WM Market Reports

How Wealth Managers, Banks Reimagine Front Offices – Accenture

The report from Accenture found that most firms in Asia are only "scratching the surface" of what they could do in raising revenues in the coming years.

Asia’s wealth management industry will hold an estimated $363

trillion in onshore assets for affluent and high net worth

individuals in 2026, with those holding $100,000 to $5 million

accounting for 78 per cent of the total, a report has

said.

A 61-page report from Accenture, Front office

reimagined, said that “most firms are only scratching the

surface” of the opportunity, saying that the main observed

tactics of incremental business units and relationship manager

advisors have delivered only limited upside.

This cautious approach, Accenture said, has typically unlocked

only 10 per cent of potential revenue uplift over a three-year

horizon.

The research was based on a survey of more than 4,762 investors

and 16 senior executives across 11 markets.

The consultancy says there are five main levers

for reinventing how front offices in wealth management work:

pricing, penetration (onshore); penetration (offshore),

productivity and proposition.

“Pricing” refers to aggressive discounting eroding value perception and profitability;

“Penetration” (onshore and offshore) is about how such channels are critical, particularly in HNW segments;

“Productivity” shows that the main opportunity is about empowering existing RMs; and

“Proposition” relates to clients increasingly wanting access to

more sophisticated investment solutions.

“The wealth opportunity in Asia is too large and complex for

business-as-usual responses,” the report said. “Our research

modelling suggests that for a hypothetical Asia-based wealth firm

with a deliberate focus on RM productivity, pricing and market

penetration, revenue could scale from $700 million in 2026 to

$2.1 billion in 2029.”

“The most promising segments are also the toughest, demanding

stronger offerings, precise targeting and strict commercial

discipline. For example, waiving custody fees to stay competitive

reduces returns, even though custody accounts for almost 25 per

cent of revenue in key markets like Singapore,” it

said.

The study referred to the need for firms to consider their

“Target Operating Model.”

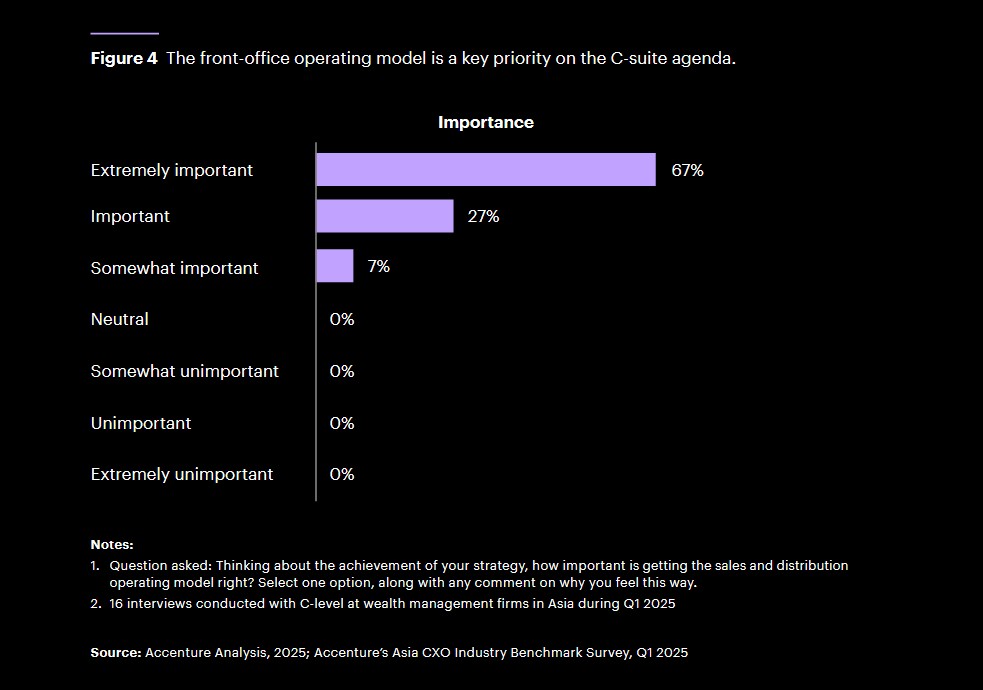

It noted that all Asia wealth executives identified the

front-office operating model as a priority.

“Our survey found that 67 per cent of Asia wealth executives rate a well-structured front-office operating model as `extremely important’ and 27 per cent call it `important’. This is not just about front-line configuration. It is about elevating the client experience, accelerating sales growth and delivering the proposition efficiently at scale.

“For 52 per cent of affluent and HNW clients, the firm is the primary reason for banking with their wealth provider, compared to 36 per cent for the RM – a gap that has grown by 1.7 percentage points since Q1 2023. Hence, rather than relying on the human relationship solely, clients expect firms to create a service model that is frictionless and effective,” it said.

The importance of front office models

In its analysis of brands and business models, the Accenture

report said there are three broad approaches:

Single brand across segments (41 per cent of interviewed firms):

These promote consistency and firm-wide recognition. Examples are

Barclays Private Bank, BNP Paribas Wealth Management, Julius

Baer. and Union Bancaire Privée;

Unique brand per segment (53 per cent): This type of firm

delivers targeted value propositions across the affluent,

affluent+, HNW and UHNW segments. Firms include CIMB Bank Berhad,

HSBC Private Bank, Maybank, Mitsubishi UFJ Financial Group, and

StashAway.

The third model involve multiple brands across segments (6 per

cent). These involve complex organisations with broader client

coverage.