Alt Investments

Private Markets Outlook Remains Strong, But Investors Must Be Choosy – BlackRock

The case for private market investment continues to grow but

public listed equities remain a major part of portfolios as

business cycles and company journeys oscillate, according to an

overview of alternative asset markets by BlackRock.

Technology, healthcare and the new ways in which people are

consuming will drive the growth of privately held businesses and

the returns they generate, the report said.

Often companies will move back and forth between listed/private

markets at different stages during their lives. The private

markets benefit from a greater pool of potential investments, but

participants need to be able to address both public and private,

or risk losing an investment relationship with a strong

corporate, BlackRock, overseeing $9.46 trillion in assets at

end-September 2021, said.

Wealth managers that cannot offer both private and public market

access will be in a difficult position, the report

said.

“A blurring of the lines is leading to increased opportunity sets

but also challenges for investors who cannot navigate across both

public and private markets, or across private markets'

verticals,” it said.

The risk premia paid on private equity and credit remains,

explaining why wealth managers, family offices and high net worth

individuals continue to put more money into such asset classes.

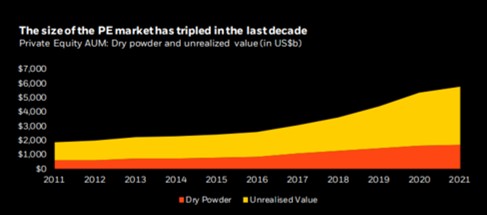

The size of the private equity market has tripled in the last

decade, from about $2 trillion in 2010 to more than $6 trillion

in 2021. The number of active private equity investors has also

tripled.

Source: BlackRock

That said, BlackRock expects private equity valuations, for

example, to remain strong, putting more pressure on investors and

advisors to be choosy. More than a decade of very low official

interest rates has squeezed yields on listed equities, making

less liquid, private investments more attractive by

comparison.

Private market investments – such as private equity and credit –

have exploded 30-fold from 2000 to $30.5 trillion today. US-based

firm ALTSMARK, which

provides a solution for managing, reporting and risk analysis on

private market investments,

has argued that wealth managers who lack the ability to

offer clients access to the space could go out of

business.

Drivers and tailwinds

The report, entitled 2022 Private Markets Outlook: Resilience

and Adaptation, said that the coming 12 months should see a

wider rise in real assets as markets rebound from the disruptions

of COVID-19 and associated State restrictions.

Among its predictions, the report said that private credit assets

under management are expected to expand 11 per cent per year to

$1.46 trillion by 2025

“For real assets, we see the cyclical rebound, technological

change and the response to climate change as three dominant

drivers of the outlook. At the same time, the market is driven by

a decoupled rebound due to variations in reopening strategies and

a longer-term push towards re-shored supply chains; a

differentiated market upswing across sectors, reflecting the

booming conditions in logistics, telecom and renewable power, and

a lagging recovery in air transport and hospitality; and finally

a competitive deployment stage, due to abundant capital moving

into real assets, partly reflecting a shift from other asset

classes for relatively higher and more resilient yields.

“For infrastructure markets, the outlook is marked by the 3Ds of

decarbonisation, digitalisation and decentralisation. The push to

decarbonise the global economy requires a massive energy

transition from fossil fuels to renewables, not just with the

mainstays of solar and wind, but increasingly with carbon

capture, battery storage and blue and green hydrogen. The digital

world continues to transform our daily lives, with online work,

shopping, schooling and entertainment markedly accelerated by the

pandemic, as robotics and automation deliver genuine productivity

gains.

“Moreover, infrastructure services are decentralising on several

fronts, as location becomes less important for virtual work and

shopping, and as holdings diversify for resilience and

operational efficiency.

"For real estate markets, the 3Ds of infrastructure are similarly

applicable, while we see several additional drivers at work. In

particular, the wide and sustained divergence in performance

between the winners (sheds and beds) and losers (hotels and

retail) are likely to be sustained for now, providing

considerable scope for alpha from sector selection. At the same

time, distressed and dislocated real estate segments are starting

to show signs of deep value, although these opportunities need

on-the-ground, off-market sourcing capabilities to unlock.

Looking further ahead, long-run demographic drivers remain

all-important, with local differences in population and ageing

trends making compelling cases for childcare centers in

Australia, multifamily housing in the US and senior living in

Japan,” it concluded.