Wealth Strategies

Protecting Porfolios Vs Forex Gyrations: No Easy Answers

To hedge forex risk or not to hedge? Aye, that is the question that this family office attempts to answer.

The following commentary comes from Christian Armbruester, chief investment officer of the European firm Blu Family Office, who regularly airs views in these pages. This publication recently attended a seminar held in the firm’s offices in Richmond-on-Thames, and was struck by Armbruester’s discussion of foreign currency volatility and how deciding whether to hedge forex risk or not can be a tough call. So we asked him to elaborate on his presentation here. We are very grateful to Blu Family Office for sharing these insights. As ever, of course, the usual editorial disclaimers apply. If readers want to react, they can email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

The world is a big place with more than 200 countries and an

almost equal amount of different local currencies. Any investor

who is seeking global diversification in their asset allocation,

would therefore have to exchange much of their money from one

currency to many others. How much? That is a matter of strategy

and also mechanics. After all, not everyone can simply exchange

so many different currencies in a cost-effective manner. One

thing is for certain: the minute we do anything we are at risk

and there are also costs. Here is the journey we took as a family

office, to figure out what would be the most optimal way of

investing our money into the world.

The first thing we noticed is that we do not need to invest in

every country. The top 50 countries make up 95 per cent of global

gross domestic product and operate on 35 currencies. The marginal

benefit of investing in Iraq or Zimbabwe seemed rather small

versus the high cost and additional administrative burden. That

made things simpler, but the more complicated question we had to

answer was: how were we going to measure our success of

investing? We needed a reference currency, or “base-currency”, as

it is often called. Simply put, it is the currency that matters

to you – where you live, where you draw income, where you pay

your bills and what you are ultimately investing so that you can

get more.

The next decision we had to make was, how much of our money were

we going to convert. How much do we buy in the US or in Europe

and what about Yen or Brazilian Real? There are wonderful

investment opportunities everywhere and in so many different

currencies, it really is difficult to say how much we would want

of each part of the rest of the world. Some try to categorise the

world by economic strength, others by the value of the local

stock market, and even some look at growth. The fact is, no

matter what you do, a large portion of your risk and returns from

your investment activities will be determined by how much you

retained in your base currency.

Let’s look at the numbers. Say 10 per cent of your money is in

sterling and 90 per cent in all the other currencies, as part of

your globally diversified investment strategy. And please note

that sterling has even less than a 10 per cent weight in the MSCI

World index. What happens if sterling goes down? Then you have

made money in all the other currencies and when you convert those

into the weaker pound, you have more than you had before. But

what if sterling goes up? Then you would lose on 90 per cent of

your portfolio. In other words, if there was such an event, such

as no hard Brexit, and sterling were to re-trace some of the 20

per cent it lost against all the other currencies after the

referendum, it could result in huge losses.

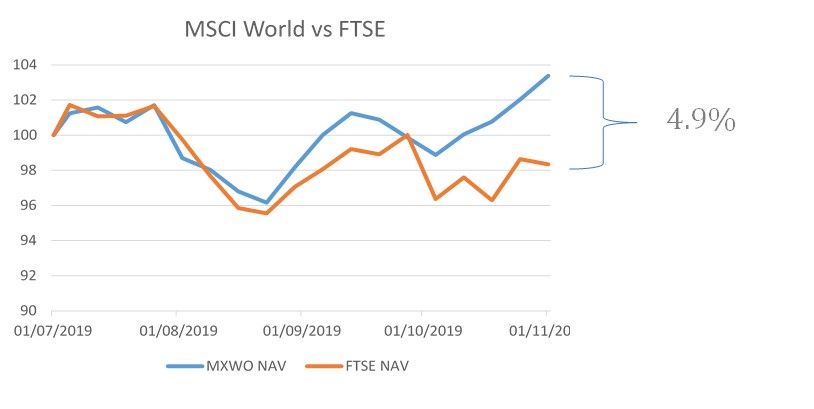

The chart below shows the performance of the FTSE 100 index versus the MSCI World index since July. Sterling has appreciated more than 6 per cent since then, which means those companies that export into other countries have lost a lot of their revenues relative to sterling which explains the almost 5 per cent underperformance.

Source: Blu Family Office

Can we hedge this risk and not worry about currencies at all? You

could invest only in your base currency. But the whole idea of

diversification is to invest in other things and how many people

in Argentina had wished they had put their money abroad? It can

always go horribly wrong and the only thing we know for sure, is

not to put all your money into any one thing. You have to take

risk in different regions, opportunities and denominations to

manage wealth effectively.

The other way to manage currency exposure is through the

financial derivatives markets. There, we can buy forwards, calls,

puts and even futures on any currency we like, allowing us to

hedge whatever risk we wish to take off. There is a price, of

course, which is not only a function of the spreads and execution

costs, but also the interest rates in the countries with

different currencies. Say you wanted to hedge US dollars into

euros, then your costs are currently more than 2.5 per cent, as

interest rates in the US are still relatively high compared with

negative rates for the euro. Not something you want to be paying

for the next 25 years, which is also why it is not economical to

hedge all of your currency risk. And moreover, your currency

could also depreciate, in which case the hedge would also cost in

performance.

Complicated stuff, and there is no right or wrong answer, and

your base currency will either go up or down. Whatever level of

currency risk you choose to take on, remember this: the sheer

size of the position warrants some serious consideration. The

biggest risk of all is often the most obvious and therefore also

the easiest to ignore.