julius Baer says: “The past 25 years have correlated with

a period of remarkable stability for the Singapore dollar. While

it is not uncommon to see peak-to-trough/trough-to-peak moves of

40 per cent-50 per cent in major Asian currencies like the

Australian dollar, Japanese yen and Korean won, especially during

periods of global shocks, such volatility is virtually

non-existent in the case of the Singapore dollar. Instead, it has

appreciated at a steady CAGR of 1.55 per cent over the past 25

years.”

This currency strength has an effect. Singaporeans are splashing

the cash on foreign trips, because their money gets them further.

On the downside, Singaporeans investing in places such as

Australia, for example, can be hit by the forex effect for the

same reason that a Switzerland-based investor might be. What

about exporters? Well, Julius Baer argues that those based in

Singapore aren’t as hurt by a strong currency as one might

suppose.

Julius Baer explains: “Contrary to conventional thinking, the

impact of Singapore dollar strength has been more neutral for

Singapore-based exporters. This is due to the high share of

imported content (the cost of which is lowered when the Singapore

dollar is strong) and a skew in export mix towards higher value

products like electronics or niche products, which are more price

inelastic. The prevalence of US dollar invoicing has also

dampened the effect of forex-translation related swings, since an

estimated 73 per cent of Singapore’s imports are transacted in US

dollars.”

While not without its costs, it looks as ithough the rise of the

Singapore dollar does reflect rude economic health in the Asian

city-state. The country has sought to galvanise its stock market,

for example, with its S$5 billion ($3.87 billion) Equity Market

Development Program (EQDP) launched in February 2025.

Singapore is on an upward path

All this leads Julius Baer to describe the Singapore dollar as a

“small but mighty” currency. Its bank's paper is a trove of data:

“The Singapore dollar, together with the Swiss franc, is the only

major currency to have consistently posted positive 10-, 20- and

30-year spot returns against the US dollar.”

There’s more: “Within Asia, it is also the best performing

currency against the US dollar in the past 20 years, having risen

29.3 per cent since 2000, closely followed by the Thai baht with

spot returns of 28.3 per cent.”

So what is the upshot of all this? Well, for the moment, I see

few signs of Singapore-based banks such as DBS, UOB and OCBC

shifting to reporting financial results in the US currency rather

than their own currency. And for the reasons given by Julius

Baer, it is not clear why having a strong currency is going to be

a problem, particularly if it reflects wise economics rather than

spendthrift policies of many debt-addicted developed countries.

Singapore has a safe-haven status – a fact that might once have

struck policymakers as astonishing when the jurisdiction became

an independent state in the mid-sixties. Its management of the

currency has been exemplary. As Julius Baer says, although the

Singapore dollar is fiat currency, all of Singapore’s currency-in

circulation – estimated at S$67.5 billion – is fully backed by

gold, silver and other foreign assets held by the MAS, as

required under the Currency Act. Further, the jurisdiction is the

only Asian nation with triple-A ratings from all three major

credit-grading companies.

The chessboard of the world's financial centres, including wealth

management hubs, continues to change. One big plus factor for any

centre must be having a robust currency, and that's

particularly the case for smaller places such as Singapore. There

is a sort of self-reinforcing momentum: a strong currency

attracts business and investment, and that boosts an economy, and

in turn encourages a currency to remain strong.

With all the other issues swirling around in the world, the

management of currency may not make front-page news. But it feeds

into a wider story of success and stability. What the Singapore

tale shows is that it takes years of painstaking effort and

financial discipline to achieve monetary credibility, just as it

does for a private bank in building a trustworthy reputation.

There appears no immediate sign that the Singapore dollar is

going to lose its shine.