Wealth Strategies

Is The Window Closing For Capturing Cyclical Upswing?

The Swiss private bank and investment firm takes another look at how, it says, investors should use the current situation to adjust asset allocation. Forward-looking markets have rallied, but this process will not last forever.

Financial markets recovered from their slide of last March

after central banks pumped liquidity into the system; the rollout

of vaccines in a number of countries has also cheered investors,

hopeful that some kind of normality will return later this year.

Before the pandemic hit, investors had been speculating that the

West was at risk of a Japanese-style period of low growth and

interest rates. It may be, so such commentators say, that any

sharp rise in growth and markets this year should be treated as

an opportunity to re-jig asset allocation before longer-term

trends reassert themselves.

An organisation that has talked before about such trends is the

Swiss firm, SYZ Group. It has already argued that investors

should use this current period as an opportunity before the

situation shifts. And it has

warned about the "Japanification" of growth. Here are

comments from Adrien Pichoud, chief economist and senior

portfolio manager at SYZ Group. The

editors of this news service are pleased to share these views;

the usual editorial disclaimers apply. Jump into the debate!

Email tom.burroughes@wealthbriefing.com

or jackie.bennion@clearviewpublishing,com

Staggering spikes in COVID-19 cases, all-too-expected Brexit

disruptions and shocking anti-democratic developments in the US

kicked off 2021 with a bang. From a different vantage point,

however, the beginning of 2021 can be seen as positive. Vaccines

roll-outs are bringing us closer to the end of the pandemic,

uncertainty around Brexit is over and a Democrat majority in the

US Senate will enable enhanced fiscal support.

While the COVID-19 situation has worsened, governments have

learned how to mitigate the economic impacts since the first wave

last March, and we do not believe that the second tsunami of

infections will derail the recovery. Crucially, vaccination is

helping businesses see the light at the end of the tunnel and

hold tight until things normalise.

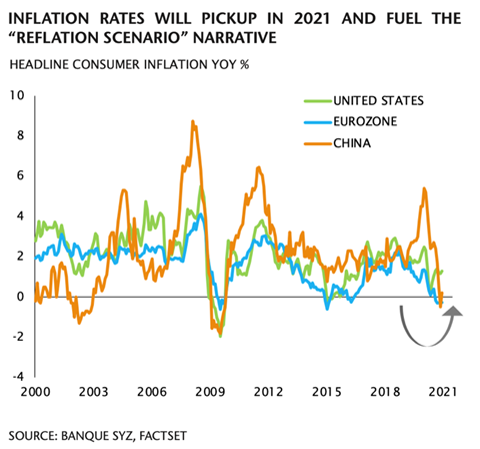

As a result, forward-looking markets have rallied to new highs,

and we expect pent-up demand to keep fuelling macroeconomic

momentum. In the context of continued accommodative central banks

and government support, we should also see inflation pick up from

a low base.

Making the most of growth

This acceleration will not be permanent, however. The long-term

Japanification trend of low growth and low inflation - which does

not rule out short reflationary cycles - will inevitably resume

its gravitational pull on the economy towards the end of the

year.

Once the recovery is well underway, perhaps towards the end of

the summer, we expect governments and central banks to gradually

shift their tone - highlighting economic improvements rather than

downside risks. As they contemplate the withdrawal of supportive

measures, markets will need to fundamentally reassess the

outlook. The removal of the proverbial punchbowl can hurt assets

across the board and lead investors to re-evaluate the premium

they are prepared to pay for risk.

With this in mind, the current rally presents a tactical window

of opportunity to capitalise on higher growth and inflation.

Since we identified the potential for a return of growth in

November, we have been gradually repositioning the portfolios to

capture more cyclical equity exposure and less rate sensitivity.

As the upward trend has been steadily confirmed by economic

data, we have made a series of incremental changes – from

increasing the equity allocation and reducing our quality and

growth stock bias to obtaining broad-based value exposure through

global exchange traded funds.

Taking cyclicality to the next level

Our confidence in imminent economic growth has increased and we

are now contemplating additional moves within the equity

allocation - replacing sector-neutral value and quality growth

stocks temporarily with sector-specific cyclical exposure. While

we will retain certain all-weather quality growth stocks, we want

to benefit from the cyclical companies poised to assume market

leadership.

Downtrodden commodity-related sectors, such as materials, and

financials offer significant catch-up potential, and the

temporary growth outlook offers a tactical opportunity to benefit

from these sectors we otherwise classify as “structural losers”

of Japanification. A reflation scenario should increase demand

for raw materials, while financials, which have lagged

structurally over the past several years, should rapidly benefit

from steeper yield curves and higher long-term rates. Despite an

initial rebound, these sectors are still cheap compared with

others.

Core eurozone equity markets, such as Germany and France, are

also attractive, given the super low-rate context in Europe, and

could benefit from a global reflation scenario, as well as the

Japanese market. Meanwhile, Chinese equities continue to be

boosted by macro momentum and a raft of domestic support

measures.

Reducing rate risk

On the fixed income side, we have also made changes to reflect

the solidifying reflation scenario. As the US curve appears prone

to further steepening, due to positive growth prospects and

additional fiscal stimulus, we are exercising caution on nominal

government bonds, especially US treasuries.

The combination of rising yields and stretched valuations across

the entire credit spectrum have also led us to decrease our

investment grade credit exposure, as both carry and potential for

spread compression are very limited. In fact, credit spreads are

at risk of widening along with rising rates. While macro and

liquidity conditions are favourable, we prefer to seek

opportunities elsewhere, as the potential for positive

performance appears limited in a temporary reflation

scenario.

Emerging market hard currency debt remains our favourite segment

of the fixed income universe, as the combination of improving

global growth dynamic, ample US dollar liquidity, very low rates

and the recent weakening of the dollar clears the outlook for

some issuers and allows us to benefit from still attractive

spreads. We also continue to see value in high yield, where

additional spread compression remains possible for cyclical

issuers and short-dated bonds offer positive carry.