Philanthropy

Philanthropy Surges In Fighting Pandemic

Visit the Bill and Melinda Gates Foundation website and the first message that greets you is “All lives have equal value”. It’s a comforting thought if not the current reality as the global health emergency shows up glaring fault lines in inequality. The crisis has also thrown philanthropy into high gear.

While commentators are running out of superlatives to describe the suspended state, and most countries are only a few weeks into counting the human and economic costs, the world's wealthiest philanthropists have been swift and visceral in their response.

Philanthropic funding to combat the coronavirus topped $1 billion by early March, including $182 million from US donors, according to foundation research group Candid. This dwarfs the $363 million raised to combat the Ebola outbreak in 2014. Break the coronavirus pledges down further and the US ranked second to China, whose early response committed upwards of $729 million. More than half of the first wave of philanthropy from the US, a global leader in giving, came from the Bill & Melinda Gates Foundation. Where those pledges currently stand are listed in detail below and now top $5 billion.

Global corporate responses to the crisis are worth studying as the social and governance aspects of ESG principles are being reshuffled, arguably giving climate and environmental concerns a back seat. Amazon is keeping households stocked but has been raising social hackles for not protecting its warehouse and delivery staff from the virus. Boards are cancelling dividends left and right. The UK's top five banks announced that they were freezing their dividends last week. Share buybacks are looking like shareholder-over-stakeholder acts of calllous self-interest. Without putting capitalism in the dock, these are highly charged times.

Technology and telcos providers have been jumping through hoops to keep networks running as millions migrate to home working. Healthcare, technology and telcos are clearly early indispensable winners, and another reason why Bill Gates is such a compelling figure at this time. Microsoft, the company he built his fortune on, is one of three leading cloud services providers, from where global business is mostly organised and served. And for the most part it is holding up pretty well.

As a leading philanthropist, Gates' acutely prescient eight-minute TED talk The Next Outbreak? We’re Not Ready has now been viewed on YouTube 24 million times. Delivered in 2015, he urged world leaders to prepare for a pandemic in the same way in which they prepare for war - run simulations and find the cracks in the system, then work in unison to formalise a global response, were his words. “As we’ve seen this year, we have a long way to go,” he stated plainly in the Washington Post a few days ago. Still “if we make the right decisions now, informed by science, data and the experience of medical professionals, we can save lives and get the country back to work," he wrote.

The Gates Foundation said that its $100 million commitment to the COVID-19 outbreak will go towards improving detection, isolation, and treatment efforts; protecting the most at-risk populations; and accelerating the development of vaccines. He told US audiences this week of his plan to help fund the seven leading vaccine contenders and support their manufacture. "It'll be a few billion dollars we'll waste on manufacturing for the constructs that don't get picked because something else is better," Gates said. "But a few billion in the situation we're in, where there are trillions of dollars being lost economically, it is worth it."

Andrew Grabois, who is compiling the pandemic funding for Candid admits that data is changing constantly as more countries come online with their responses. The research group is now producing a rolling website to monitor pledges and recipients.

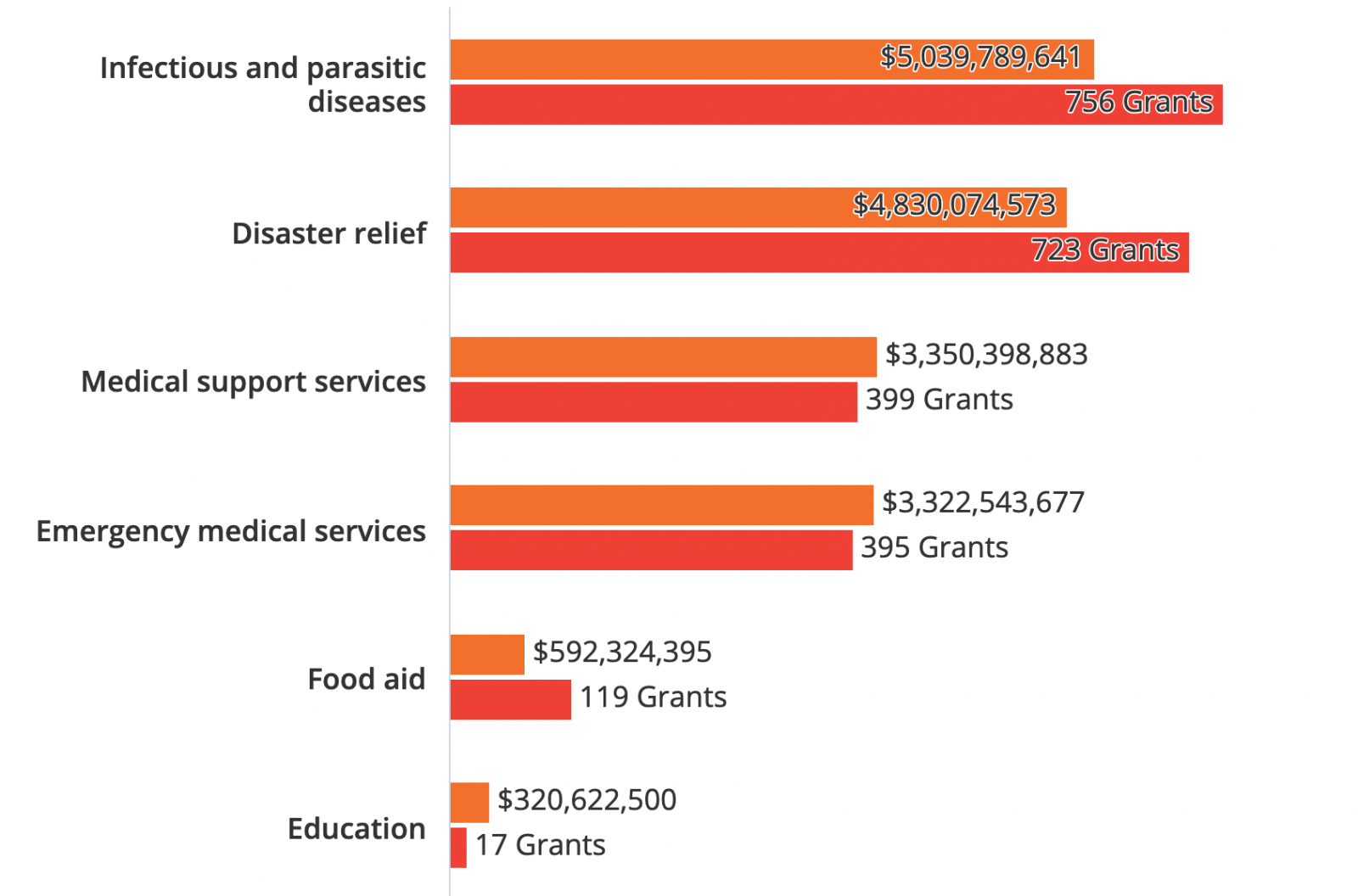

At a glance, the scale is eye-watering, with 771 grantees currently sharing just over $5 billion in commitments from companies, foundations, and individuals. The top 25 donors in dollar terms, according to Candid, looked like this as of 8 April, with Sillicon Valley technology firms and their Chinese counterparts among the top runners and riders:

Top Funders

1. Google.org Contributions Program - 11 Grants $906,750,000

2. Cisco Systems, Inc. Corporate Giving Program - 2 Grants

$218,000,000

3. Tata Trusts - 1 Grant $199,097,425

4. Royal Holding Al Mada - 1 Grant $197,912,028

5. Wells Fargo Foundation - 4 Grants $181,250,000

6. Tencent Holdings - 2 Grants $173,040,000

7. Alibaba Group - 1 Grant $144,200,000

8. Facebook, Inc. Contributions Program - 7 Grants

$122,025,000

9. China Evergrande Group - 1 Grant $115,000,000

10. Bank of America Corporation Contributions Program - 6

Grants $111,500,000

11. Assicurazioni Generali S.p.A. - 1 Grant $110,093,500

12. Intesa Sanpaolo S.p.A. - 1 Grant $110,093,500

13. Bill & Melinda Gates Foundation - 6 Grants $110,000,000

14. Jeff Bezos 1 - Grant $100,000,000

15. Netflix - 1 Grant $100,000,000

16. Sony Corporation Contributions Program - 1 Grants

$100,000,000

17. Naspers Limited 2 Grants - $83,447,910

18. Squirrel AI Learning - 2 Grants $73,542,000

19. Motsepe Family Foundation - 1 Grant $55,631,940

20. JPMorgan Chase & Co. Contributions Program - 2 Grants

$51,000,000

21. LEGO Fonden - 1 Grant $50,000,000

22. Otto Bremer Trust - 1 Grant $50,000,000

23. Mother Cabrini Health Foundation - 1 Grant $50,000,000

24. Wellcome Trust - 1 Grant $50,000,000

25. Lilly Endowment Inc - 3 Grants $48,500,000

View updates on philanthropy’s response at candid.org/coronavirus.

It shows that great challenges can’t be tackled by one stakeholder group alone, and why the crisis has so galvanised businesses, philanthropists, impact investors and entrepreneurs, together with their governments, to retroactively mount a response. The lives versus livelihoods debate is for a clearer time.

A flavour of giving

Industrialist families in Europe have also been pledging large

sums to tackle the outbreak. The Fiat founder Agnelli family in

Italy, the family-owned LVMH luxury goods group in France,

the family-run healthcare giant Roche in Switzerland are some of

those giving hundreds of millions to local health authorities,

retooling their factories, and using their pharmaceutical

capacity to produce protective equipment, testing kits, and the

hopeful end-game, a workable vaccine. Through his foundation,

China’s wealthiest man, Jack Ma, worth around $40 billion, has

reportedly given $14 million to help find a vaccine. There are

also reports that he is planning to ship 500,000 testing kits and

1 million masks to the US.

UBS Wealth Management arguably has one of the most robust philanthropy offerings in the sector. In March the Swiss wealth manager launched the UBS Optimus Foundation COVID-19 Response Fund, where UBS will 100-per-cent match donor pledges up to $5 million. This news service has asked the firm what the fund has raised so far among clients. An early grant of around $500,000 has gone to Americares in the US to help support under-resourced health systems.

“We probably have 40 or 50 people overall in our philanthropy services team, that includes our advisory team plus our Optimus Foundation,” Phyllis Kurlander Costanza, head UBS in Society and Optimus Foundation CEO told this service about its work funding large scale health projects with private clients.

Philanthropy new wave

“We know that 90 per cent of our clients are active in

philanthropy so it is a topic that almost all of our big clients

care about,” she said. “From high net worth up, 80 per cent of

our clients are engaged, yet fewer than 20 per cent are satisfied

they are making an impact," Costanza said. It is why wealthy

donors are increasingly asking wealth managers to help them pool

resources and introduce them to like-minded peers to achieve

scale, and also fund measuring the impact they are having through

the companies and NGOs they support. It's an area in which

traditional philanthropy often falls short. “Even if you are a

billionaire, you still don’t have enough money to solve key

problems on your own,” Costanza said.

Speaking before the COVID-19 outbreak about philanthropy more broadly, Costanza indicated that a transformation is due. “There will be Philanthropy 2.0 that starts to shift away from a focus on activity to social impact bonds that do well and measure outcomes.

“Sustainable investing is delivering market-based returns, philanthropy is delivering zero returns, and there is this gaping hole in there that is social finance. I think we will see a lot more in that social finance space, and it will deliver concessional returns; a development impact bond delivers 8 per cent uncorrelated returns, and this is payback if the NGO delivers on what it said it would. It doesn’t matter what is happening in the market, it is a beautiful 8 per cent. I will take that any day.”

This news service has chronicled how ultra-high net worth individuals have made large gifts, sometimes to medical and health-related causes, as part of a trend in the philanthropy space. Michael Bloomberg, for example, has donated $1.8 billion to John Hopkins University to fund health research. FWR recently carried an article by Strategic Philanthropy chief operating officer Susan Winer about what individuals can do to help coronavirus relief efforts.