WM Market Reports

Global Wealth Managers Log Buoyant AuM Growth; "Alarm Bell" On Margins - Scorpio

An annual benchmark of the world's wealth management industry shows they held more assets last year and raised their profits. UBS remains number one. Cost/income ratios, meanwhile, have actually risen.

The world’s wealth management industry saw profits rise last year

although cost/income ratios widened in the face of new rules,

while Switzerland’s UBS held its spot as the world’s largest

player in the sector, a report by Scorpio

Partnership shows. The report also highlighted how American

firms have found it more profitable to focus on a “stay at home”

strategy.

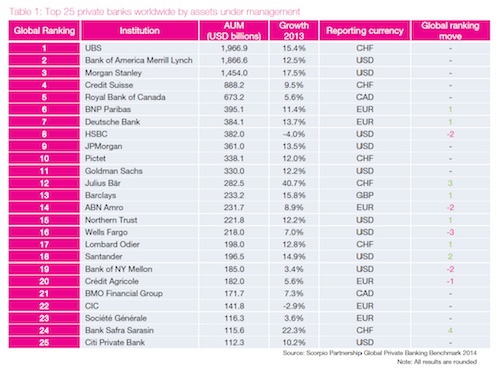

Examining 25 of the world’s largest wealth managers in its Global

Private Banking Benchmark 2014 report, it found managers logged

an average rise of 11.3 per cent in assets under management last

year. The top 25 firms oversee over 78 per cent of industry AuM,

which is a one per cent rise from 2012, suggesting further

industry consolidation at work.

AuM at UBS rose last year by 15.4 per cent to stand at $1.966.9

trillion, followed in second place (unchanged from 2012) by Bank

of America Merrill Lynch, with AuM rising 12.5 per cent, at

$1.866.6 trillion, and in third spot, by Morgan Stanley, with a

rise of 17.5 per cent in AuM to $1.454 trillion, the report said.

To register interest in obtaining a copy of the report

in full with your WealthBriefing discount, click here.

Up and down

Among the notable changes in the rankings for 2013 were rises by

France’s BNP Paribas and Germany’s Deutsche Bank, while Hong

Kong/London-listed HSBC slipped from sixth to eighth place.

Scorpio said that HSBC’s decline in AuM “would appear to be due

to its ongoing strategy of pulling out of non-core markets”. On

the other side of the coin, Zurich-listed Julius Baer, which is

taking over non-US wealth management assets of Bank of America

Merrill Lynch, has seen its assets surge 40.7 per cent, the

report said. (The report would have been issued prior to the

recent heavy fine on BNP Paribas by the US authorities regarding

sanctions violations.)

Across the wider industry figures for 200 benchmark banks,

Scorpio said that AuM growth has been strong, at 19.7 per cent,

more than double the growth rate seen in 2012. This means the

industry as a whole oversees a total of $20.3 trillion of high

net worth money, up from $18.5 trillion a year before.

Some of these gains have been driven by rises in markets, as well

as net new inflows. At the benchmark banks, net new inflows

averaged $1.8 billion.

Net new money also drove income growth; wealth managers saw an

average rise of 10.9 per cent in income for 2013.

Margins

In a world of rising regulatory costs – with no immediate end in

sight – private banks have had to adapt; the cost/income ratio

across the sector was 83 per cent in 2013, up from 80 per cent in

2012. In spite of that rise,, net new money figures meant

profitability nudged up 1.7 per cent last year, although not as

fast as the 5.3 per cent rise in 2012.

“This year’s results highlight major structural changes taking

place in global wealth management,” Seb Dovey, managing partner

at Scorpio, said in the report. “Overall, key growth indicators

are positive but efficiency averages are not yet improving, which

is an alarm bell to consider by many in the corridors of power,”

he added.

Bringing it all back home

One feature of the report is noting how US firms in particular

have, in certain cases, disposed of non-domestic business to

focus on home markets. Both Bank of America and Morgan Stanley

have, for example, spun off some of their non-domestic business

(as previously mentioned, BoA has sold its international wealth

business of Merrill Lynch to Julius Baer.)

As a result of such behaviour, Scorpio has brought out a new

ranking for leading US wealth managers, with BoA Merrill Lynch in

top spot, followed by Morgan Stanley; JP Morgan; Goldman Sachs;

Northern Trust; Wells Fargo; BNY Mellon, and Citi Private Bank.