Legal

Malaysian Wealth Management - Latest Developments

This news service is pleased to share this update outlining

important developments affecting the wealth management sector in

Malaysia. The note comes from Wong & Partners, member firm of

Baker

McKenzie in Malaysia.

Authors of the article are Adeline Wong – partner; Istee Cheah –

partner; Tanya Tan – associate; Lisa Yeoh – associate, and Mei

Yeo - legal assistant.

The editors of this news service are pleased to share these

views, and invite responses. The usual editorial disclaimers

apply. To respond, email tom.burroughes@wealthbriefing.com

and jackie.bennion@clearviewpublishing.com

The COVID-19 pandemic brought about the largest Malaysian Budget

in history, which was unveiled on 6 November 2020, in efforts to

shore up the Malaysian economy and keep livelihoods and local

businesses afloat. The Malaysian Budget 2021 (Budget) was

announced in the midst of a number of other COVID-19-related

stimulus packages implemented to help Malaysians weather the

pandemic, and was later legislated into the Finance Act 2020

(gazetted on 31 December 2020) (Finance Act).

We have summarised some of the key legal and tax developments in

the past year that are relevant to the wealth management

industry.

Direct tax and indirect tax matters

Income tax

Reduction of income tax rate

Pursuant to the Budget, the resident individual income tax rate

for the chargeable income band of RM 50,001 to RM 70,000 has been

reduced from 14 per cent to 13 per cent with effect from the year

of assessment (YA) 2021.

With this, in line with Malaysia's progressive personal income

tax system, tax resident individuals with a chargeable income of

over RM 70,000 will be able to enjoy a slight reduction in income

tax payable.

Increase in tax deduction cap for lifestyle

Previously, individual taxpayers could claim a lifestyle tax

relief of up to RM 2,500 for expenses incurred in purchasing

reading materials (such as e-books, printed daily newspapers), a

personal computer, smartphone or tablet, internet subscription,

sports equipment and gymnasium memberships.

Under the Finance Act, effective from YA 2021 onwards:

-- an additional RM 500 income tax relief is allocated for

the cost of purchase of sports equipment, entry or rental fees

for sport facilities and fees for participation in sports

competitions; and

-- the scope of the lifestyle income tax relief for reading

materials now includes subscriptions to electronic reading

materials.

Real property gains tax (RPGT)

RPGT exemption for disposal of residential

properties

Any Malaysian citizen is exempted from paying RPGT on gains

received on the disposal of up to three residential properties in

Malaysia on or after 1 June 2020 until 31 December 2021, provided

that:

-- the property was not acquired by way of a transfer

between spouses, or a gift between spouses, parent and child or

grandparent and grandchild, where the donor is a citizen; and

-- the sale and purchase agreement or any other instrument

of transfer for the disposal of the residential property is

executed between 1 June 2020 and 31 December 2021 (inclusive) and

is duly stamped no later than 31 January 2022.

Stamp duty

Extension of stamp duty exemption for the purchase of a first

residential home.

To increase the number of home owners in Malaysia, the Malaysian

Government has raised the stamp duty exemption limit for

first-time residential property buyers from RM 300,000 to RM

500,000.

The exemption now applies to sale and purchase agreements

executed from 1 January 2021 to 31 December 2025. The exemption

is available only to Malaysian citizens.

Extension of stamp duty exemption for exchange traded funds

(ETF)

Previously, contract notes for the sale and purchase of ETFs

executed within the period from 1 January 2018 to 31 December

2020 were exempted from stamp duty. The government has

extended this stamp duty exemption for five years to cover

contract notes for the trading of ETFs executed from 1 January

2021 to 31 December 2025.

Audits following disclosure under the 2018 Special

Voluntary Disclosure Programme (SVDP)

The previous government administration had introduced the SVDP

(1) to encourage taxpayers to come forward to disclose their

previously misreported income and deductions. A lower penalty

rate of 10 per cent or 15 per cent was offered. Under the

Operational Guidelines No. 1/2019 on the SVDP (SVDP Guidelines),

the Inland Revenue Board (IRB) had stated that it would accept

such disclosures in good faith, and that audits would not be

carried out for the years in respect of which voluntary

disclosures were made.

Earlier this year, there were reports of the IRB initiating

probes and audits against a number of SVDP participants in

relation to the periods for which the voluntary disclosures were

made.

In a media statement released by the IRB on 9 March 2021, the IRB

clarified that its promise to refrain from future audits was

conditional upon, amongst others, the taxpayer ensuring that the

voluntary disclosure made takes into account all taxable income.

Audits or investigations by the IRB may be conducted if the SVDP

participants did not fully comply with the conditions stipulated

under the SVDP Guidelines.

Developments regarding the Labuan tax regime

Updates to the economic substance requirements in

Labuan

New management and control requirements for Labuan entities

undertaking pure equity holding (PEH) activities (Labuan PEH

Entities) (2)

Previously, the Labuan Business Activity Tax (Requirements for

Labuan Business Activity) Regulations 2018 had required all

Labuan holding companies, which arguably includes all Labuan PEH

Entities, to have a minimum of two full-time employees in Labuan

and an annual operating expenditure (OPEX) of RM 50,000 in

Labuan.

The Labuan Business Activity Tax (Exemption) Order 2020, which

was gazetted on 2 June 2020 and had retrospective effect from 1

January 2019, exempts Labuan PEH Entities from the requirement to

have full-time employees in Labuan. Additionally, the amount of

minimum OPEX required in Labuan is also reduced from RM 50,000 to

RM 20,000 pursuant to an amendment to the Regulations. (3)

Although Labuan PEH Entities are no longer required to have

full-time employees in Labuan, in practice, the Labuan Financial

Services Authority (LFSA) requires all such entities to ensure

that management and control are exercised in Labuan.

(4)

For this purpose, LFSA has directed all Labuan PEH Entities to

comply with the following requirements:

-- have at least one board meeting in Labuan in the

relevant tax year; (5)

-- have their registered office in Labuan;

-- appoint a Labuan trust company as resident secretary in

Labuan; and

-- keep the accounting and business records, including

minutes of meetings, in Labuan.

In view of ongoing travel restrictions due to the COVID-19

pandemic, the LFSA had previously allowed a concession to the

board meeting requirement. Board meetings could be held virtually

up to 31 December 2020, provided that the hosting of such

meetings was arranged by the resident secretary in Labuan.

Further guidance has yet to be released by the relevant

authorities on whether this concession will be extended.

Availability of stamp duty exemption subject to fulfilment of

economic substance requirements

Presently, stamp duty exemption (6) is available in respect of

the following instruments:

-- all instruments that are executed by a Labuan entity in

connection with a Labuan business activity; (7)

-- all Memoranda and Articles of Association, statute,

charter, rules, by-laws, partnership agreements or other

instruments, under or by which a Labuan entity is established and

the scope of that entity's function, business, powers and duties

are set out, whether contained in one or more documents; and

-- all instruments of transfer of shares in a Labuan entity.

In a letter dated 29 January 2021, the IRB stipulated that

persons who wish to avail themselves of the stamp duty exemption

above will need to ensure that the relevant Labuan entity has

satisfied the relevant economic substance requirements described

above.

In the same vein, the IRB also instructed that the stamping of

all instruments relating to Labuan entities has to be done via

the online STAMPS portal from 1 February 2021 onwards. Such

stamping applications would need to be accompanied by supporting

documents to evidence compliance with the relevant economic

substance requirements. This includes, amongst others, employment

letters, employees provident fund (EPF)/social security

organisation (SOCSO) contribution documents, employer tax returns

for the employees (i.e., Form EA), utility bills and documents

evidencing expenditure on rental of office space.

Taxation of Labuan entities carrying on "other trading"

activities under the Income Tax Act (ITA)

Previously, the LFSA had issued a circular dated 21 January 2020

announcing that the Ministry of Finance had approved Labuan

entities undertaking "other trading" activities to be eligible

for the preferential tax regime under the Labuan Business

Activity Tax Act (LBATA), provided such entities comply with the

requirement to have two full-time employees in Labuan, and an

annual OPEX of RM 50,000. Such "other trading" activities

included administrative, accounting and legal services including

backroom processing, payroll services, insolvency-related

services and management services.

However, such policy decision was not included in the amended

regulations. Instead, the IRB had issued a letter dated 5

February 2021 stipulating that Labuan entities that carried out

such "other trading" activities are to be taxed under the ITA

instead of the LBATA.

Changes relating to the disclosure of beneficial ownership

Extension of transitional period

Previously, the Companies Commission of Malaysia (CCM) had issued

the Guidelines for the Reporting Framework for Beneficial

Ownership of Legal Persons which came into force on 1 March 2020.

Under these beneficial ownership guidelines, existing companies

in Malaysia had until 31 December 2020 to obtain and update the

requisite information about their beneficial owners. This was

known as the transitional period, and such information collected

had to be submitted to the CCM within 14 days from the end of the

transitional period.

However, on 17 December 2020, the CCM announced an indefinite

extension of the transitional period. (8) Specifically, the CCM

clarified that the end of the extended transitional period would

coincide with the Companies (Amendment) Bill 2020 (CA Bill) and

the Limited Liability Partnerships (Amendment) Bill 2020 (LLPA

Bill) coming into force. Apart from allowing companies, limited

liability partnerships, company secretaries, and compliance

officers to familiarise themselves with their obligations under

the beneficial ownership guidelines. The transitional period was

also extended to facilitate the practical implementation of the

new provisions relating to beneficial ownership proposed under

the CA Bill and LLPA Bill.

At the time of writing, there is no information as to when the CA

Bill and LLPA Bill will come into force.

New beneficial ownership-related provisions proposed

under the CA Bill

Presently, Section 56 of the Companies Act empowers companies to,

amongst others, request beneficial ownership-related information

from their shareholders by way of a notice in writing and record

the same in a separate part of the register of members.

Under the CA Bill, there are new provisions proposed to further

augment the obligation for companies to identify and disclose

their beneficial owners to the CCM. Some of the notable

amendments proposed under the CA Bill include the following:

-- the definition of a beneficial owner is to be refined to

mean "a natural person who ultimately owns or controls a company

and includes an individual who exercises ultimate effective

control over a company," expanding the ambit of the definition to

include a non-member, as long as such person ultimately controls

the company;

-- in addition to obtaining beneficial ownership information

from its members, a company may also obtain such information from

any person it knows or has reasonable grounds to believe (i) is a

beneficial owner; or (ii) has information of a beneficial

owner;

-- beneficial owners will now have a duty to notify the

company that they are a beneficial owner in relation to the

company and provide such other information as may be

prescribed;

-- companies will be required to include information on

their beneficial owners in the annual returns that are filed to

the CCM; and

-- the beneficial ownership register maintained by companies

may be made available to, amongst others, the beneficial owners

themselves, the Royal Malaysian Police, Malaysian Anti-Corruption

Commission, Royal Malaysian Customs Department, the Central Bank

of Malaysia and the Securities Commission of Malaysia.

New guidelines to be issued for the reporting of

trusts

Malaysian companies registered under the Trust Companies Act 1949

are similarly required to comply with the beneficial ownership

guidelines. In addition to this, the CCM has announced (9) that

there will be separate guidelines issued for such trust companies

to report the beneficial owners of the legal arrangements for

which such trust companies act as trustees. At the time of

writing, no further details have been released.

Common reporting standard (CRS) and automatic exchange of

information in Malaysia

Updated List of Reportable Jurisdictions

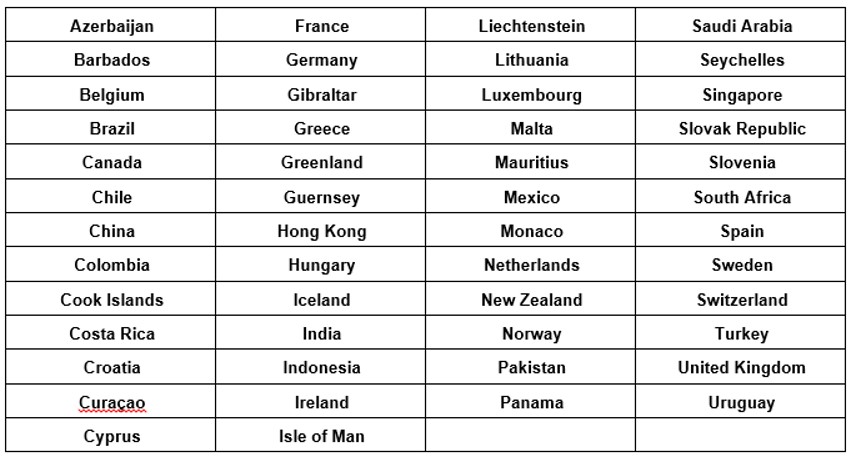

The IRB published the first List of Reportable Jurisdictions on

15 January 2018 and subsequently updated the list several times.

The latest update was on 15 January 2021 whereby Costa Rica,

Curaçao, and Turkey were added. The list now includes 70

jurisdictions (previously 67 as at 15 January 2020).

Other relevant updates

New public ruling on the taxation on trusts

On 6 November 2020, the IRB issued a Public Ruling No. 9/2020 on the Taxation of Trusts (Public Ruling). This Public Ruling provides an understanding of the interpretation taken by the IRB in respect of the taxation of trusts, including the ascertainment of the statutory income of a beneficiary.

Section 61 of the ITA provides that beneficiaries shall be taxed on, amongst others, income from their "further source", which includes the amount received outside of Malaysia from the trustee (that is subsequently remitted into Malaysia). Notably, under this Public Ruling, the IRB acknowledges that "further source" income is deemed to have been derived from outside of Malaysia and therefore not subject to Malaysian tax, in accordance with Paragraph 28 of Schedule 6 of the ITA.

Additionally, the Public Ruling provides that the remuneration paid to the trustee to manage and administer the trust is not deductible in ascertaining the total income of the trust. However, if it can be proven that the trustee is directly involved in carrying on the business of the trust, such remuneration may be deductible under Section 33 of the ITA if it is wholly and exclusively incurred in the production of income.

Updates on tax residency issues arising from the travel restrictions due to COVID-19

In view of extended travel restrictions as a result of the ongoing COVID-19 pandemic, the IRB had released an updated FAQ on International Tax Issues due to COVID-19 Travel Restrictions (10). Under the FAQ, the IRB has maintained that the presence in or absence from Malaysia due to COVID-19 travel restrictions will generally not affect an individual's tax residence status in Malaysia. Similarly, resident companies that cannot convene their board meetings in Malaysia or non-resident companies that have to convene their board meetings in Malaysia due to COVID-19 travel restrictions are unaffected in terms of tax residence, provided that certain conditions are met.

The FAQ has further clarified the type of documents to be retained and submitted to the IRB upon request in order to prove the inability to leave or enter Malaysia due to COVID-19 restrictions. Such documents include guidelines on local or foreign authority travel restrictions, documents that prove the individual's effort to leave or return to Malaysia (including responses from the Immigration Department of Malaysia or the relevant airlines) during the movement control order period in Malaysia, and minutes of directors' meetings stating the reasons why the directors were attending the meeting remotely from their respective locations.

Additionally, the FAQ sheds some light on the taxation of income received by individuals temporarily working overseas or in Malaysia. Briefly:

-- Malaysian tax residents who normally exercise their employment in Malaysia, but are forced to work temporarily overseas due to COVID-19 travel restrictions, are still regarded to be exercising employment in Malaysia and thus subject to Malaysian income tax; and

-- the IRB is prepared to consider that non-resident individuals are not exercising employment in Malaysia even if such individuals are working from Malaysia due to COVID-19 travel restrictions, provided certain conditions are met.

Expatriate-related developments

Suspension of the Malaysia My Second Home Programme (MM2H Programme)

New applications for the MM2H Programme, as well as processing new applications that have been submitted, have been suspended since 4 August 2020, while the Government reviews the programme.

It was previously reported that the MM2H Programme will be relaunched in 2021 with some changes made to the terms and conditions. No formal announcements have been made at this juncture.

Extension of the Returning Expert Programme (REP)

The REP has been extended for three years until 31 December 2023. Under the REP, skilled Malaysians may avail themselves to, amongst others, a flat income tax rate of 15 per cent on employment income for five consecutive years, as opposed to being subject to the progressive income tax rate of up to 30 per cent.

Update on the issuance of tax identification numbers (TIN)

Previously, it was announced that Malaysian individuals who are 18 years old and older, as well as corporate entities, will automatically be assigned a TIN. At the time of writing, this has not been implemented.

Footnotes:

1, The SVDP ran from 3 November 2018 to 30 September

2019.

2, A company undertaking PEH activities has been defined by

the Labuan Investment Committee as a company that only holds

equity participation and earns only dividends and capital gains.

The receipt of interest from financial institutions arising from

the placing of dividend monies or proceeds of disposal of shares,

will not disqualify a company of its PEH status.

3, Labuan Business Activity Tax (Requirements for Labuan

Business Activity) 2018 (Amendment) Regulations 2020 (gazetted 24

December 2020).

4, Directive on Management and Control Requirements for

Labuan Entities that Undertake PEH Activities (Directive) issued

by the LFSA on 10 August 2020.

5, Directive read together with the Clarification on Board

Meeting Requirement dated 10 September 2020 issued by the

LFSA.

6, Stamp Duty (Exemption) (No. 3) Order 2012.

7, "Labuan business activity" means a Labuan trading or a

Labuan non-trading activity carried on in, from or through

Labuan, excluding any activity which is an offence under any

written law.

8, Frequently Asked Questions on the Extension of Time for

the Transitional Period of the "Guidelines for the Reporting

Framework for Beneficial Ownership of Legal Persons" to a Date to

be Determined by the Registrar.

9, Frequently Asked Questions on the Beneficial Ownership

Reporting Framework of Legal Persons.

10, Issued on 9 February 2021.