Investment Strategies

Investment Trust's Purchase Of Unloved China Equities Pays Off

We talk to a manager of a London-listed investment trust that concentrates on Asia ex-Japan stocks.

There is a saying that timing the market is a fruitless exercise

but there are occasions when a decision to get in or out of a

position pays off. And this might just be the case for a

London-listed investment trust which focuses on Asia-ex

Japan equities.

About two years ago, China’s equity market was languishing,

paying the price for Beijing’s crackdown on certain sectors,

trade tensions with the West and domestic woes such as indebted

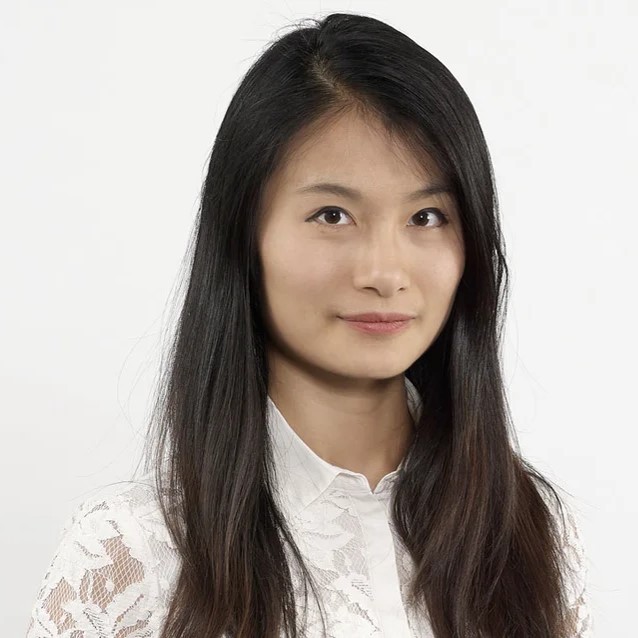

real estate firms. And yet the manager of the Invesco Asia

Trust, Fiona Yang (pictured), (now Asia Dragon Trust –

formed out of a recent trusts merger in February), judged this as

a propitious time to buy into Chinese equities.

“We used this opportunity to increase weighting in China. The

market was extremely cheap and the market was on the floor. It

enjoyed a 60 per cent rally in the last 12 months and a lot of

the companies we have bought have done extremely well,” Yang told

this publication in an interview.

At Invesco for five years, Yang and colleagues have tried to

take a contrarian approach, seeking opportunities that might not

be readily apparent. And underlying all this is that Asia, for

all its challenges, is “the world’s growth engine” – it accounts

for about 60 per cent of the world’s GDP growth, she said.

The trust aims to provide long-term capital growth and income by

investing in a mix of Asian and Australasian companies

to beat the MSCI AC Asia ex Japan Index (total return, net

of withholding tax, in sterling terms).

Performance data suggests that, over the past 10 years, it

has met that objective by a comfortable margin. The share price

has risen almost 187 per cent over 10 years; the net asset value

has risen 172 per cent, while the MSCI AC Asia ex Japan Index is

up almost 119 per cent. Yang joined Ian Hargreaves on the Invesco

Asia Trust in January 2022.

Under-loved

Much of the Asia equity sector is “under-owned” – overall, the

region trades on a forward price-earnings ratio of 14.6 times

earnings.

A reason for the relatively neglected status of Asia ex-Japan is

that the US market has been so strong for so long, in particular

the Big Tech stocks. However, forces such as a devaluing dollar

and an US Federal Reserve rate cut have changed the narrative,

she said. And a move towards Asian equities would have happened

even without the dollar factor as growth in Asian equities is

compelling, she said.

Beyond looking at macro factors, the portfolio is composed

of companies that fulfill certain tests, such

as healthy balance sheets providing resilience through

interest rate changes, a strong shareholder return policy and,

most importantly, these companies are attractively

valued, she said.

“We want firms to pay out more to shareholders via share buybacks

and dividends,” Yang said. This means that the trust has low

leverage within its overall portfolio, she continued.

Holdings

Within its top 10 holdings, as a percentage of the total

portfolio, are Taiwan Semiconductor Manufacturing (11.5 per

cent); Tencent ( 7.6 per cent); Samsung Electronics (7.2 pe

cent); HDFC Bank (5.2 per cent); AIA (3.6 per cent); NetEase

(3.0 per cent); Alibaba (2.9 per cent); Kasikornbank (2.8 per

cent); United Overseas Bank (2.6 per cent); and Shriram Finance

(2.2 per cent).

The trust has a share price discount to NAV of -8.8 per cent, as

at the end of July. According to its 31 July factsheet, the trust

has a net gearing of 3.2 per cent. It intends to maintain an

aggregate annual dividend equal to 4 per cent of its NAV.

(Note: The Asia Dragon Trust was formed this year through the

merger of two investment trusts: the original Asia Dragon Trust

and the Invesco Asia Trust.)