Investment Strategies

Seeking A Sustained Asia Rebound Amid Rising Risks

PineBridge Investments asks what sort of market rebound in Asia is likely at a time of economic and geopolitical risks.

The following commentary on the Asian economic and financial landscape comes from PineBridge Investments, and its chief economist, Markus Schomer. As readers can imagine, the editorial team at this news service are regularly regaled with wealth managers’ views on what they think will happen in markets, and we like to pick out those views that are unusually detailed, or contrarian, or have a specific angle. Schomer’s article adds to debate and we hope readers find it useful.

As with all guest contributions, the editors of this news service don’t necessarily share views of outside commentators. Jump into the debate and make your view heard! Email tom.burroughes@wealthbriefing.com

Our outlook for Asia for 2022 was pushed off track by another

exogenous shock in the form of Russia’s invasion of neighbouring

Ukraine. We were looking for the global economy to move past the

Covid pandemic and settle into the new business cycle this year.

Instead, we are now faced with a sharp exacerbation of inflation

pressures that are depressing economic sentiment and have raised

expectations of more aggressive monetary policy tightening,

particularly in key developed economies. That, in turn, is

driving rising recession concerns that are weighing on global

financial markets.

Global monetary policy is far from synchronised, however. Many

emerging market central banks have been raising rates for well

over a year now, while the People’s Bank of China is actually

cutting rates. The reason why China is on a very different policy

trajectory is its “dynamic zero-Covid” policy, which has seen

rolling lockdowns on its economy. Recently some restrictions have

eased, allowing for more mobility but with frequent testing.

Purchasing managers’ indices have pointed to a sharp slowdown and

possibly a contraction in Chinese GDP growth in the second

quarter, which seriously threatens the country’s growth target.

In its April 2022 World Economic Outlook, the

International Monetary Fund (IMF) cut its China forecast by more

than a full percentage point to 5.1 per cent from its

previous forecast in October 2021, acknowledging this development

(1).

Growth Is slowing in China, but government stimulus is

underway

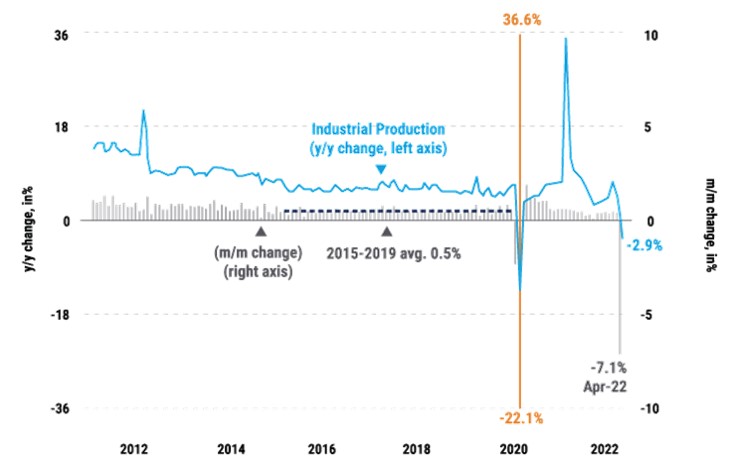

Industrial Production Posted Its Second Biggest Drop Since 2020

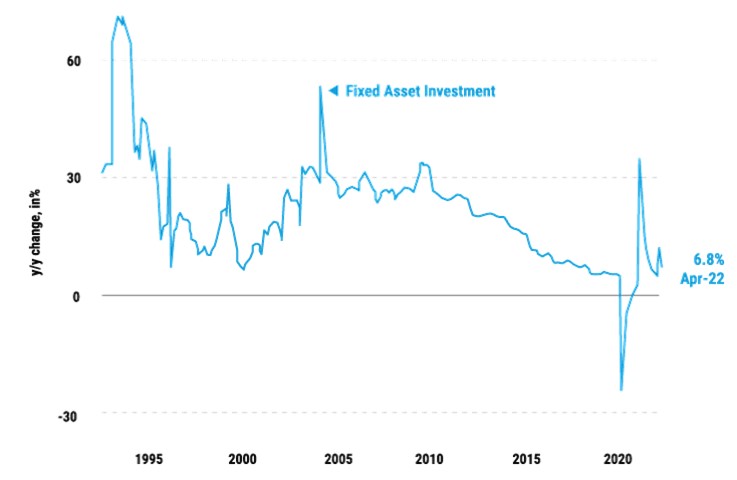

Annual Growth in Fixed Asset Investment Remained Positive,

Highlighting Efforts to Stabilise Growth

Source: Macrobond, Bloomberg, PineBridge Investments

Calculations as of 16 May 2022

The Chinese government has moved to implement more policy

stimulus. Yet, it is not just zero-Covid that is weighing on the

economy, but also problems in the property sector, which are

complicating attempts to use traditional stimulus tools such as

increasing credit supply or cutting interest rates. China’s

outlook has deteriorated the most among the major Asian economies

since our initial 2022 outlook publication.

Another global outlier in terms of monetary policy is Japan,

where the central bank is keeping the 10-year government bond

yield near zero. Japan started the year with another GDP

contraction. The poor first quarter performance was the result of

yet another round of Covid-related restriction, highlighting how

much the country lags the US and Europe, which have largely

removed most Covid measures. But the economy should rebound in

the spring, and continued monetary and fiscal policy support,

together with stronger exports boosted by a weaker yen, should

extend that recovery well into next year. In fact, the IMF

forecasts about the same rate of GDP growth for the US, the

eurozone, and Japan in 2023 (1). It would be remarkable if that

were achieved with three dramatically different monetary policy

regimes.

India’s economy slowed sharply in the first three months as Covid

restrictions held down growth to an annualised rate of just 1.2

per cent. Yet purchasing managers indices suggest growth should

pick up again in the second quarter as restrictions are lifted.

The main risk for India’s outlook is the surge in oil prices. The

country imports 85 per cent of the oil it consumes, which means

that oil costs will put increased strain on India’s current

account, potentially requiring higher interest rates or a weaker

currency. Yet the latter is not desirable, as it would fuel more

inflation. Hence, tighter monetary policy is in the cards, which

means downside risks to growth are on the rise. In June, the

Reserve Bank of India raised the repo rate by 50 basis points to

4.90 per cent and announced a gradual withdrawal of accommodative

measures implemented during the pandemic in a bid to keep

inflation within target.

The economic outlook for Asia is looking a bit weaker compared

with the end of 2021, when we wrote our initial outlook. The

Russian invasion in Ukraine has pushed up inflation even more,

raising the risk that central banks may go too far in their

attempts to counter the price surge. China is subject to more

Covid containment measures since the pandemic began. On the flip

side, a weaker growth outlook also means fewer rate hikes and

less restrictive monetary policy. We would need to see a more

sustained market rebound, and a turnaround in inflation, to

(quickly) lead to a pause in the rate-hike cycle and fading risks

of recession.

Footnote,

1, International Monetary Fund, April 2022, https://www.imf.org/en/Publications/WEO/Issues/2022/04/19/world-economic-outlook-april-2022