WM Market Reports

Charting Overseas Chinese Families' Wealth Prowess - DBS, EIU Study

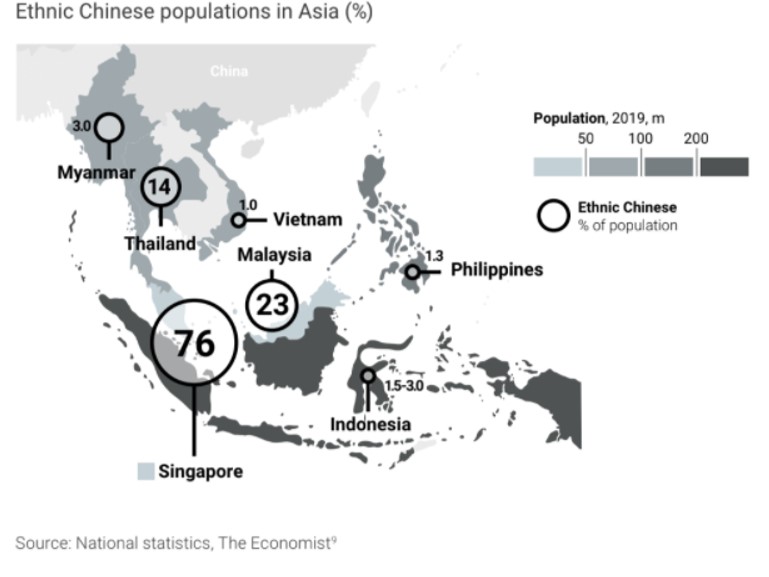

The network of Chinese families across Southeast Asia is sometimes called "the bamboo network." There are specific cultural and family structure features that wealth managers and private bankers must understand to serve this group effectively.

Overseas Chinese families controlled more than three-quarters of

Southeast Asia’s $369 billion in wealth, highlighting why it is

so important to understand specific drivers of wealth creation

and governance in this group, a study says.

The adoption of a family office among overseas Chinese HNW

business families in Asia is growing. However, there are various

cultural reasons why family governance mechanisms, such as

succession planning and risk management strategies, are slower to

catch on, including their hesitance to seek or trust outside

advice or unwillingness to break with birth-order hierarchy or

succession traditions. That is one of the findings of a

36-page report from the Economist Intelligence Unit entitled

Governance and succession: Family offices and the Chinese

diaspora in Asia, sponsored by Singapore-based DBS.

As wealth in Asia grows, new Chinese families are joining the HNW

ranks, and the structure and investment objectives of Chinese

families are changing. Adopting family governance has the

potential to protect family businesses for generations while

allowing all family members to be involved in advancing their

legacy and wealth into the future, the report said.

Ethnic Chinese account for around 5 per cent of Southeast Asia’s

650 million people but dominate the region’s $3

trillion economy.

The rapid growth of HNW wealth among overseas Chinese, sometimes

dubbed the “bamboo network,” is clearly a big attraction for

private banks, advisory firms and family office creators across

the region. Despite headwinds caused by the pandemic, and

mainland China’s trade rows with Washington, Asia’s general

ascent in the number of millionaires remains powerful.

This report chronicles the history and dynamics of the Chinese

diaspora in Asia, the cultural constructs and other factors

influencing their wealth planning decisions, and the family

office and family governance structures taking shape today.

“Despite being a key contributor of global wealth, many of the

Chinese diaspora have yet to institutionalise a formal system

with which to manage their assets, oftentimes due to deep-set

traditions or cultural reasons. However, we do see this changing

in view of these families’ evolving dynamics and growing wealth,

and with many now on the cusp of passing the baton to the next

generation,” Lee Woon Shiu, group head of wealth planning, family

office and insurance solutions, DBS Private Bank, said.

“The pandemic is further accelerating this shift, having reminded

families of their potential vulnerabilities and the importance of

planning with stability and longevity in mind. For families that

have already set up family offices, many are also relooking their

structures to ensure greater agility and adaptability in times of

change,” he continued.

Perhaps unsurprisingly, Lee broadcast the merits of Singapore for

such overseas Chinese.

“We see a long runway of growth for Singapore’s family office

landscape and, as a leading bank in both Singapore and Asia, our

deep understanding of regional business dynamics, regulations and

cultural nuances, as well as our extensive Asian insights,

networks, and connectivity to the family office ecosystem, leave

us in good stead to partner these families on their wealth

journey,” he added.