Surveys

Family Offices Fret Over Rising Inflation - Citi Private Bank

In its sixth annual report of family offices, the US private bank delved into what these entities are concerned about. Perhaps, unsurprisingly, rising inflation is making them concerned.

A survey of family offices by Citi Private

Bank finds that these organisations are concerned about

rising inflation amidst heavy central bank money printing and

some of the disruptions caused by the pandemic.

The US bank carried out its poll during its annual family office

leadership programme held virtually in June. The total number of

survey respondents increased this year to 197 (versus 177 in

2020). Of those, 79 per cent were family offices, rising 24 per

cent year-over-year.

Increased inflation rates are giving investors and business

owners the jitters. In the US, the annual inflation rate was 5.3

per cent for the 12 months ending August 2021, following two

straight 5.4 per cent increases.

The Citi report said that four predominant themes emerged:

concern over rising inflation, the prominence of high cash levels

in the face of a low yield environment, continued growth in

portfolio allocation to direct investing opportunities, and a

marked comeback in portfolio values year-over-year despite a

prevalent degree of macroeconomic uncertainty.

While over three-fourths of all respondents seek returns of 5 per

cent or more over the next 12 months, the outlook is more

optimistic for family offices with assets under management of

over $500 million with 30 per cent seeking over 10 per cent

returns versus 19 per cent of family offices with AuM under $500

million.

The survey also logged rising interest in direct investing in

private enterprise. For almost half of the participants, this

level of exposure represents 25 per cent or more of their overall

allocation.

“In these unusual times, our exclusive survey offers an

invaluable glimpse of the thinking of family offices and other

leading investors,” Ida Liu, global head of private banking,

said. “It’s reassuring to note that investor sentiment isn’t

negative. Instead, family offices have weathered the COVID crisis

well and are uniquely positioned to deploy further capital as

they see opportunities arise. We stand ready to offer them our

fullest support in the emerging post-pandemic landscape.”

“Among our many intriguing findings, it’s the rise of direct

investing in private enterprise that reflects deep confidence in

the flexibility and strength of the global economy,” James

Holder, global head of Citi private capital group, Citi Private

Bank, said. “It also underlines the vital role family offices and

private capital play in supporting innovation, entrepreneurship,

development of the stakeholder economy, creating jobs and new

solutions to the challenges of our day.”

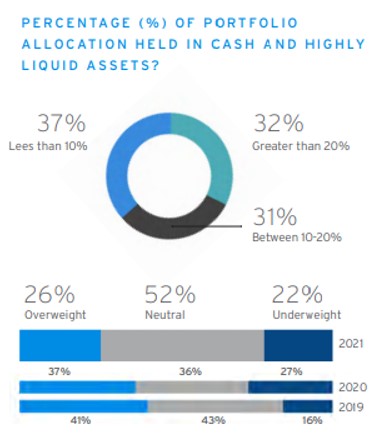

Also of note, the 2021 Family Office Survey found that two-thirds

of respondents responded as “overweight” or “neutral” when it

came to commodities in their portfolios, and there was also a

continued shift in interest in emerging market equities.

The study said that family offices own significant amounts of cash, and queried whether this was wise.

"Based on the responses, it is clear that family offices continue to hold significant cash, some perhaps hoping to time the markets, others seeking safety and liquidy. No matter what the reason, we see it as a potential detractor to overall portfolio performance given the low-yield environment. It would be prudent to revisit the main reasons for having such significant cash allocation," it said.

Source: Citi Private Bank

On global developed market equities, the report noted: "While investors appear to have taken a slightly more cautious view in 2021, driven by concerns of high valuation and record territory for indexes especially in the US, there certainly appears to be continued expectation of higher returns in this asset class with investors seeking out key sectors like healthcare, which still trades at a discount and can be defensive. We agree that the S&P 500 absolute valuations as measured by P/E ratios are not cheap on a historical basis, but when compared to the alternatives across other traditional asset classes (e.g. high-quality US bonds), valuations are still trading at average levels."