Statistics

Investment In Classic Cars Continues To Bring Rewards; Equities Are In Faster Lane

Classic car prices enjoyed a strong rise in March from February, rising 4.23 per cent, and have logged a 6.66 per cent increase so far in 2012, according to the HAGI Top Index measure of exceptional automobiles. However, prices have not risen as quickly as most equity benchmarks this year.

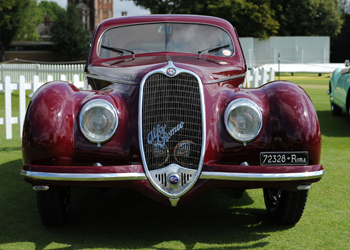

Based on a figure of 100 at 31 December 2008 when the index was launched, the price index is now 147.18, according to Historic Automobile Group International, a UK-based group that tracks prices of classic cars such as Ferraris, Porsches, Maseratis, Aston Martins and other sought-after marques.

The HAGI Top ex P&F, which represents top classic cars excluding Ferraris and Porsches is up 6.27 per cent in March, producing a year-to-date increase of 6.99 per cent.

Interest in such collectable assets has grown in recent years as concerns about the economic outlook, and the threat of inflation, have encouraged some investors to examine “real assets” such as property and art.

Equity markets around the world have, however, overtaken price rises of classic cars this year. The MSCI World Index of developed countries’ shares has delivered total returns (capital growth with reinvested dividends) of 11.56 per cent between the start of January and the end of March this year.