Asset Management

Crude Oil Prices Keep Climbing, Driven By Ukraine – Reactions

Oil prices are red hot, with sanctions against Russia, worries about global supply chains and the ongoing crisis in Ukraine keeping levels high. Here are reactions from economists and asset managers.

Crude oil prices surged yesterday before easing off a touch, and higher energy prices – which will drive up production and distribution costs for goods and services – have spooked stock markets. The Russian invasion of Ukraine – an important producer of commodities such as wheat – has been met by strong Western sanctions against Vladimir Putin’s regime in Moscow. Coupled with supply chain disruptions caused by COVID-19 and associated lockdowns, economists are trying to work out how central banks can mop up excess monetary liquidity caused by quantitative easing at such a difficult time.

Here is a range of commentaries from different parts of the world from economists and asset managers.

Bank of America Securities, part of Bank of

America

At this stage we have three key economic calls around the Ukraine

crisis: (1) the US and global economy enters the crisis with

strong momentum, (2) if current sanctions are sustained, they are

a big hit to Russian growth, a moderate hit to European growth

and only a small shock to the US economy, and (3) the risks to

this outlook are large and very much skewed to the downside.

Indeed, we are a bit surprised by the resilience of risk assets

thus far.

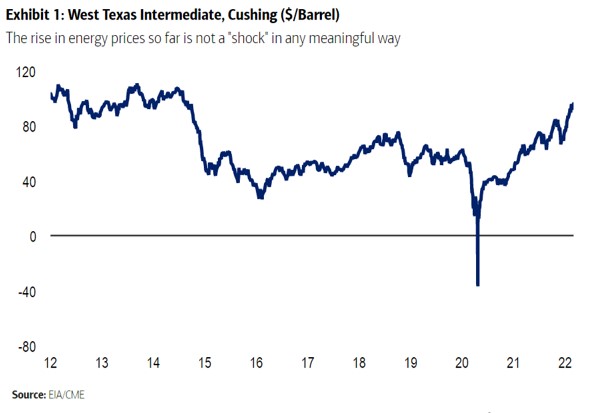

The big missing element in the sanctions thus far is that they

have little impact on Russian energy exports. The threat of such

sanctions has put a risk premium into the oil market, but the

rise in energy prices so far is not a "shock" in any meaningful

way

The problem is that we have no confidence in predicting what

happens next. Russia experts have repeatedly under-estimated how

far Putin would go not only in this crisis but also in Russia's

previous incursions into Ukraine. It also appears that both the

experts and Putin himself have been surprised by the remarkable

resistance from the Ukraine people and the stronger-than-expected

NATO response. Perhaps this will cause Putin to look for a

face-saving way out of Ukraine, but we are very concerned about

the opposite – a sharp escalation of the attack with energy

sanctions to follow.

If the West cuts off most of Russia's energy exports it would be

a major shock to global markets. Francisco Blanch [head of

global commodities, equity derivatives and cross-asset

quantitative investment strategies] and team estimate that

every unexpected 1mn b/d supply or demand move can result, other

things being equal, in an about $20/per barrel move in

prices. If most of Russia's oil exports are cut off, there could

be a 5 million b/d or larger shortfall even if there is some

offset from the release of strategic reserves and some increase

in OPEC exports. That means oil prices could double from $100/bbl

to $200/bbl.

For moderate movements in oil prices our rule of thumb suggests

that sustained $100/bbl higher prices lowers GDP growth in the

year ahead by 1 per cent or so. The low number comes from the

fact that the US is energy independent (that is, we produce as

much energy as we consume). However, history shows that big

shocks can have non-linear effects. This is particularly the case

if there is sticker shock from record-high gasoline prices. We

could see a hit to growth closer to 2 per cent.

We want to emphasise that this is a scenario and not a forecast.

However, the outlook is highly uncertain and investors need to

consider the range of risks.

Capital Economics, the UK firm, on what the European

Central Bank might conclude:

The war in Ukraine has prompted us to revise our forecasts for

eurozone GDP, inflation and monetary policy. Russia’s downturn in

2015 had no obvious impact on eurozone GDP and Russia has become

less important as an export market since then. But we expect a

much deeper recession in Russia this year, and the spillovers to

Europe will be larger due to the severity of the sanctions. For

now, we are cutting our eurozone GDP growth forecast for this

year from 3.5 per cent to 2.8 per cent. Meanwhile, the recent

surge in commodity prices, together with upside surprises to

inflation in January and February, mean that we now think

headline inflation will average around 5.5 per cent this

year and 2.5 per cent next year, well above the European Central

Bank’s 2 per cent target. Finally, the war seems to have made

policymakers at the central bank more cautious, so we think they

will wait a little longer before tightening policy than

previously seemed likely. We now anticipate one 25bp rate

increase late this year and another 50bp during 2023.

Tracy Chen, a portfolio manager on the fixed income team

at Brandywine Global

The Russia-Ukraine crisis has not only heightened geopolitical

risk, but it signifies a major shift in the world order to one

that is more multi-polar. The end results are likely to be more

frequent and more unpredictable flare-ups and higher market

volatility. And higher market volatility may introduce more

opportunities to generate alpha for global investment

managers.

Derek Deutsch, managing director and portfolio manager at

ClearBridge Investments

Military invasions have historically created an equity market

low, with US stocks becoming increasingly volatile over the last

several trading days and making what could be a near-term

bottom.

With inflation risks skewed even more to the upside by

conflict-related commodity price spikes, the US Federal Reserve

is not likely to deviate materially from the market’s pricing of

rate hikes. Such inflationary pressures are felt more strongly

and directly in Europe and could lead to a more dovish policy

stance by the European Central Bank.