Strategy

Women And Wealth In The Middle East - An Assessment

A change is on the way in the relationship that women have with private wealth in the Middle East. Their control is growing and the trend will continue. That carries big implications for the wealth management industry in the region, and beyond.

Women need to get a better deal out of wealth management. As

they make up half of the world’s population and increasingly

account for significant holders of wealth, it is an issue of

natural justice as well as smart commercial sense to ensure that

women get top-class service. It matters, for example, that more

women are promoted in wealth management roles and are in senior

roles. This is not about “political correctness” or “virtue

signalling”, but hard, commercial sense.

Change is taking place, and it is taking place also in the Middle

East. For a variety of reasons, women have not always had much

chance to get a seat at the financial table, but the situation is

not as simple as some impressions might suggest. To write about

these topics is Alex Ruffel, partner, and Kate Caldwell,

consultant, at the UK-based law firm Irwin Mitchell. The

editors have taken great content from Irwin Mitchell before and

again welcome this latest contribution. As always, the usual

editorial disclaimers apply. To get involved in debate, email the

team at tom.burroughes@wealthbriefing.com

and jackie.bennion@clearviewpublishing.com

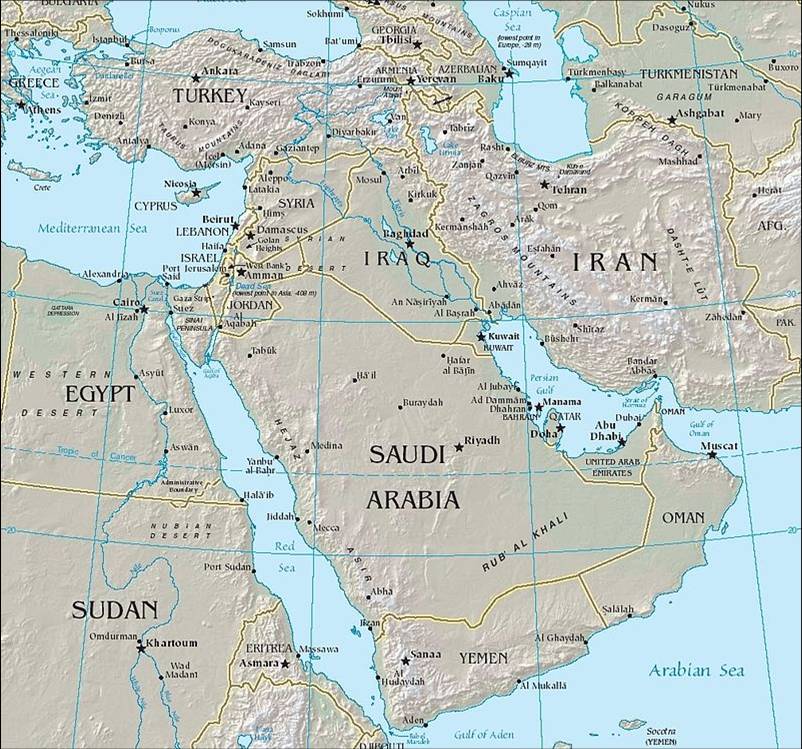

Writing about ‘the Middle East’ is difficult. The term itself

only gained wide currency last century and no-one quite agrees

what it covers. According to our (Wikipedia) research, it

encompasses 17 countries from Cyprus to Yemen via Israel and

Turkey. There are large cultural, economic and religious

differences between these countries and the role and status of

women in them. Attempts to generalise can be misleading and

embarrassing. What is clear is that there is a vast amount of

wealth in the region - recent estimates suggest that the Middle

East has around $3.1 trillion of investable assets - and that a

significant and increasing proportion, estimated variously

between 20 per cent and 40 per cent, of it is held by, or for

women.

Historically, private wealth in the Middle East has often been

viewed as family, as opposed to individual, wealth and run

centrally, with strategic management led by male family members.

Whilst decisions and actions are often highly influenced by

female family members, such influence is informal and usually not

visible.

We are now seeing increasing participation and visibility of

women in entrepreneurship, in the strategic management of family

wealth and in the growth of their own independent investment

portfolios parallel to but separate from family wealth. The

causes for this are complex but include sophisticated and

advanced education (for example, more than half of all graduating

students in Saudi Arabia are women and Middle Eastern women study

across the world), liberalisation of society, increasing

globalisation and a shift of wealth between generations that

encourages reassessment of who manages it and how.

Women in the Middle East have been patchily served in the private

wealth market. Cultural and religious practices can limit their

access to advisors in a male-dominated industry: US or

European-style networking may not be an option and women may

often feel happier dealing with a female advisor, particularly in

relation to their private assets. This is starting to change and

there has been a growth in bank and boutique advisory services

concentrating on female investors, although it still has a long

way to go. The global lifestyle of many high net worth Middle

Eastern families can also mitigate any dearth of local advisors:

an Omani female investor may very well have an English lawyer, a

Swiss banker and a Guernsey trustee.

Apart from access to advisors, is there any difference between

the wealth management needs and priorities of female investors in

the Middle East?

While there are many highly knowledgeable and sophisticated

female investors and entrepreneurs in the Middle East, there is

often an experience gap caused by historic factors. They

particularly value clear, honest advice that makes no assumptions

about their knowledge while avoiding patronising them.

We are seeing greater willingness to take risks and move out of

cash and real property into private equity and newer sectors,

such as green energy. This is driven by several factors: a

growing female entrepreneurial sector; increasing confidence in

their own investment decisions; sometimes a well-established

family business that allows for greater adventurousness in

dealing with the cash that it generates; and recognition that

diversification into different geographic regions and sectors is

key when the Middle East faces serious threats to its stability.

The idea of female investors as risk-averse is often wide of the

mark, especially for female entrepreneurs, who have usually had

to take significant risks to succeed in societies that can be

oriented against them.

Asset protection and succession are also key concerns of many

female investors and this can be reflected in both the choice of

investments and the structure in which they are held. Sharia law

generally means unequal division of assets between male and

female children and parents may wish to invest in assets that are

not governed by it. Real property in the UK has (almost) always

been a desirable investment but has particular interest for

investors who wish to ring-fence specific assets for daughters –

as Shariah law does not apply to such property, owners can leave

it as they wish in accordance with English or Scottish law.

Use of trusts can also address privacy and security

considerations. A trust can provide a protected pot of assets

that has limited vulnerability to foreign laws and judgments and

whose value and terms are not public information. This is of

particular value in a region where some areas have relatively

high divorce rates (the rate in Kuwait reached 60 per cent in

2017) and whose financial settlements on divorce are very far

from the 50:50 starting point in the UK, for example. Trusts can

also continue past the death of their creator, ensuring that, for

example, daughters’ inheritances remain protected.

Active philanthropy, often focussing on women’s education and

health in the MENA region, is also a priority but there is

greater interest in not simply donating but putting a proper

governance structure in place for their charitable projects so

that the donors are involved in decision-making and the projects

are sustainable. This in turn requires a proper investment

strategy for any endowments.

As women’s role and visibility in the Middle East develops, we

are seeing a significant change in the relationship that women

have with private wealth - their control over it is growing and

this trend is only likely to continue.