Family Office

Family Offices Gradually Fall More In Love With VC

.jpg)

A report casts its eye over how family offices around the world approach venture capital. Such organisations are often thought of as holders of "patient capital", making them logical partners for VC as an asset class.

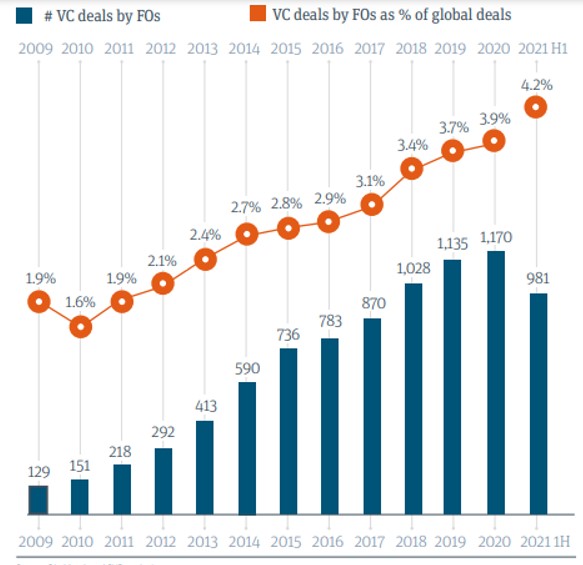

Family offices have become more involved in the world’s venture

capital deals, latest data in a report shows, increasing their

share of the total market and the volume of specific

transactions.

A study of 139 ultra-high net worth families and family offices,

as well as follow-on interviews with 10 family offices, found

that in the first half of 2021, FO-backed venture deals accounted

for 4.2 per cent of the total. That figure was up from 3.9 per

cent in 2020 and 2019.

The total number of VC deals by family offices fell to 981 in the

first six months of this year; there were 1,179 in the whole of

2020 and 1,235 a year earlier. In 2020, the average family

office held eight venture funds and 10 direct venture

investments. Today, they hold 10 funds and 17 direct investments.

Within the next 24 months, they expect to make 18 new investments

(six funds and 12 direct deals).

The findings come from Family Offices Investing in Venture

Capital Report, by Silicon Valley

Bank and Campden Research.

Such figures underscore how ultra-wealthy families, mindful that

they are holders of “patient capital” and with less urgent need

for liquidity than some other investors, are a natural fit for

the VC sector. Venture capital funds typically have a maturity of

around 10 years or more. To justify that relatively low

liquidity, they promise superior returns to those in public

markets – a compelling proposition at a time of ultra-low

interest rates.

Among the main takeaways from the report are that investments

tend to be focused on growth areas, at 48 per cent of the venture

portfolio, followed by 28 per cent in pre-seed and seed

investments and 24 per cent in Series A investments. Meanwhile,

the study found that family office staff and VC teams are

growing, but top talent is in short supply. Today the average

family office staff consists of 15 members, including two VC

investment professionals, with plans to bring in one additional

venture capital specialist within the next five years.

Some two-thirds (67 per cent) of family offices rely on their

existing network for deal flow, as the best venture deals

continue to be hard to access. Most family offices rely on their

existing networks, GPs of venture funds, founders, and other

family offices for deal flow. Only 1 per cent currently use

digital platforms.

Perhaps understandably in the age of COVID-19, the report found

that 18 per cent of family offices have venture investments in

life sciences, e.g., biopharma, drug discovery, medical devices,

diagnostics, etc. Energy and resource innovation, including

climate and sustainability, is an increasing area of focus.

Notably, a family office was behind the team in Germany

developing the BioNTech vaccine for Pfizer, as revealed

by Highworth

Research. (This news service is exclusive media partner with

Highworth, which is a database and research facility for single

family offices.)

The family offices have headquarters across 30 countries, with 49 per cent cent being in North America, 27 per cent in Europe, and 25 per cent in the rest of the world.

Other numbers

Globally, the average single-family office with experience in

venture capital manages $989 million in assets – or 75 per cent

of the average $1.3 billion in family net wealth (compared with

$797 million in AuM reported in our 2020 report). However, 66 per

cent of the offices manage up to $500 million. The report noted

that family offices “tend to follow a similar path in their

venture capital journeys.”

Family offices often begin with fund of funds – a convenient

option, which can provide diversified exposure, including to

established managers – and ad hoc direct investments referred

from friends and family – which help them gain crucial

experience, the report said.

Single-family offices employ a variety of structures for their venture investments, including an annual allocation (29 per cent of the relevant participants), a special purpose vehicle to capitalise on opportunities as they arise (28 per cent), and a venture fund with management team and single limited partner (i.e., the family) (21 per cent). Funds with a single LP are relatively more popular in North America (31 per cent versus 11 per cent for the rest of the world). SPVs and subsidiaries with a dedicated pool of capital are relatively more popular in the rest of the world (32 per cent and 18 per cent, respectively - versus 24 per cent and 7 per cent, respectively, for North America).

As of 31 August 2021, $418 billion was invested in venture capital deals globally, surpassing the full year record established in 2020 of $333 billion.