Emerging Markets

There Are Storms, But India's Investment Case Is Strong – BlackRock

The US investment firm's think tank takes a look at the investment case for India and examines specific developments in technology to make its point.

Global investors should tap into India’s increasingly liquid and

accessible market in the medium term, even though the world’s

fifth-largest economy cannot shrug off geopolitical and financial

woes, the BlackRock

Investment Institute says.

“We see India as a large, increasingly liquid and investable

Asian market with unique domestic dynamics at play that global

investors should look to get access to in portfolios. It also

underscores why differentiation within emerging markets is key,”

Prasoon Agrawal, portfolio manager, fundamental equities and Ben

Powell, Asia-Pacific chief investment strategist, said in a

recent note.

As China’s trade and diplomatic relations have soured, raising

questions about supply chains – and intensified by the pandemic –

India’s role as a manufacturing and business hub has risen. This

news service

has written about how investors cannot afford to ignore a

country that in the past hasn’t always been open to foreign

investment. Under the government of Narenda Modi, the country has

taken a distinct “modernisation” path. (See other examples of

articles about India here

and

here.)

The BlackRock authors note that next year, India is likely to

overtake China as the world’s most populous nation (citing data

from the United Nations Development Programme’s latest

assessment).

“And with a median age below 29, it is a relatively young country

with such a large working age population. Yet that is only one

part of the story. The other critical aspect is anticipated

increases in productivity,” they wrote.

“This has been a challenge in the past – feeding a

perception that India is a country of slow-moving bureaucracy and

creaking infrastructure. However, we see signs on the ground that

challenge some of these perceptions and make us more optimistic

over the medium term,” they continued.

Dynamics

“India is not immune to global risks, yet we believe its unique

domestic dynamics put it on a firm footing over the medium

term and underscore why differentiation is key when assessing

emerging markets,” they said. “Most notable among these dynamics

are certain structural forces at play – such as improvements

to daily life facilitated by India’s successful rollout of its

biometric ID system a decade ago to nearly all its citizens, a

more efficient tax regime and a gradual shift towards more

productive, formal-sector jobs from informal sectors.”

The authors cite a technology development as a reason for

optimism.

“Benefits of Aadhar – India’s biometric ID system launched a

decade ago and which takes its name from the Hindi word for

foundation – are becoming increasingly apparent, particularly via

making the day-to-day life of consumers more convenient. India

has issued 1.3 billion unique biometric IDs so far, according to

data from the Unique Identification Authority of India as of 31

August 2022,” they wrote.

“These have become the building blocks for a range of

technological and social innovations – ranging from the

near-ubiquitous person-to-person mobile payments all the way to

government subsidies paid directly to those who need them the

most. This is leading to greater convenience and efficiency while

minimising slippages that had historically bogged down the

system,” they continued.

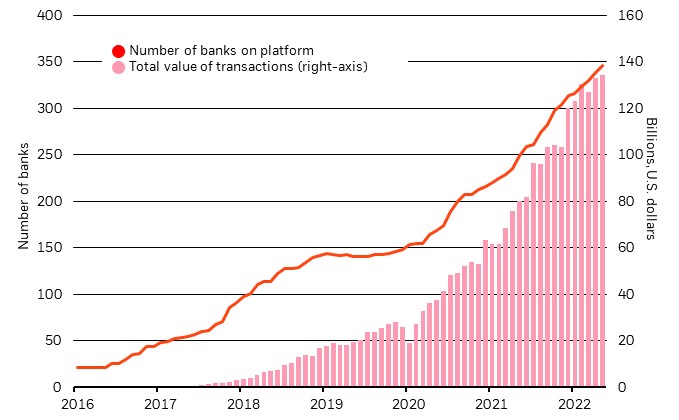

“From near-zero transactions in 2016, the platform saw $134

billion worth of transactions with more than 300 banks signed up

as of August 2022 – with growth accelerating through the

pandemic, as shown in the chart below. This explosion in payments

is just one example of the improvement in day-to-day efficiency

post-Aadhar. Others include the direct benefit transfer system of

delivering government subsidies that aim to deliver payouts

directly to those who need them the most,” they

continued. The writers considered the realm of mobile

payments.

“The proliferation of smartphones and the ease with which India’s

Unified Payments Interface has scaled up to work for a large

population means it has quickly become the go-to method of making

all kinds of payments – from bills to groceries to

cross-border money transfers,” they said.

Source: BlackRock Investment Institute, with data from the

National Payments Corporation of India, August 2022. Note: The

chart shows the number of banks signed up to India’s Unified

Payments Interface and the total value of monthly transactions

conducted.

“From near-zero transactions in 2016, the platform saw $134

billion worth of transactions with more than 300 banks signed up

as of August 2022 – with growth accelerating through the

pandemic, as shown in the above chart. This explosion in payments

is just one example of the improvement in day-to-day efficiency

post-Aadhar. Others include the direct benefit transfer system of

delivering government subsidies that aim to deliver payouts

directly to those who need them the most,” they continued.

More generally, the authors said: “Productivity gains so far are

most visible for the consumer. There is still room for

improvement on the corporate side. Supply chain inefficiencies

remain problematic. Yet the rollout of harmonised good and

services taxes (GST) across 27 of India’s 28 states for

everything except land, alcohol, and petroleum – is helping

iron out some problems.”

“Why? A single GST across the country means companies do not need

to maintain warehouses in each state they do business in to

manage supply,” they added.