Real Estate

Fewer Financial Centres Qualify For "Bubble" Status – UBS

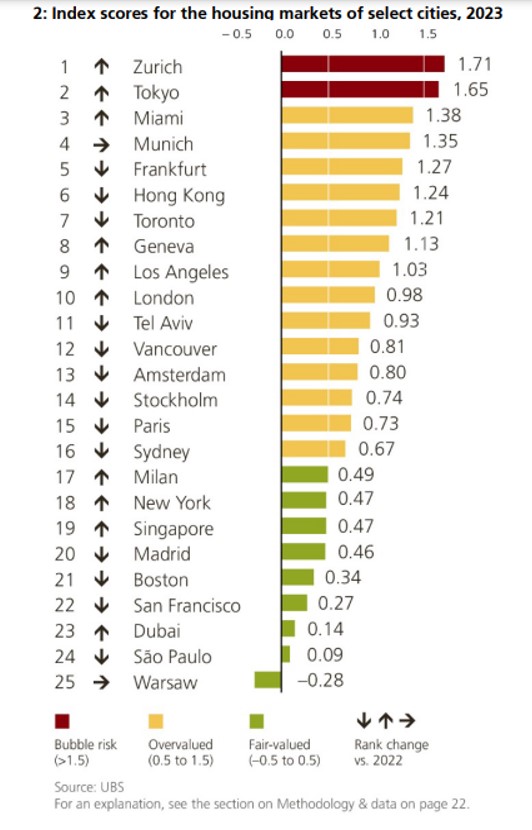

While not pointing to an implosion of the "bubbles" in past property markets, the UBS study suggests that at least for the time being, the heat has gone from certain real estate markets in major financial centres.

Zurich (pictured) and Tokyo remain the cities at the top of the

“bubble risk” category as measured by UBS in one of its regular reports

examining the state of real estate markets in global financial

centres.

However, the Japanese and Swiss cities are the only cities that

belong in the bubble category, the Swiss banking group said in

its UBS Global Real Estate Bubble Index 2023 report. In 2022,

nine cities belonged in this bracket.

Formerly in the bubble risk zone – Toronto, Frankfurt,

Munich, Hong Kong, Vancouver, Amsterdam, and Tel

Aviv – are now all in the overvalued territory, rather

than the “bubble” end, UBS said.

Unchanged from the previous year, housing markets in Miami,

Geneva, Los Angeles, London, Stockholm, Paris, and Sydney also

continue to be overvalued, it said. Similarly, New York, Boston,

San Francisco, and Madrid have experienced a drop in imbalances.

These housing markets are now “fairly” valued, according to the

index, as are Milan, São Paulo, and Warsaw. This also applies to

Singapore and Dubai, even though their reputation as geopolitical

safe havens has recently triggered a surge in demand for both

renting and buying.

A year of rising interest rates, trade disruptions post-Covid and

the geopolitical chills caused by Russia’s invasion of Ukraine

have, alongside other factors, deflated some of the property

sector “bubbles” in particular cities.

House price growth has suffered due to rising financing costs as

average mortgage rates have roughly tripled since 2021 in most

markets. Annual nominal price growth in the 25 cities analysed

came to a standstill after a 10 per cent rise a year ago, UBS

said.

“In inflation-adjusted terms, prices are actually 5 per cent

lower now than in mid-2022. On average the cities lost most

of the real price gains made during the pandemic and are now

close to mid-2020 levels again,” Claudio Saputelli, head of real

estate at UBS Global Wealth Management’s Chief Investment Office,

said.

In Frankfurt and Toronto – the two cities with the highest risk

scores in last year’s edition – real prices tumbled by 15 per

cent in the last four quarters. A combination of high market

valuations and relatively short mortgage terms also put prices

under strong pressure in Stockholm and to a lesser degree in

Sydney, London, and Vancouver. In contrast, in Madrid, New York,

and São Paulo – cities with moderate risk valuations so far –

real home prices have continued to rise at a moderate pace.

Source: UBS