Family Office

EXCLUSIVE: Europe And North America – Single Family Offices Compared

The extended coverage of single family offices on the database of Highworth Research – an organization working with Family Wealth Report – throws up all kinds of useful data points for people tracking the sector around the world.

This news service, which is exclusive media partner

of Highworth

Research, which has created an online database for single

family offices, was delighted to report that Highworth is

extending its coverage to the North America market. The move can

also help industry figures compare trends in different regions –

an unmatched quality of information.

In this article, Highworth’s founder, Alastair Graham, explains

what the data shows and what conclusions can be drawn from it.

(To register for the Highworth database,

click on this link.)

It might seem reasonable to suppose that single family offices in

North America are, in aggregate, very similar to single family

offices in Europe. After all, UHNW families in both continents

should have similar thoughts about how to manage their financial

assets to achieve both growth and wealth protection over

time.

Of course similarities exist but also there are quite marked

differences. One way to understand the differences is to analyze

the profiles of comparatively large numbers of single family

offices listed online on the Highworth Single Family Offices

Database, both in North America and in Europe, to extract

statistics to compare the SFOs on both continents.

AUM and asset allocation differences

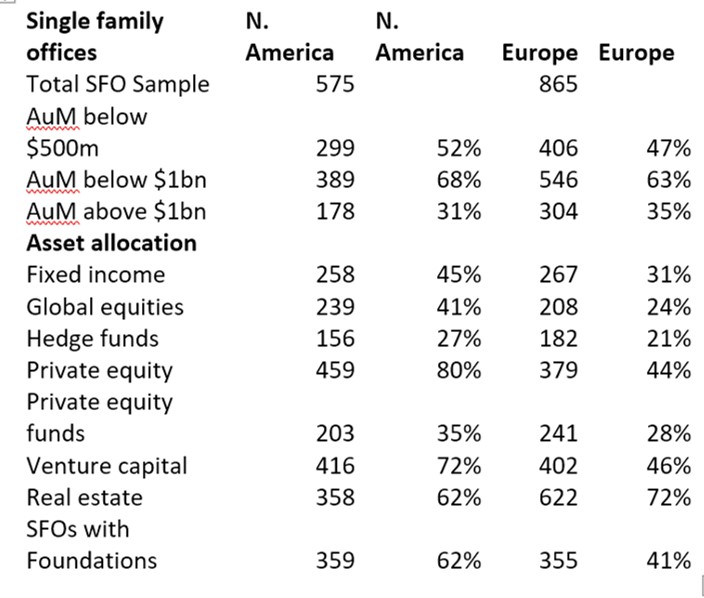

The following table compares SFOs on both continents, currently

575 in North America and 865 in Europe, as profiled on the

database, both in terms of assets under management and asset

allocation. The difference between the total numbers studied

simply reflects a difference in SFO numbers in North America and

in Europe on the database as of today, and these numbers will

become more equal in the coming months.

It’s interesting to find that a higher proportion of SFOs in

North America than in Europe have AuM below both $500 million and

$1 billion, and equally interesting that a higher proportion of

SFOs in Europe than in North America have AuM higher than $1

billion.

With asset allocation, the differences are more marked. Note of

course that these numbers don’t reflect percentage allocations

within a portfolio but rather the percentage of SFOs allocating

to that particular asset class. Much higher percentages of SFOs

in North America allocate to the core asset classes and it is

only in real estate investment that European SFOs are more

active.

These numbers don’t have the accuracy of a direct survey of SFOs.

Rather, they reflect the findings of Highworth analysts

objectively researching the investment practices of individual

SFOs from multiple sources. The outcomes should be seen as

indicative rather than precise but even allowing for that, the

differences are striking.

In the case of SFOs with connected foundations in North America

compared with Europe, a comparison of the family foundation

numbers confirms that the philanthropy levels in North America

are markedly different from those in Europe.

Private equity and VC investment differences

Private equity and venture capital investment are even more

aggressively pursued in North America than they are in Europe,

but what of the business sectors in which single family offices

invest in PE and VC on either side of the pond?

The following table, also sourced from the Highworth Family

Offices Database, identifies the family offices which have

invested in each of 15 business sectors in North America and

Europe expressed as a percentage of the total SFO numbers on the

database in each region.

The data shows not only the much more active PE and VC investment activity shown by North American SFOs but also serves as a guide to fundraisers as to which business sectors have been in favor with family offices in the past two years and which have been more in the doldrums.