Family Office

EXCLUSIVE: Europe's Single Family Offices: How Assets Compare

This article shows the actual size of Europe's single family offices and see how they stack up in total AuM against the region's leading pension funds.

It is no surprise that the world’s family office industry is getting so much attention from banks, service providers and other organisations, because collectively they wield a great deal of financial firepower. This publication has been working with data analysed by Highworth which explores trends in the single family offices space (see here to register for a trial). This latest analysis from Highworth’s founder and managing director, Alastair Graham, examines how large family offices are compared with the big blocks of institutional money, run by pension funds. This article, which focuses on Europe, concludes that single family offices in Europe collectively hold €1.52 trillion ($1.68 trillion) of assets, which equates to 20 per cent of the AuM held by the region’s largest pension funds. (Please send feedback to tom.burroughes@wealthbriefing.com)

In September IPE, a specialist pensions journal, published a ranking of the largest European pension funds by assets managed, the IPE 1,000. IPE calculated that in 2018-19 the assets managed by the top 1,000 European pension funds grew by 7 per cent to €7.72 trillion. The IPE calculation is in the same ballpark as the assessment of EFAMA, the European Fund & Asset Management Association, which calculated that in 2018 assets under management by European institutional investors was €25 trillion, of which pension funds comprised 28 per cent or €7 trillion.

For IPE to compile a European pension fund assets ranking was painstaking and useful, but public sources are readily available. The journal said: “There is a wide number of sources of data for European pension funds …with associations, the OECD, and others.”

Identifying AuM of single family offices

The same cannot be said of another significant group of European

capital managers, single family offices, because there is no

requirement for SFOs to file reports of their assets under

management. Moreover, many single family offices fly under the

radar and few sources exist which systematically identify and

profile single family offices, let alone report on their assets

under management.

Yet one source does exist, and its assessment of the aggregate AuM of 1,000 single family offices in Europe shows that although SFOs cannot match pension funds for total AuM, nonetheless they are a significant force in the European market for the management of capital.

Highworth-Wealthbriefing SFO Database

The Single Family Offices in EMEA database – stripping out the

Middle East segment – shows that the European countries within

the database hold profiles of 545 single family offices and this

number will rise to 1,000 in the coming months as Highworth adds

further SFO profiles to the database.

In addition to much of the other information on each SFO, the database includes a carefully considered assessment of the probable value range of AuM for each SFO, based on as full a body of professionally sourced evidence as is available. A small minority of SFOs either directly disclose their assets under management or provide sufficient evidence to allow Highworth to calculate it to within a few tens of millions. For the majority, however, Highworth has placed each SFO’s assets under management into one of 10 ranges.

SFOs assets assessed in 10 ranges

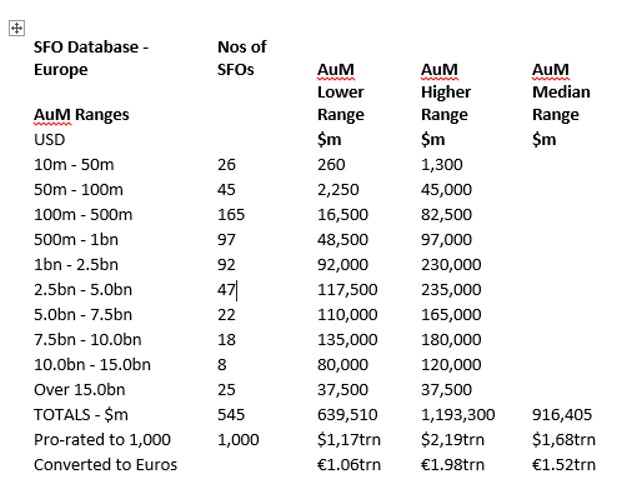

The following table shows the 10 AuM ranges, and the numbers of

SFOs which fall within each range, out of a total of 545 European

SFO profiles as at mid-September 2019.The table further shows the

aggregate AuM for each range, taken at the lower, higher and

median assessments.

The table then pro-rates the 545 SFOs to the 1,000 total scheduled to be on the database by Q2, 2020, and similarly pro-rates the AuM totals from 545 to 1,000 SFOs. The AuM totals are then converted from dollars, for which Highworth standardises its AuM reporting, to euros to allow comparison with the IPE figures for European pension funds.

European SFOs assets under management

The table shows that at the median aggregate AuM assessment of €1.52 trillion, the 1,000 European SFOs both presently and to be listed on the Highworth Database hold nearly 20 per cent of the AuM of the largest 1,000 European pension funds.

The calculation of the assets under management of 1,000 European single family offices of course cannot yet be determined on the same objective basis as that for the largest European pension funds. However, the broad assessments which the Highworth SFO Database allows, shows that the capital held by European single family offices is on a scale which makes them a very appealing prospect for asset managers.