Client Affairs

The Case For Avoiding GameStop Craze

The surge in retail investor trading in shares such as computer games retailer GameStop, cinema chain AMC and now the silver market, has prompted warning noises from regulators and considerable media chatter. What should wealth advisors think about this and what message should go to their clients?

The extraordinary market events of recent days, in which users of popular social media platform Reddit combined to hit short-selling hedge funds in stocks such as GameStop, AMC, and also in the silver commodities sector, raise a number of questions. Are these examples of healthy, if disruptive forces, at work? Is there something more dangerous going on? What, if anything, should regulators do? As for wealth managers and their clients, what lessons can be drawn?

(It is worth noting that as of today, 3

February, GameStop shares sank by a whopping 60 per

cent, losing more than $9 billion in market value; AMC

dropped 41 per cent. The sharp falls came after CME Group,

the derivatives marketplace, hiked margin requirements for silver

futures, which on Monday this week had risen by the most in one

day for a decade after online traders attempted to boost the

price. Silver futures dropped by about 10 per cent yesterday.

(Source: Wall Street Journal.)

To try and get a handle on all this, we publish a guest article

from UK wealth management house Waverton

Investment Management. The article is written by Charles

Jones, CFA and Tommy Faber, CFA.

The editors of this news service are pleased to share these

views; the usual editorial disclaimers apply, and for readers who

want to add comments, email tom.burroughes@wealthbriefing.com

and jackie.bennion@clearviewpublishing.com

Before 12 January, very few people would have been aware of the

Texas-based video games retailer, GameStop. Like many bricks and

mortar store operators, the company had struggled to adapt to the

shift towards digital distribution within gaming, a trend

accelerated by the COVID-19 pandemic.

Fast forward just a fortnight and more than $29 billion worth of

shares in the company traded hands on a day when the world’s most

valuable company, Apple, managed just over $20 billion. GameStop

has become the subject of a David-versus-Goliath fight between

smaller retail investors acting in concert (unkindly known as

“dumb money” by many professional investors following heavy

retail speculation during the technology bubble), and the global

hedge fund industry.

Drawing up battle lines

Throughout 2020 and heading into the start of this year, hedge

funds were collectively convinced that GameStop would go bankrupt

on the back of the company’s weak fundamental outlook. To make

money on this view materialising, investors are required to

“short” the stock. Shorting involves borrowing stock from another

investor, selling it instantly and buying it back at a later date

(and, hopefully, a cheaper price) at which point the shares are

returned to the lender. The trade is profitable if the price

declines but importantly, if the shares rise, the theoretical

losses are unlimited.

In mid-2019, a user of popular social media platform, Reddit,

better known by his tag, “RoaringKitty,” took a markedly

different opinion on GameStop’s prospects and began to draw

attention to a $53,000 investment he had made in the company.

Though initially ridiculed, he remained steadfast and eventually

built legions of fans who were empowered by the introduction of

zero-fee trading platforms and driven to invest in the stock

markets themselves.

Launching the attack

The swarms of retail investors have been guided by Reddit’s

popular investing chat forum WallStreetBets which has encouraged

users to buy shares of not just GameStop but other companies

undergoing operational difficulties which the hedge fund industry

has bet against. Cinema operator, AMC Entertainment and the

reinvented smartphone company, Blackberry are other examples.

This was achieved primarily through options trading, with

individual investors paying small amounts of money to buy “call”

options giving the investor the right to buy a stock at a fixed

price in the future. The option seller usually buys the

underlying share in the market, so that if the share price rises

it already has the stock to give to the option buyer. The frantic

options buying by small investors forced option sellers to buy

shares in the open market, causing the price to rise sharply.

Since the start of 2021, the shares of GameStop, AMC and

BlackBerry are up by 1577 per cent, 479 per cent and 113 per cent

respectively in US dollars at the time of writing. RoaringKitty’s

$53,000 turned into close to $50 million last week.

Casualties

The early casualties were clear. Those hedge funds with short

positions in such companies were suddenly trapped in a trade that

was becoming rapidly loss-making. As mentioned earlier, the

theoretical loss is unlimited and so hedge funds caught in a

“short squeeze” were forced to start buying back shares of

GameStop and other such positions to avoid spiralling losses.

This accelerated the rise in the share prices, creating a vicious

circle with ever higher losses.

New York-based hedge fund, Melvin Capital,

received a $2.75 billion bailout by Point72 and Citadel as its

assets more than halved in January alone. There will undoubtedly

be more high-profile cases to come.

Last week also saw the secondary impact of these effects in

markets. To fund the repurchase of the short positions, hedge

funds became forced sellers of well-established companies held in

their long book that typically have the best fundamental

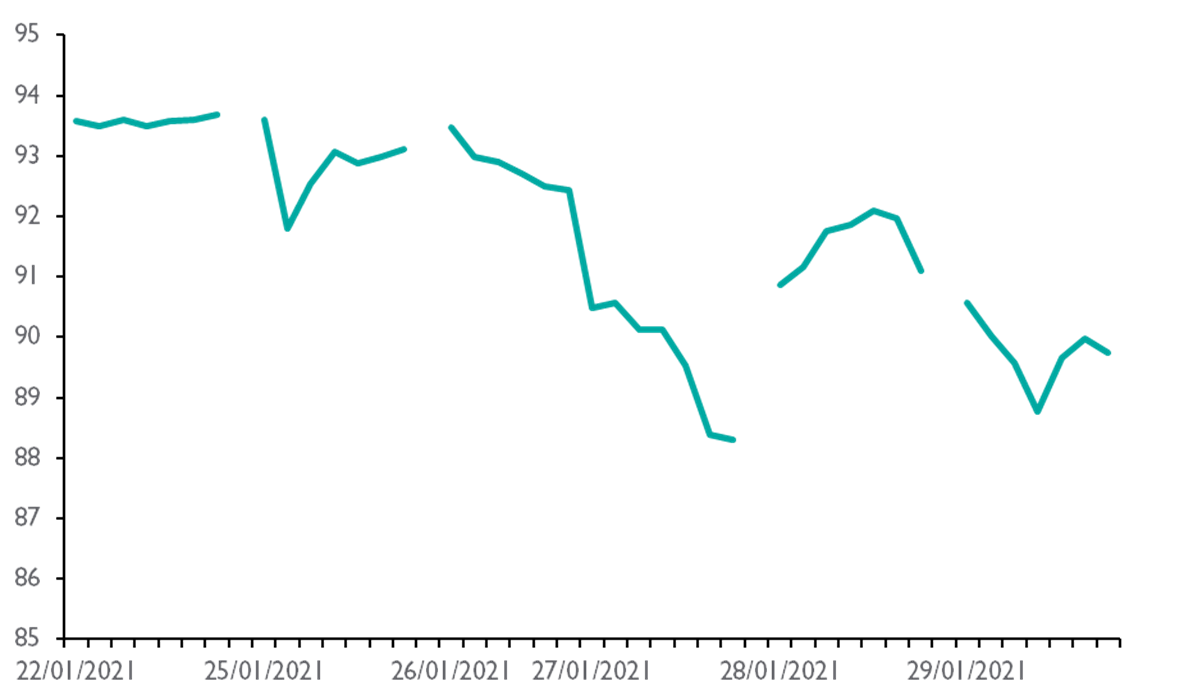

prospects. The Goldman Sachs Hedge Industry VIP ETF is one of the

best representations of these stocks and, as the figure below

highlights, this index fell by 4.52 per cent in US dollar terms

from 22 January to 29 January. Over the same time period, the top

10 most heavily shorted stocks rose by over 92 per cent.

Goldman Sachs Hedge Fund Industry VIP ETF

Source: Raymond James

Does David conquer Goliath?

Left untouched, eventually hedge funds will have bought back

enough stock to close their short positions, or they will go

bust. At this point, buyers of GameStop stock will dry up and the

share price is likely to collapse, burning individuals who have

purchased call options as these will expire worthless.

Additionally, the call option sellers will hold material losses

on the actual shares (which they bought in case the call buyers

exercised their options). In effect, David is slinging so many

stones in all directions that he harms himself as much as

Goliath.

Aftermath

The regulators and share trading platform operators face a

difficult challenge balancing protecting retail investors from

the eventual losses they will inflict on themselves, versus a

retail investor’s legitimate right to buy the stock.

US trading platform Robinhood restricted trading in GameStop (and

others) on 28 January, only to have to permit it again on 29

January as retail investors filed a class action. The same

company was forced to raise more than $1 billion from investors

to pay individual investors and provide cash to its clearing

facilities to protect partners from losses.

This may not actually be the end, however. The hedge fund

industry is always eager to sniff out a profit particularly when

it is at the expense of struggling peers. Attractively

positioned shares that become “forced sales” may themselves

become targeted shorts as traders look to benefit from this

technical dynamic.

Are there any winners?

It is difficult to estimate how long these dynamics will last but

it is possible that long-only investors are the eventual winners,

since they can use this market turmoil to buy shares in excellent

businesses at discounted valuations with no change to the

fundamentals. However, we should not be too complacent. Usually a

bubble like GameStop is caused by greed, this one is driven by

rage against unfairness in the financial system in which long

investors have benefitted. David is being motivated by good

old-fashioned vengeance, let us hope he doesn’t look for new

targets.