Investment Strategies

How Can Investors Guard Wealth Amid Rising Protectionism?

What should investors do when thinking of the rise of some trade barriers, as appears to be on the cards in countries such as the US? A UK-based family office considers some ideas.

There is a spectre, a spectre of protectionism rising around

the world. The push by President Donald Trump to slap tariffs on

imported steel and aluminium, which has provoked moves by the EU

to put levies on some US imports, raises fears about a trade war.

Economists famously disagree about many things but it is said

that on international trade, the case against protectionism is

supported by the overwhelming majority of economists – uniting a

Milton Friedman with a Paul Krugman. Whether that consensus still

holds is an open question; we have seen the rise of critiques of

“neo-liberalism” and globalisation (in plain English, free trade

and free market economics) from a number of sources over recent

years. The financial crisis of 2008, even though it was arguably

more about the sins of government than of free markets gone amok,

has led many to think that the case for unfettered free trade

that seemed to reign supreme after the end of the Cold War, was

waning.

With all that in mind, the idea that protectionism could be on

the rise may cause high net worth individuals and their advisors

to re-think their investments and shape of their portfolios. How

should the issue of trade affect one’s thinking? To consider such

questions, Christian Armbruester, CEO and founding principal of

UK-based Blu

Family Office, offers some thoughts. The editors of this news

service are pleased to share these ideas with readers and invite

responses. They can email tom.burroughes@wealthbriefing.com

The views of guest contributors are not necessarily shared by this publication’s editors.

With all the talk about tariffs and a looming global trade war,

what can we do as investors to protect ourselves and are there

any investment ideas to take advantage of potential

opportunities?

There is always a trade and one can always take out insurance.

So, to explore our options, let us first examine the effect of

any such tariffs. As we all know from attending our very first

economics class, trade wars are bad. For one, they restrict trade

and two, they divert resources to inefficient industries

(otherwise why protect them). Indirectly, protectionist action in

one area usually affects trade in other industries and, for the

most part, there really are no winners. Which is why we rarely

have trade wars, but Trump politics is the topic for another

article.

So, how can you protect yourself from reduced trade, fear of

contagion and a general slowdown of global growth? Increase your

credit exposure and reduce equity risk are the obvious choice,

but that will also go hand in hand with lower expected returns.

Something to bear in mind, if the trade wars don’t turn out as

bad as expected.

What about investment ideas to benefit from the proposed actions?

With US steel, aluminium and auto makers under the protection of

the US government, and European companies bearing the brunt of

increased prices, could we buy one set of companies and short the

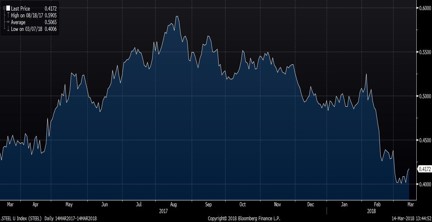

other? The following chart displays how such a trade would have

looked in anticipation of the tariffs and after the announcement

in regard to the steel sector.

Chart: Steel – Comparing the performance of a group of

European versus US Steel companies

Source: Bloomberg

From the chart we can clearly see that European steel companies

have underperformed their US rivals since the beginning of

February. The problem is of course, when were the tariffs priced

into the shares, e.g. did we already know they were coming and

hence the shares started moving months before the actual

announcement? The second problem is, we don’t know what the

market is now pricing in going forward, e.g. is that it now, and

pending any changes, will the shares just stay where they are as

far as tariffs are concerned?

The other thing we don’t know, is how long these trade

impediments will stay in effect. Already there have been

announcements that some parties will be exempted and, with the EU

announcing that they will charge tariffs on US imports of

Bourbon, Levi Strauss and Harley Davidson, the lunacy of the

whole idea may become clearer and cooler heads could

prevail.

Another investment idea could be to buy some options on the

companies affected in anticipation of increased volatility. With

the almost daily rhetoric of tariff on or off, which industries

and what country may or may not be exempt, it might just make the

shares a bit more active until we see a greater

clarity.

Chart: Volatility of a group of US and European steel

companies

Source: Bloomberg

As the chart makes clear, the volatility has surely increased in

the shares affected by the tariffs. The success of the trade will

clearly depend on getting the entry level right as when to buy

volatility. But the nice thing about buying options is that you

can only ever lose the amount of the premium you buy. As such, at

least we know exactly how much we are risking on the

trade.

Overall, I think the main moves in shares and the industries

affected on this round of tariffs is done, and it will be hard to

make money in any trade unless there is further information or

escalation. It might make sense to speculate which shares or

industries could get hit next with tariffs from either side. “Buy

the rumour, sell the fact” is a well-known trading strategy. But

my favourite strategy is probably to do absolutely nothing and

wait for the fall out and carnage to play itself out. As we know,

there will only be losers from this exercise and waiting to buy

when things are at their most bleak has historically proven to be

the most successful trading strategy. So, go ahead Trump, do your

worst.