Alt Investments

Prospects Brighten For Growth Businesses After Tough Year

.png)

This private investment matchmaker looks at the toll 2020 has taken on early stage businesses and what this bodes for the next generation of growth businesses. It's been a tough year but deals are flowing.

We asked Oliver Woolley, CEO of Envestors to explain why high net worth individuals and those with large savings should be putting their money into growth businesses, when many of them have done anything but this year and are facing an agonising exit from the UK's largest trading partner. Obviously there has been a shift in search for returns because of low/negative interest rates at the same time as a creeping aversion to riskier investing. It is a conundrum, but Woolley provides plenty of data for the year on UK private investment and where capital is flowing. He also assesses the effects of governmment business schemes, such as the Future Fund, and whether the Treasury's response to the pandemic has helped UK entrepreneurs. The editors are pleased to share this contribution and invite readers to jump in.

The usual editorial disclaimers apply to outside contributors. Join the debate! Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com.

The sun also rises

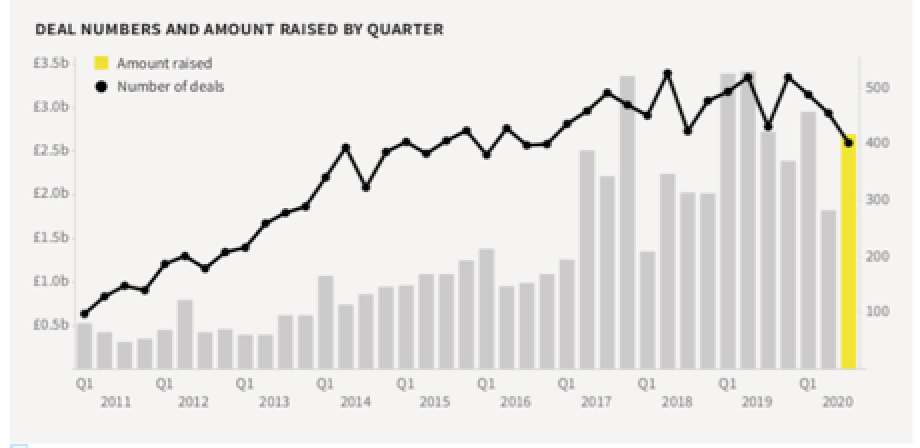

This year, private UK companies have seen a diminished investment

landscape, but one which seems to be picking up as the year draws

to a close. Whilst overall deal value fell in Q1 and Q2 2020, it

remained higher in Q3 at £2.7 billion, just a 1 per cent drop

compared with Q3 2019.

There has, however, been a shift in direction of funds; investors have been focusing on portfolio companies, as well as more mature companies.

Throughout COVID-19, there has also been a shift in sector preference with investment flowing towards video conferencing services, EdTech, eHealth and ‘community sharing’ businesses. Some sectors rather unsurprisingly, however, are seeing worse damage than others as a result of the pandemic – namely leisure, entertainment and transport. The government stepped up to offer a range of business support schemes in attempts to mitigate these negative results, which has undoubtedly helped to soften the impact.

A new low

The number and value of fundraisings have dropped since 2019, a

decline that started in March 2020. According to research firm

Beauhurst, Q1 2020 saw 344 equity investments into private UK

companies, the lowest number since Q3 2014 and a 32 per cent drop

from Q4 2019. In Q3, this rose to 402, but remained 7 per cent

below that of Q3 2019.

Source: Beauhurst

While the number of deals has dropped, the average deal value has risen. Since January 2020, £9.02 billion was invested into high-growth private UK companies. This trend is likely to have been exaggerated by a few outliers such as Molo Finance who recently raised £266 million.

The biggest losers

As uncertainty hit the market, investors began favouring later

stage deals. A lot of investment activity was focused on

follow-on funding for existing portfolio companies, in order to

help see them through the impact of COVID-19. On top of that

trend, weary of risk, investors shied away from earlier stage

deals and backed more mature business.

This left seed-stage businesses out in the cold. Whilst the number of seed investments was steady between Q4 2019 and Q2 2020, they fell by 20 per cent between Q2 and Q3 2020.

The number of newly registered businesses remained fairly stable up to and including Q2 2020. In Q3 2020, however, the number fell by 32 per cent.

This spells trouble for the next generation of growth businesses. Without the capital they need to move from the concept state, many great ideas will never get off the ground – and that is a shame for the UK which holds a strong international reputation for innovation.

.png)

Source: Companies House

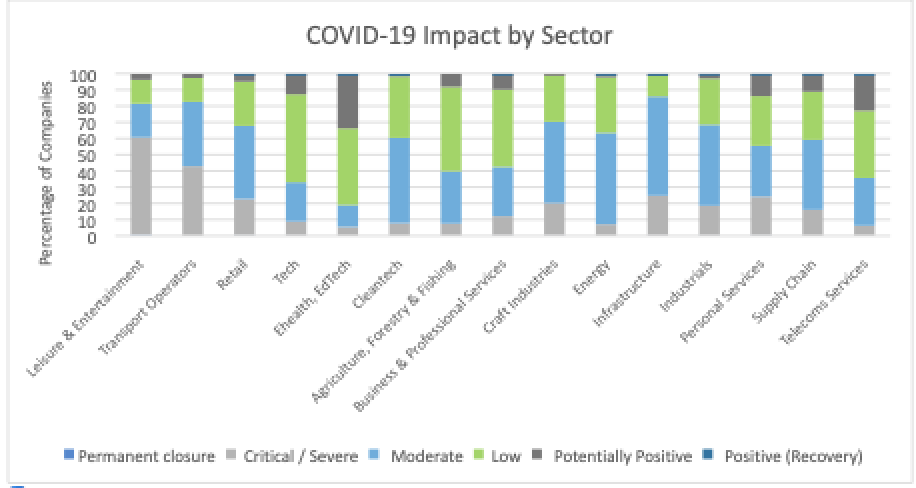

Tracking the impact of COVID-19

There are few sectors that have escaped unscathed by the global

pandemic. However, some have been worse affected than others. The

obvious being leisure, hospitality, transport operators and

retail. Beauhurst, who tracks COVID-19's impact in high growth

businesses, put eHealth and EdTech as those sectors that have

benefitted most with a 34 per cent ‘potentially positive’ ranking

from the pandemic. While the tech sector largely sat in the

middle with 54 per cent of companies experiencing a ‘low impact’,

only 13 per cent were able to capitalise on the situation.

The low number of businesses who have been able to turn the fallout of the pandemic into an opportunity is unsurprising given the pattern of uncertainty we have experienced over the last year. Uncertainty has ebbed and flowed, presenting an inconstant and difficult-to-predict environment for all businesses. While things looked dire in March, by June the mood began to change with promises of normality by September. This was short-lived with the country returning to uncertainty by mid-October as case numbers rose. While news of the vaccine has brightened the outlook, the challenges of a national rollout and the uncertainty of Brexit are likely to continue fuelling feelings of uncertainty for the near future.

A helping hand

The government has rolled out several programmes to help early

stage businesses. Designed for growth business, the Future Fund

received a lot of attention and applications when it was

launched.

While the scheme allows eligible companies to apply for a convertible loan from £125,000 to £5 million, the eligibility criteria ruled it out for many businesses – particularly those seed stage businesses which were already facing hardship in raising investment.

Three requirements were problematic. First, funding had to be matched by private investment. Second, since investment needed to be structured as a Convertible Loan Note (CLN) it was not compatible with the Enterprise Investment Scheme (EIS) which made it less attractive to UK private investors. Thirdly, the business had to have raised £250,000 within the past five years. This requirement left a large number of entrepreneurs out of the equation.

In addition to this high-profile programme, the government made available a number of grants and loan schemes for businesses, including its Coronavirus Business Interruption Loan Scheme, The Small Business Grant Fund and the Coronavirus Job Retention Scheme (furlough), which have no doubt prolonged the life of many high-potential businesses.

Winning sectors

COVID-19 has inevitably had an impact on where investors are

choosing to channel their funds. There has been a shift towards

investment in healthcare, in part due to the disastrous impact

COVID-19 has had on even the most developed nations, highlighting

the importance of innovation in healthcare.

Beauhurst has identified four areas which, for private companies, have seen rising investment as a result of the pandemic, the first being video conferencing. Whilst newer services, such as Hopin (an online platform which allows hosting of live events at a large scale), have seen some investment – Hopin has recently received a $2.1 billion valuation, just eight months since its founding – established companies such as Zoom have remained dominant in the market. eHealth and EdTech have, unsurprisingly, seen increased investment. This rise has been stronger in eHealth, which has seen 11 and 15 deals monitored by Beauhurst in Q2 and Q3 respectively.

EdTech on the other hand has not seen as large an increase as expected – possibly due to reopening of schools, resulting in less home learning – with 12 deals at a combined value of £14.4 million in Q2 and eigth at a combined value of £7.2 million in Q3, compared with 10 in Q3 2019.

Finally, companies that facilitate ‘community sharing’ have seen increased investment – Farmdrop, a business allowing consumers to buy food directly from its source, received £6 million in equity fundraising in June. This trend, according to Beauhurst, probably came as a result of stockpiling at the start of the pandemic, resulting in “calls for people to become more community-minded.”

This year has been a difficult one for private UK businesses, particularly those in leisure and entertainment, retail and transportation operations. Seed stage companies have also seen reduced investment as funds are directed towards both portfolio companies and mature businesses, and the number of new companies registered has fallen in Q3.

With vaccinations due to be rolled out, change is on the horizon – good news for all private businesses. With the end of the tax year approaching, investors will be considering taking advantage of tax savings through the EIS and SEIS schemes; this is likely to result in an uptick in investment as we head into March. However, until vaccination is widespread, unlikely before the third quarter, we can expect to see continued caution by investors and continued hardship for scaling businesses. So, while the sun is rising for private businesses, we have a long wait before the dawn.

About the author

Oliver Woolley is CEO and co-founder of Envestors, a digital

investment platform that brings together entrepreneurs and

investors across geographies, communities and sectors – creating

the single marketplace for early stage investment in the UK.