Investment Strategies

Are Debt, Digital And Climate Transforming Central Banking, Broader Economy?

Central banking faces three pressing challenges: debt,

digital and climate. The author of this article thinks that such

banks will change how they conduct policy. Meanwhile, the spectre

of inflation is back, perhaps unsurprisingly after a period of

large money printing to inoculate the financial system against

heavy government borrowing. The rules of economic life haven’t

been suspended, so what does this mean? Here is Fabrizio Pagani,

global head of economics and capital markets strategy at Muzinich & Co,

to explain more.

The editors of this news service are pleased to share these

insights and we invite readers to jump into the conversation. The

usual editorial disclaimers about the views of outside

contributors apply. Email tom.burroughes@wealthbriefing.com

and jackie.bennion@clearviewpublishing.com

Central banking is facing three pressing challenges: debt,

digital and climate. We believe that the response to these

challenges by the major central banks will change the nature of

monetary policy and the role of central banking in the economy

and society at large.

Debt

Since the 2007/2008 Great Financial Crisis (GFC), central banks

have enriched the toolkit of monetary policy by introducing new

non-standard instruments and enhancing existing ones. Among these

unconventional policies, quantitative easing stands out. As

defined by Ben Bernanke, “Quantitative easing involves central

bank purchases of securities in the open market, financed by the

creation of bank reserves held at the central bank.” [1]

Major central banks have engaged in quantitative easing (QE) in the years following the GFC and have made further, massive, recourse to this instrument in response to the COVID–19 pandemic. The Federal Reserve (Fed), European Central Bank (ECB), Bank of England and Bank of Japan have all undertaken quantitative easing.

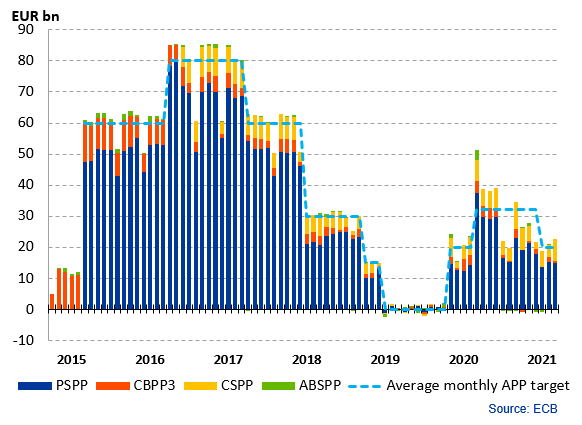

Fig. 1 – European Central Bank Asset Purchase Programmes

The graph does not include the purchases under the PEPP, the

purchase programme specifically established during the pandemic.

(PSPP – public sector purchase programme, CBPP3 - third covered

bond purchase programme, CSPP – corporate sector purchase

programme, ABSPP – asset-backed securities purchase programme,

APP – asset purchase programme.) As of 31 March 2021.

In the last decade, central bank balance sheets have grown

dramatically. For example, the amount of bonds bought by the

Eurosystem through its different programmes (APP and PEPP) stood

at around €4,000 billion in mid-April 2021. [2]

More than 75 per cent of the securities owned by the ECB are

government bonds, the purchase of which will continue at a

substantive pace until at least the end of March 2022, swelling

its balance sheet even more. Equally, in April 2021,

Fed-owned assets amounted to more than US$7700 billion, with a

striking ninefold increase since early 2008. [3]

The ECB and Fed will end up owning between 25 per cent and 30 per

cent of their governments’ debt, and the Bank of Japan over 40

per cent.

Existential questions loom over this debt, well beyond contingent

issues about the length of the extension to the current purchase

programmes. Will central banks embark on an indefinite roll over,

possibly extending the maturity? Will this debt eventually be

made perpetual or even cancelled as has been proposed? In the

case of the European Union, will the ECB progressively replace

national debt with a supranational one issued by the Commission

under programmes such as the Next Generation EU?

Each central bank has its own mandate, culture and practices and

these questions can, possibly, find narrow, technical answers

according to each jurisdiction.

However, there is a general interrogative on the long-term role

that central banks will play vis-à-vis the increasing levels of

government indebtedness and the rising amount of national debt

which they own. Perhaps we have not yet reached a time to

answer these questions fully.

Digital

In recent years, we have seen an acceleration in the pace of

digitalisation in all aspects of the economy and within society

more broadly. A technological revolution is taking place: money

could not remain unaffected. Indeed, it is not the first

time that money has undergone a radical technological

transformation and each transformation, such as from gold coins

to banknotes, has had its own challenges. There is much

confusion on the exact definition of the digitalisation of money.

It is a notion that includes different phenomena such as

electronic payment systems, the most successful being the digital

wallets of China’s WeChat and Alipay; the emerging array of fiat

cryptocurrencies, such as the popular bitcoin and “stablecoins”

on blockchain; and the possibility of central banks issuing

digital currencies.

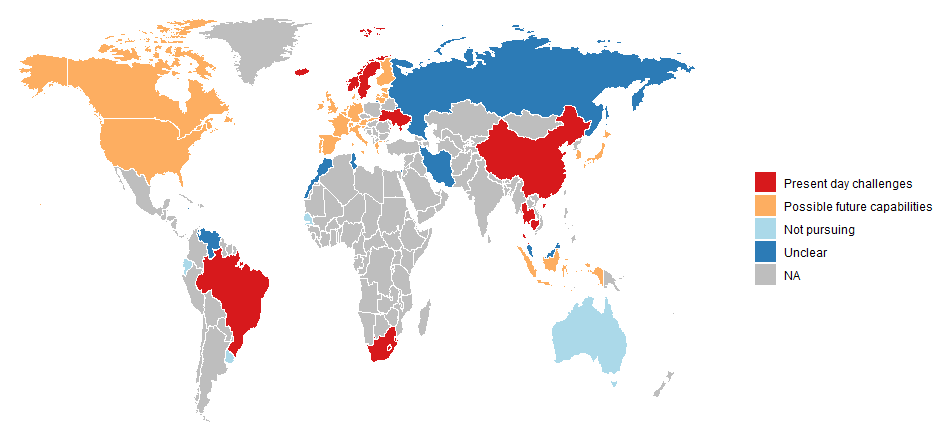

Central banks and governments globally are considering

introducing central bank digital currencies (CBDCs), as shown in

Fig. 2: [4]

Countries have been assigned one of five categories: (1)

addressing a present day challenge, (2) exploring possible future

capabilities, (3) not pursuing research and experimentation, (4)

unclear motivations, and (5) not available.

Source: Jess Cheng, Angela N Lawson, and Paul Wong, Preconditions

for a general-purpose central bank digital currency, Feds notes,

24 February 2021

https://www.federalreserve.gov/econres/notes/feds-notes/preconditions-for-a-general-purpose-central-bank-digital-currency-20210224.htm#fig1

For some time, the Bank of International Settlement (BIS) has

been trying to find clarity and provide some early taxonomy.

[5]

Central bankers are eager to stress the difference between CBDCs

and cryptocurrencies, which they prefer to call “crypto assets”.

We believe that there is an emerging “official” view which

broadly sees digital currencies relying on a central authority

and being associated with a physical currency, such as the US

dollar or the euro. On the contrary, cryptocurrencies are

considered closer to investment than to money and are “mined” or

“produced” in a decentralised way by private players.

Reality is more complex. The development of private currencies is

possible - bitcoin could soon be accepted as a means of payment

by certain businesses. The dystopian risk of fragmentation,

multiplication and competition of currencies could soon become

real, as is the possibility of the creation of

privately-sponsored international digital currency areas across

national borders.

Facing this threat, but also with the ability to use new tools to

fulfil their mandates, central banks are more actively exploring

whether and how to create digital currencies. A recent Report on

a Digital Euro by the ECB makes a compelling case for its

pursuance. [6]

The challenge for central banks will be to combine the

fast-evolving world of digital technologies with the mandate of

stability entrusted to them and descending from their mandates.

Much preparatory work is necessary and there are numerous areas

to be solved, e.g., access, privacy, safety, anti-money

laundering, possible restrictions in use, remuneration etc.

The digitalisation of the currency opens a realm of possibilities

and its introduction could have wide ramifications. Monetary

policy could be transformed. Looking into CBDC remuneration,

effects could be manifold. For example: i) the transmission of

interest rates to household deposit rates could become more

direct; ii) the case for negative interest rates, what economists

call the “zero low bound problem” could disappear; iii)

remuneration could be tiered, with different interest rates

applied in different cases. On the latter point, which could open

fascinating policy avenues, the ECB writes that CBDC would “allow

the Eurosystem to pay less attractive interest rates on large

holdings of digital euro or on holdings by foreign investors in

order to discourage excessive use of the digital euro as an

investment or to mitigate the risk of attracting huge

international investment flows”. [7]

Obviously, the banking system will also be deeply affected, with

the possibility of a drastic disintermediation of commercial

banks.

At the current stage, no final decision of issuing CBDC has been

taken by any major central bank. In this changing and uncertain

environment, central banks - and governments - need to act and

react fast if they want to retain monetary sovereignty.

Perhaps CBDCs are becoming an inevitable necessity, on top of

being useful tools.

Climate

Climate change is a major threat to mankind. Its impact on

economic activities cannot be underestimated.

Fighting climate change appears far beyond the remit of central

banks. However, climate change has an impact on the economy,

including on financial and even price stability. [8] There

is therefore growing consensus that central banks, without being

the main actors, must play a role. This role, which is advocated

by many as part of the mobilisation of the whole of society

against climate change, could cut across monetary policy,

financial stability, prudential regulation and supervision.

Central banks are devoting resources to study climate change and

its implications for monetary policy. The Swedish Riksbank, the

Bank of England, the ECB and more recently the Fed have set up

specific processes for working groups to study the matter.

[9]

In 2017 the Network for Greening the Financial System (NGFS) was

created, which gathers over 80 monetary authorities and financial

regulators across the world. The Fed joined in December 2020. The

NGFS helps “strengthening the global response required to meet

the goals of the Paris agreement and to enhance the role of the

financial system to manage risks and to mobilise capital for

green and low-carbon investments in the broader context of

environmentally sustainable development.” [10] A recent NGFS

document provides a range of options for central banks’ action

around three axis: credit operations, collateral and asset

purchase. They are summed up in the following table [11].

Selected stylised options for adjusting operational

frameworks to climate-related risks

(1) Adjust pricing to reflect counterparties’

climate-related lending; and

(2) Adjust pricing to reflect the composition

of pledged collateral.

Make the interest rate for central bank lending facilities

conditional on the extent to which a counterparty’s lending

(relative to a relevant benchmark) is contributing to climate

change mitigation and/or the extent to which they are

decarbonising their business model.

Charge a lower (or higher) interest rate to counterparties that

pledge a higher proportion of low-carbon (or carbon-intensive)

assets as collateral or set up a credit facility (potentially at

concessional rates) accessible only against low-carbon

assets.

Footnotes

[1] Ben S. Bernanke, Monetary Policy in a new Era, Brookings

Institutions, paper prepared for conference on Rethinking

Macroeconomic Policy, Peterson Institute, Washington DC, October

12-13, 2017

[2] ECB Press Release, Consolidated financial statement of the

Eurosystem as at 16 April 2021,

https://www.ecb.europa.eu/press/pr/wfs/2021/html/ecb.fs210420.en.html

[3] Federal Reserve, Credit and Liquidity Programs and the

Balance Sheet,

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm,

as at 20 April 2021

[4] A 2021 BIS survey of central banks found that 86% are

actively researching the potential for CBDCs, 60% were

experimenting with the technology and 14% were deploying pilot

projects,

https://www.bis.org/about/bisih/topics/cbdc.htm?m=1%7C441%7C714%7C98,

as at 29 April 2021

[5] For example, Morten Linnemann Bech, Rodney Garratt, Central

bank cryptocurrencies, BIS Quarterly Review, September 2017.

https://www.bis.org/publ/qtrpdf/r_qt1709.pdf

[6]

https://www.ecb.europa.eu/pub/pdf/other/Report_on_a_digital_euro~4d7268b458.en.pdf,

October 2020. See also Introductory remarks by Fabio Panetta,

Member of the Executive Board of the ECB, at the ECON Committee

of the European Parliament, 14 April 2021,

https://www.ecb.europa.eu/press/key/date/2021/html/ecb.sp210414_1~e76b855b5c.en.html

[7]

https://www.ecb.europa.eu/pub/pdf/other/Report_on_a_digital_euro~4d7268b458.en.pdf,

October 2020

[8] FSB, The Implications of Climate Change for Financial

Stability, https://www.fsb.org/wp-content/uploads/P231120.pdf 23

November 2020; and Celso Brunetti, Benjamin Dennis, Dylan Gates,

Diana Hancock, David Ignell, Elizabeth K. Kiser, Gurubala Kotta,

Anna Kovner, Richard J. Rosen, Nicholas K. Tabor, Climate Change

and Financial Stability, Feds Notes, 19 March 2021

[9] Riksbank Executive Board, Sustainability strategy for the

Riksbank, 16 December 2020

https://www.riksbank.se/globalassets/media/riksbanken/hallbarhetsstrategi/engelska/sustainability-strategy-for-the-riksbank.pdf;

https://www.bankofengland.co.uk/climate-change; Lael Brainard,

Financial Stability Implications of Climate Change, 23 March 2021

https://www.federalreserve.gov/newsevents/speech/brainard20210323a.htm

[10]

https://www.ngfs.net/en/about-us/governance/origin-and-purpose,

13 September 2019

[11] NGFS, Adapting central bank operations to a hotter world.

Reviewing some options, March 2021

https://www.ngfs.net/sites/default/files/medias/documents/ngfs_monetary_policy_operations_final.pdf