New Products

Putting Wealth Clients In Investment Driver's Seat At UBS

The bank talked about how its UBS My Way offering is a new way to engage with HNW clients, build closer relationships, and demonstrate more variety in its business. The service enables clients to construct asset allocations themselves and leave the finer details to the bank, going beyond a discretionary model. It is available in multiple jurisdictions.

Like all large banks working to capture a larger “share of

wallet” among HNW and ultra-HNW clients, as well as foster

loyalty, UBS is trying to

develop services that fill perceived “gaps” in a

marketplace.

It is broadening access to its UBS My Way offering to clients in

the UK and Jersey. The service allows clients – those with at

least $500,000 – to become involved in constructing their own

asset allocations, leaving the role of picking stocks, bonds

and other individual assets to the bank. This goes a step beyond

a conventional discretionary model because the client, not the

firm, directs the asset allocation that best fits with his or her

personal views and preferences (in line with their overall risk

tolerance and objectives).

This “build-your-own” asset allocation framework has in the

past been more the preserve of clients with tens of millions of

dollars in assets, not those lower down the HNW or even

mass-affluent scale. UBS My Way makes wider access to this

approach possible, Josef Risi, head Product Development and

Management for discretionary solutions at UBS Global Wealth

Management, told this news service in an interview.

In May, UBS expanded its offering to clients across the UK and

Jersey; it is already available in Singapore, and operated in

Switzerland in 2020. It is also available in Hong Kong, Germany,

Italy and Japan.

For some time, UBS realised that some of its wealthy clients were

not content to pass over all discretion to the bank and wanted to

keep involved in portfolio construction at a broad level and/or

pursue a theme, Risi said.

Clients, for example, might have strong views about a sector such

as robotics and would want this expressed in how their portfolios

were put together, without necessarily waiting for a manager to

pull the trigger, Risi said. “We are bringing the building blocks

[of portfolios] to clients in a digital way,” he

continued.

UBS My Way is suitable for clients who want to tweak existing

asset allocation, build such an allocation from scratch or do

most investing decisions themselves but with a friendly, helping

hand on the shoulder for a particular theme which they play via

My Way, he said.

Considering that a rising cohort of HNW individuals have made

money in areas such as tech, private markets and other fields,

many of them want to have a hands-on approach to running their

money, but without entirely going solo either. Digital tech

enables wealth management in some ways to be personalised in a

scalable way. Organisations such as Refinitiv, among others,

operate in this space, through the Refinitiv Workspace For Wealth

Advisors, for example.

Risi reckons that so far the offering is unique.

“As far as we know, so far, no other bank was able to create a

state-of-the-art combination of digital user experience, access

to depth and breadth of content (including single stocks, single

bonds, active and passive and alternatives investment modules;

with access to the whole UBS WM ecosystem including the UBS

global access and buying power); coverage (advisor involvement in

helping clients to navigate and act as sparring partner) and

implementation capabilities. This allows us to implement My Way

at scale via our discretionary portfolio management platform,” he

said.

Impetus

The force leading to creation of UBS My Way did not come solely

from the bank or from clients, but from both, Risi said. The

offering does change UBS’s relationships with clients, because it

takes engagement to a “new level” and gives clients and advisors

new topics to chat about.

With each “building block” of an asset allocation, such as

industrials, consumer goods, or some other division, they all

connect automatically on a platform to the views of UBS’s chief

investment office. What this means is that clients can

exploit the bank’s global network of advisors and strategists,

tapping their expertise on a myriad of subjects.

To use UBS My Way, clients must already be clients of UBS.

The rollout of this service is another way for the bank to reach

into fresh markets, Risi said. “This clearly helps us to start a

conversation,” he continued.

“A significant share of our discretionary sales growth is

associated with My Way.

UBS enables clients to check whether their portfolios are

suitable based on a risk profile; they can adjust

allocations within such limits, get proposals, check historical

performance data, and more. Advisors can also contact a client

and discuss possible action if there has been a large market move

or other development.

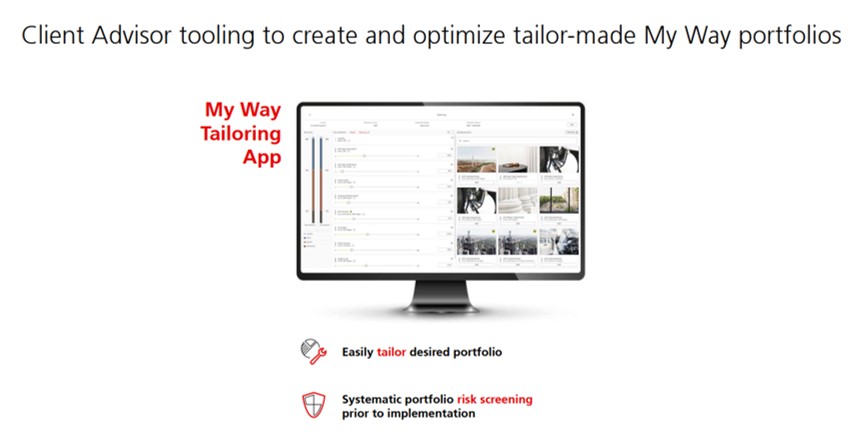

The platform is designed to be scalable – there is an element of

mass customisation on how the elements of asset allocation are

assembled, and the UBS engine of data feeds into this. Some UBS

advisors look after up to 40 fully-personalised My Way portfolios

each, and UBS supports advisors via tools that enable advisors to

manage these relationships efficiently, Risi added.

(Note: UBS is scheduled to report second-quarter financial results on 31 August.)