Alt Investments

Lloyd’s of London - The Role It Can Play In Succession Planning

This news service carries this article from Argenta Private Capital on the subject of investing via the Lloyd's of London insurance market and what it can do for diversification and the protection of wealth.

The following article comes from Argenta Private Capital. The editors are pleased to share this content; we also have this link to a recent webinar discussion around the issues in the following article. The usual editorial disclaimers apply. Email tom.burroughes@wealthbriefing.com if you wish to comment.

At Argenta

Private Capital, we are lucky enough to have long-standing

relationships with many of our clients, sometimes over several

generations. This has led to honest and open conversations on a

range of topics with succession planning being one that almost

inevitably comes up time and time again.

That’s because investments at Lloyd’s of London, the world’s

leading and oldest insurance market, are structured in such a way

that they complement other approaches that a wealth manager may

adopt in the succession planning process.

Having the necessary, sometimes difficult conversations, between

clients, advisors and ourselves about how wealth is to be passed

between generations at an early enough stage is key to maximising

the potential benefits to everyone involved and ensuring that

everyone is on the same page when the time comes.

What does an investment at Lloyd’s look

like?

But taking a step back, why is this particular investment often

used as part of succession planning? Investors at Lloyd’s of

London pledge their capital to a pool of specialist insurance

syndicates, all of whom underwrite a variety of different risks

across the globe. In good years, premiums exceed pay-outs and

investors profit, while in bad years, pay-outs exceed premiums

and a limited loss is incurred.

This is an investment which, by its very nature, has a low

correlation to traditional asset classes, meaning that it can be

an attractive diversifier as part of a long-term portfolio and a

balanced strategy.

Moreover, the Lloyd’s insurance market itself operates on

long-term investment horizons, something which fits naturally

with wealth being passed through different generations.

Additionally, depending on their tax jurisdiction, investors in

the Lloyd’s insurance market qualify for Business Relief, which

provides 100 per cent relief for the value of their assets for

Inheritance Tax purposes.

An investor at Lloyd’s can retain ownership and income from the

collateral that is lodged to support a Lloyd’s investment. Such

capital can take the form of cash, equities or bonds, thus

generating two returns from these assets, i.e. income from these

investments used as collateral and underwriting income from the

portfolio of syndicates.

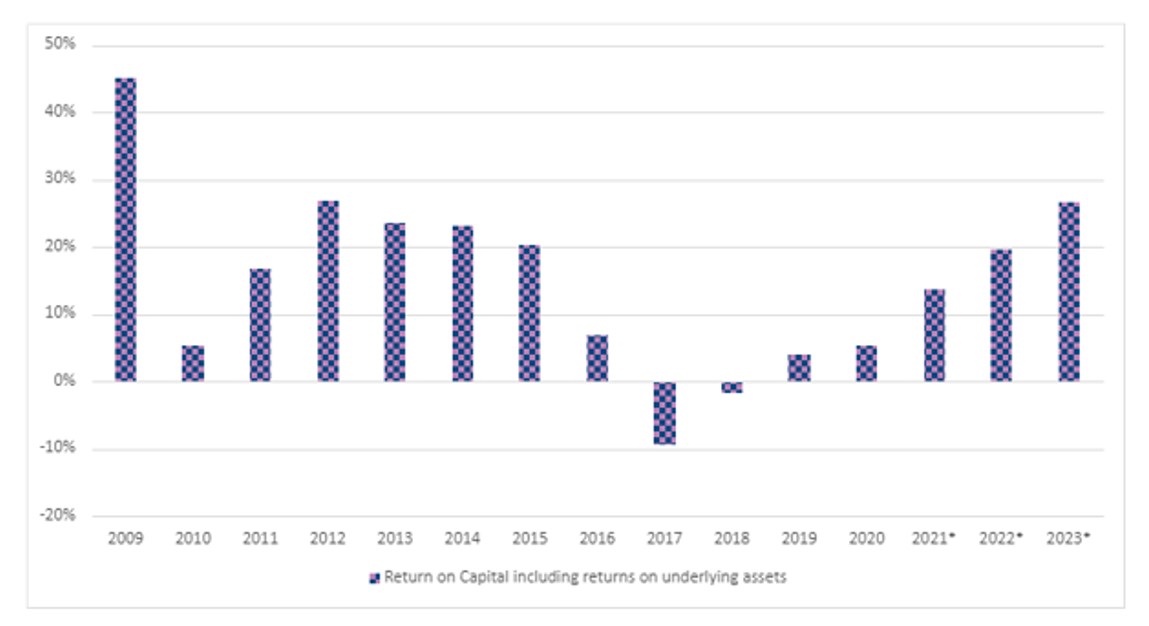

As the graph below demonstrates, the Lloyd’s market is cyclical,

and whilst there can be no guarantee, right now the returns

profile for investors is the best in a decade - with returns of

more than 20 per cent predicted for the current year.

Over the longer-term, average annualised returns for investors

have been in excess of 10 per cent over a 15 year period,

excluding income from the double use of underlying assets.

Source: Argenta Private Capital advised private clients’

Return on Funds at Lloyd’s net of costs and assuming standard fee

terms. Return on FAL assumes FTSE all share annual return of 5.07

per cent from 2005-2022

* 2021, 2022 and 2023 based on estimates as at 30th June 2023.

2021 and 2022 are Managing Agent’s forecasts and 2023 is a

Research forecast

The opportunity to make use of an investment at Lloyd’s as part

of succession planning has never been greater than it is now.

Argenta Private Capital has been advising clients on investments

at Lloyd’s for more than 60 years and has been involved in

succession planning throughout. These are important decisions,

which should be made with as much information as possible, with

clarity about the outcomes that individuals and families are

looking to achieve. As a leading experts in investments at

Lloyd’s, APCL is well placed to advise on all aspects of the

planning of investments at Lloyd’s, with multiple generations of

families, to preserve wealth into the future.