Alt Investments

Outlook Brightens For World's Asset Management Industry - Moody's

.jpg)

A major reason for the improved outlook, Moody's said, is the continued growth in private markets' assets such as private equity and debt. Family offices and other wealth management entities have been among the main drivers of this trend.

The outlook for the world’s asset management industry has improved since the pandemic-induced fears of last spring, buoyed by heightened investor risk appetite. It has been fueled by inflows into index-tracking funds, private market assets and ESG strategies, one of the world’s “Big Three” rating agencies has said.

Moody’s said in a report that it has revised its outlook to

“stable” from the “negative” outlook in place since March last

year – the month when the COVID-19 pandemic crisis sent markets

crashing.

“The return to stable reflects a clear improvement in the

industry's operating conditions thanks to an improving

macroeconomic environment, a sustained rally in financial markets

and increasing investor risk appetites,” it said. “A strong

market recovery has boosted investor confidence and industry

flows. Sustained improvement in active equity fund performance

could help the industry regain its appeal for investors.

Institutional and high net worth flows into alternative

strategies in the second half of 2020 and Q1 2021 were strong.

Flows into alternatives and into ESG products will likely

increase over the next 12 to 18 months as demand widens.”

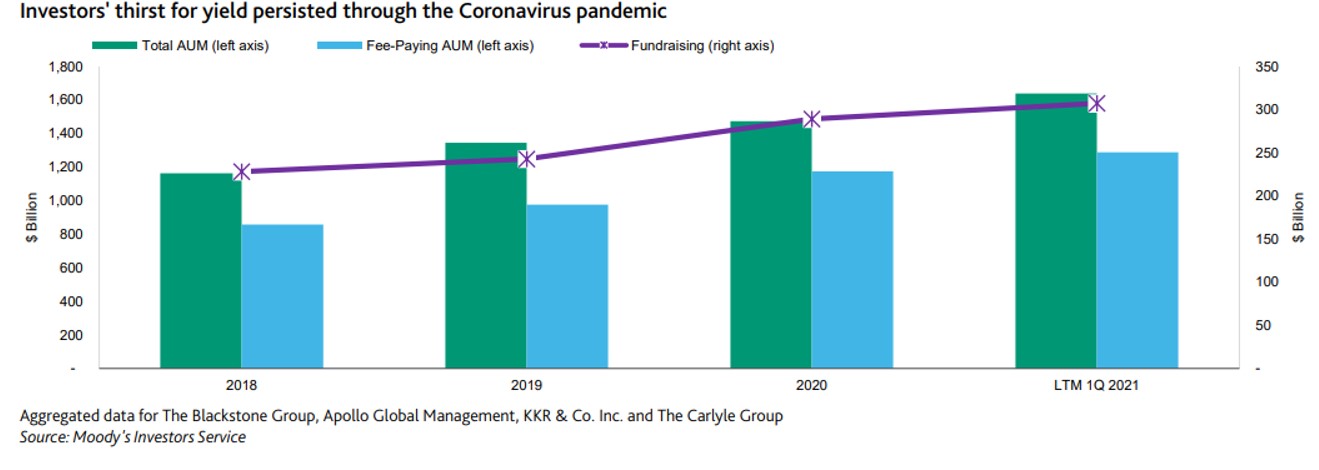

One of the big themes well known to wealth management

institutions has been how the hunger for yield, against a

background of ultra-low interest rates, has boosted private

assets such as private equity. Clients are willing to hold

illiquid assets to obtain the premium. Moody’s says its data

shows continued inflows to the space during the market gyrations

of 2020.

Another driver of private markets investing – which typically

attracts higher fees – is that more companies are waiting longer

to float on the stock market. Also, the total number of listed

firms has actually contracted since the dotcom peak of the 1990s.

Private market investments – such as private equity and credit –

have exploded 30-fold from 2000 to $30.5 trillion today.

Alternative assets are used by 57 per cent of wirehouses, 43 per

cent of hybrid RIAs and 64 per cent of retail bank

broker-dealers. At the ultra-HNW end of the spectrum, such

investors hold 46 per cent of all money in private markets

(source: ALTSMARK).

“Capital raising is one of the key metrics used to assess the

industry’s growth outlook. Aggregate fundraising for four of the

largest publicly listed, alternative asset managers was $67.3

billion in Q1 2021 and $307.2 billion for the last 12 months

ended March 31, up 22 per cent and 45.6 per cent year-over-year,

respectively. These results highlight strong investor demand for

alternative asset manager strategies. Investors will continue to

increase their allocation to alternative investments over time,

which will provide further AUM and revenue growth opportunities

given the higher fees on these products,” Moody’s said.

Fees

The report noted that asset manager revenue is highly correlated

to market beta and investment performance.

“The extreme market volatility that erupted in March 2020 had a

material impact on asset manager AuM in Q1 2020. Our base case at

the time assumed the AuM shock would have a significant impact on

Q2 2020 revenue and that the strain would carry through the

remainder of the year given the large economic and market

uncertainties. The impact on asset managers' revenue proved to be

short-lived as equity markets rebounded sharply in Q2 2020,” it

said.

“Even before the coronavirus pandemic, organic AuM growth was

elusive to most players in the industry with the exception of

certain industry sub-segments (such as ETF managers and

alternative asset managers). Active underperformance and the

shift to passive are two of the primary drivers behind

traditional active managers' persistent organic AuM growth

weakness,” it said.

Moody’s said that another positive sign is the “improvement in

the performance of active equity funds, particularly

value-oriented equity strategies, which represent the largest

share of the active equity fund universe and have been chronic

underperformers.”

“A sustained period of performance improvement could help active

managers re-establish trust with their clients and accelerate the

industry's recent positive flow trends,” it added.