Strategy

Deutsche Cuts Business Risks; Wealth Arm Seen Gaining Ground

The bank is cutting as many as 18,000 jobs, reports said, as it reduces exposures on its investment banking side, and shuts equities sales and trading.

(An earlier version of this news story appeared on Family Wealth Report yesterday, sister news service to this one. This item is updated for share price and analysts' reaction.)

Deutsche Bank

stressed its commitment to wealth management, an area expected to

come into sharper focus after Germany’s biggest lender announced

that it will get out of equities sales and trading and shrink

corporate and investment banking assets. As many as 18,000 jobs

are reportedly being shed.

Christian Sewing, chief executive, said it is accelerating

changes to boost profitability. The bank recently abandoned

attempts to merge with Commerzbank, Germany’s

second largest bank. The bank will cut costs, reducing

adjusted costs to €17 billion ($19.1 billion) in 2022 and target

a cost/income ratio of 70 per cent in that year. Deutsche Bank

said it expects to report a second-quarter pre-tax loss when it

announces results on 24 July.

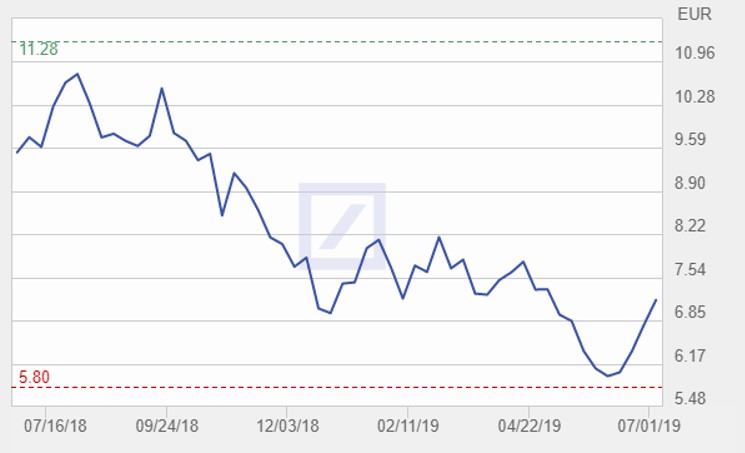

Investors appeared to be unimpressed. Shares in Deutsche Bank were down by 4.3 per cent at around 15:30 local London time yesterday, at €6.85 per share. Broader market indices also fell yesterday.

"Deutsche Bank’s grand restructuring plan comes with significant execution risk. Even assuming everything turns out as planned, the fact remains that most of the big European banking groups are years ahead in their redesigns. Competitive success for Deutsche Bank is not a given. Scope downgraded Deutsche Bank on 28 May, saying `the road to successful business-model recalibration and a return to sustainable profitability is still steep and fraught with uncertainties”. Sunday’s announcements don’t change that'," Scope Ratings said of the bank's changes.

Three senior figures - Sylvie Matherat, Garth Ritchie and Frank

Strauss – are leaving the bank. Ritchie led the corporate and

investment bank; Matherat was chief regulatory officer, and

Strauss was head of the private and commercial bank.

Germany’s largest bank – with a footprint in the US, Asia and

other parts of the world – has been struggling with heavy costs

and lowering profits. It is seen in some ways as a bellweather

for the German economy and eurozone.

As far as this publication knows, wealth management jobs are not directly affected – in fact the bank last week announced it plans to hire hundreds of client-facing staff in the next two years. Such moves fit with a pattern of banks cutting balance sheet exposures and focusing on less capital-intensive areas instead. For example, since 2008 Switzerland’s UBS and Credit Suisse have focused more on wealth management.

In a call with journalists, Sewing said: “We will further

strengthen our wealth management franchise by building on its

strong German and European businesses. Particular areas of growth

and investment will be the Americas and our emerging markets

region, which includes Asia-Pacific and the Middle East. And we

will go “all in” on digital.”

Even so, with some large banking groups stressing how they

provide wealthy clients with access to its balance sheet and

range of investment know-how, questions arise over whether big

cuts to the IB side of a business could affect wealth management

in certain ways. This publication understands that in Deutsche’s

case the impact should be limited not just because the parts of

the investment bank that cater for wealthy clients will be

relatively less affected by the cuts, but also because wealth

management has in-house advisory capabilities and an

open-architecture platform.

One report (Guardian, 8 July), said 18,000 jobs will be

cut. This publication has sought to confirm those figures and add

details and may update in due course.

Changes

“Deutsche Bank will exit its Equities Sales & Trading business,

while retaining a focused equity capital markets operation. In

addition, the bank plans to resize its fixed income operations,

in particular its rates business and will accelerate the

wind-down of its existing non-strategic portfolio. In aggregate,

Deutsche Bank will reduce risk-weighted assets currently

allocated to these businesses by approximately 40 per cent,” the

bank said in its statement on Sunday.

Deutsche Bank said it will create a new “Capital Release Unit” to

manage the “efficient wind-down” of the assets related to

business activities, which are being exited or reduced. These

assets and businesses represented €74 billion of risk-weighted

assets and €288 billion of leverage exposure, as of 31 December

2018.

The firm said its cuts will allow it to invest in corporate

banking, foreign exchange, financing, origination and advisory,

private banking and asset management.

To restructure, the bank said that it expects to take about €3

billion of aggregate charges in the second quarter of 2019, of

which approximately €200 million would affect Common Equity Tier

1 capital.

These charges include a deferred tax asset write-down of around

€2 billion and impairments of approximately €900 million. It

predicts it will sustain further restructuring charges in the

second half of 2019 and subsequent years. In all, it expects

cumulative charges of €7.4 billion by the end of 2022.

Results

Including the charges related to the restructuring, Deutsche Bank

expects to report a second quarter 2019 loss before income taxes

of about €500 million and a net loss of €2.8 billion. Excluding

these charges, Deutsche Bank expects to report second quarter

2019 income before income taxes of approximately €400 million and

net profit of €120 million. Results reflect revenues of €6.2

billion with non-interest expenses of €5.6 billion and adjusted

costs of €5.35 billion.

The bank intends to release second quarter results on 24 July

2019.

Source: Deutsche Bank.

Speeding up

Sewing said in his statement that he regretted the job cuts but

argued that the bank had no choice in acting decisively.

“What we have announced today is nothing less than a fundamental

rebuilding of Deutsche Bank through which we are ushering in a

new era for our bank. This is a rebuilding which, in a way, also

takes us back to our roots. We are creating a bank that will be

more profitable, leaner, more innovative and more resilient. It

is about once again putting the needs of our clients at the

centre of what we do – and finally delivering returns for our

shareholders again,” Sewing said.

“Going forward, our investment bank will be smaller – but all the

more stable and competitive. The strict separation between

private and corporate clients also means we will have a much more

focused private client business,” he said.

Sewing said the bank wants to achieve a post-tax return on

tangible equity of 8 per cent by 2022; he said the bank was “not

far away” from that goal and was already on track to reaching it

in its private banking arm.

Leadership structure

Deutsche Bank said its management board will only represent the

bank’s central functions and regions. This includes Christiana

Riley, who will be responsible for its business in the Americas,

and Stefan Simon, who will be responsible for legal and

regulatory affairs.

The corporate bank will be led by Stefan Hoops, who will report

to Sewing; Mark Fedorcik will be head of the investment Bank. Ram

Nayak will head the fixed income and currencies business. Both

will also report to Sewing. The private bank in Germany will be

led by Manfred Knof, former CEO of Allianz Germany. Ashok Aram

will lead the international retail business (including

international commercial clients) and Fabrizio Campelli will lead

the wealth management Business. All three will report to Sewing’s

deputy, Karl von Rohr.

Asoka Wöhrmann will continue to lead Deutsche’s asset management

business DWS and will also report to Karl von Rohr. The

newly-formed Capital Release Unit will be led by Louise Kitchen

and Ashley Wilson, both of whom will report to Frank Kuhnke.