Tax

"Aggressive" UK Tax Authority Fuels Rising Tribunal Backlog, Says Law Firm

The law firm says that rising numbers of judicial reviews and an "aggressive" HMRC approach are causing tribunal cases - with damaging delays - to accumulate.

UK tax tribunals are struggling to handle appeals against

rulings, with HM Revenue & Customs’ “aggressive” anti-avoidance

approaches to blame, according to international law firm Pinsent Masons.

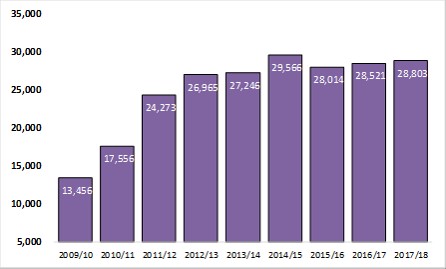

In the year ended 31 March 2018, a total of 28,000 First-Tier Tax

Chamber cases were reported, rising from 25,250 in the previous

12-month period. The backlog has swelled for three straight years

and more than doubled from 13,460 in 2009/10. Small, medium and

large firms are covered by the data, as well as private

individuals.

“HMRC’s inflexible approach to dealing with disputes is

exacerbating the growing backlog of tax tribunals. It’s generally

recognised that this backlog needs to come down but it has hardly

shifted at all,” Steven Porter, partner at Pinsent Masons, said.

“Businesses can often wait for years between when an

investigation is first launched and when a final judgement in the

courts is handed down. This uncertainty can be hugely damaging

and may result in a business falling behind its peers as

decisions and spending get shelved until the outcome is clearer,”

Porter continued.

The law firm said that while HMRC recently updated the framework

to make it easier to settle with taxpayers, this appears to have

had a limited effect on the backlog so far. In the new framework

HMRC has set the target of reaching an agreement as its “default

approach”, which was not the case previously.

The Tribunal Service said that it wanted to recruit more judges

last year, which Pinsent Masons said suggested there is a

bottleneck.

The rise may also suggest that more firms and people are

challenging HMRC through judicial review.

The number of judicial reviews faced by HMRC increased by 36 per

cent last year to 122, up from 90 in 2016. Many judicial

reviews involve taxpayers appealing against the imposition of

Accelerated Payment Notices, the law firm said.

An APN requires a taxpayer to pay the full amount of disputed tax

immediately without waiting for a court or tribunal decision on

the dispute. The tribunal does not have jurisdiction to consider

whether HMRC was correct in issuing an APN, but does have the

jurisdiction to consider the penalties issued for non-payment of

the APNs, which may be part of the explanation for the backlog

before the tribunal.

Backlog of tax disputes hits 28,800, more than double the level in 2009/10 (first recorded year).

Source: Pinsent Masons.