Technology

Conference Wrestles With Whether Red Tape Helps Or Hits Innovation

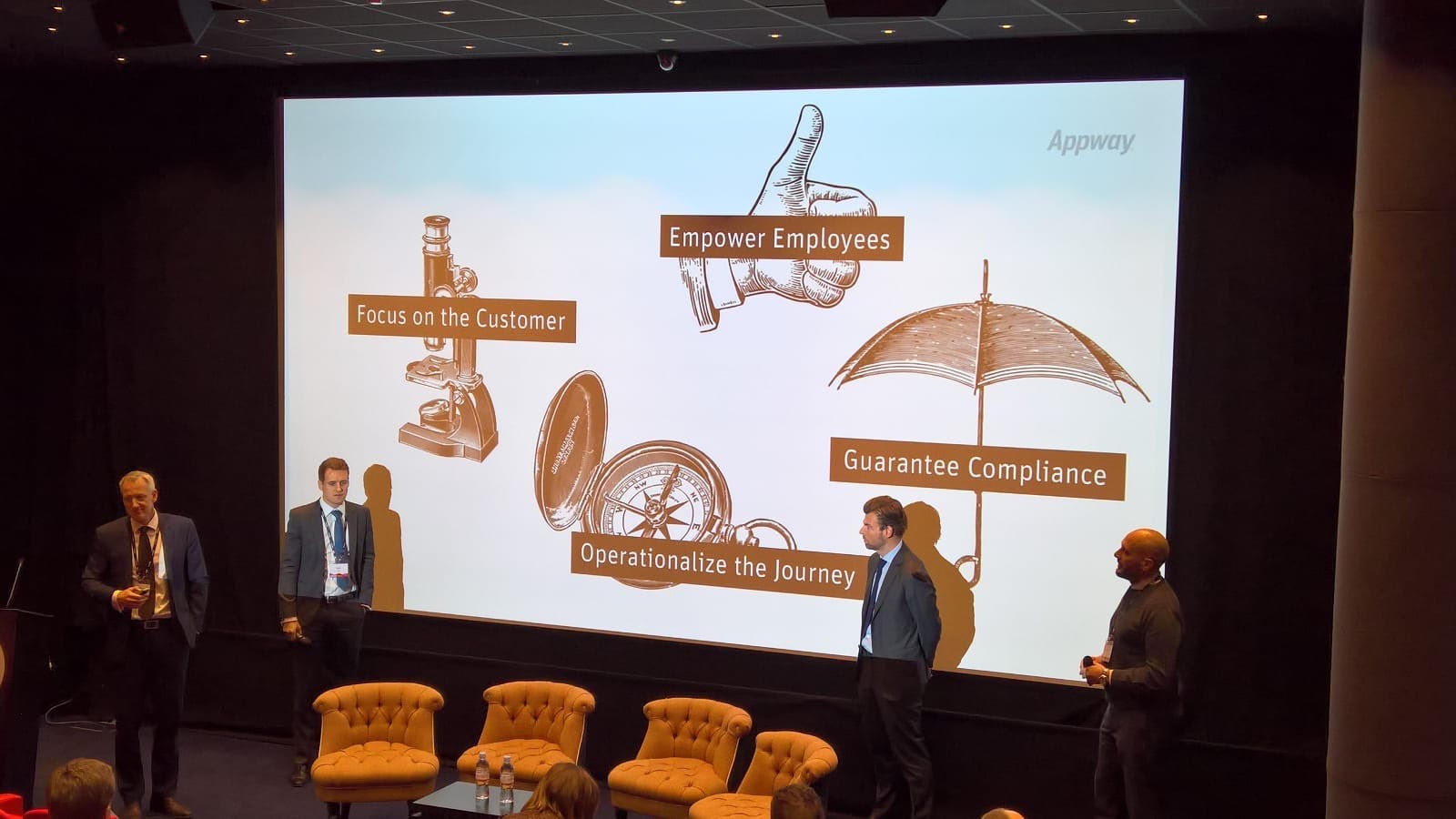

A conference hosted by onboarding specialist Appway, and supported by this publication and others, tackled issues such as whether the focus on compliance is a net driver of innovation, or restricts it. It also examined developments in Appway's own solutions for the industry.

Switzerland-headquartered onboarding and technology solutions

firm Appway set out its

latest developments in London on 1 November, rounding out a 2017

global tour that has seen its executives and staff showcase its

products and services in Geneva, Hong Kong, Singapore and New

York.

And among several of the takeaways from the conference was debate

around whether regulation fosters more innovation than would

happen in more laissez-faire conditions, or whether the

compliance wave seen in recent years is holding back business

development.

The Appway Sphere For Banking London, a conference

featuring senior figures from the firm as well as industry

practitioners, set out Appway’s offerings in the wealth and

retail financial services space, and also featured a presentation

around WealthBriefing’s own recent research report, Global

Compliance and Innovation Trends in Wealth Management. That

report was presented to assembled delegates by Stephen Harris,

publisher of this news service. (The report walks across

different regulatory developments facing the industry in the UK,

US, Canada, Hong Kong, Singapore and Switzerland. It examines the

extent to which firms’ spending on tech is being driven by

compliance issues, and other areas such as business

development.)

René Hürlimann, Head of Sales at Appway, introduced the line-up

of speakers, with Hans-Peter Wolf, Appway’s CEO and Founder,

exploring the theme of “Boundless Collaboration”. And Wolf had a

blunt message for his audience: “It’s impossible to buy digital

transformation and buy progress….it is about hard work.” “This

[transformation] isn’t something you can buy off the shelf or

about some sort of marketing exercise,” he said.

Crucially, Wolf said, any business transformation in a space such

as financial services must start with a firm’s own staff; it is a

good starting point to work out ideas and changes in a company

and among its employees long before clients see the change, he

said. Such an approach will guard against the error of budgeting

for one-off changes where there is no continuing development

afterwards, he said.

It is also important, in terms of serving clients, to be where

they are physically, he said. Without such connections it isn’t

possible to understand what clients actually want. And

co-production and collaboration, which is central to how Appway

works, requires a firm such as Appway to be close to its

customers, he continued.

Changing subjects, Wolf said that onboarding of clients is not a

one-off process; once onboarded, there should be a constant

process of “re-onboarding” the client by adjusting and updating

information and requirements about clients so businesses have an

up-to-date picture of what the client wants and is all about.

The next segment of the conference comprised a live demonstration

on Appway’s Onboarding for Wealth solution. Andrea Buzzi, Head of

Solutions at Appway, and Thomas Schär, Digital Innovations Lead,

gave the presentation, walking the audience through Appway’s

solutions.

“Appway is an orchestrating system that gathers data from

third-party systems,” Schär said. One eye-catching feature of the

system is how documents are updated and tracked, with a clear

audit trail of when, and by whom, information is added and

updated. Another highlight was the system’s use of “chat” to

rapidly update information, removing the tedious work of

providing forms from scratch, as has been a chore for wealth

management clients in the past.

After Stephen Harris’s presentation of the report, which was

produced in conjunction with Appway and Deloitte, a panel of

industry figures discussed how modern technological innovations

are playing out and whether compliance is a net benefit for

innovation, or not. Speaking on this panel were Frank Capron,

Head of Compliance at Bank Insinger de Beaufort; Jochen Dürr,

Chief Risk Officer, SIX Group; Andy Peterkin, Partner, Farrer &

Co, and Verona Smith, Head of Platform, Seven Investment

Management. Audience members were able to vote on a number of

questions, such as the priority areas for tech spending.

Oliwia Berdak, Senior Analyst at Forrester Research, walked the

audience through the present digital innovation landscape,

pointing out, for example, the surge in the number of business

“unicorns” – start-up companies valued at over $1 billion. Her

talk was followed by a panel discussion around what will drive

client experience in the future, featuring Tom Slocock, Managing

Director, Deutsche Bank Wealth Management and Hans-Peter Wolf,

Appway, Faris El Mahgiub, Innovation Manager from Lloyds Banking

Group. Again taking feedback from the audience via electronic

voting, they discussed how comfortable, or not, clients and

industry figures will be by going to more automation of financial

services, the “robo-advisor” phenomenon and the increased

digitalisation of financial services.

Please download the new Global Compliance and Innovation Trends

study here.