Asset Management

What's Driving Fixed Income Flows: BlackRock

Are we in a rising rate environment is the question on the minds of many investors looking to shore up their fixed income exposures against the potential for inflation and rate volatility. BlackRock examines how investors have reacted to the end of May.

BlackRock's head of iShares fixed income for EMEA, Brett Olson, looks at the top themes influencing how clients are thinking about their fixed-income portfolios when yield and inflation volatility are uppermost in their minds.

Inflation

Looking beyond the transitory nature of the current inflation

surge linked to economies reopening, and the US recovery moving

at a heated pace, BlackRock’s Investment Institute (BII) suggests

that inflation will "build steadily" over the medium-term as easy

monetary policy allows the trend to continue.

“Bond ETF flow data show investors are moving their allocations

to use inflation-linked bonds with YTD inflows of $3 billion at

the end of May versus $4.2 billion for the whole of 2020,” Olsen

said. They are also using short-duration corporate and government

bonds to minimise rate volatility.

For now the liquid and flexible nature of fixed-income ETFs is

allowing investors to stay nimble and adaptable, he said.

How committed are investors to their sustainability

journey?

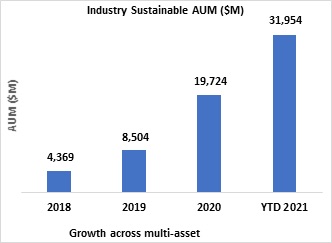

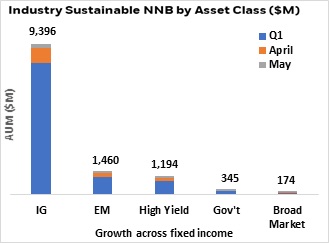

It has not been derailed. Sustainable flows across all major

fixed income asset classes continued to be positive with total

flows into fixed income ESG ETFs coming up to $12.6 billion to

the end of May, mainly driven by investment grade credit, which

accounted for 73 per cent of this total.

BlackRock reports that sustainable fixed income ETF flows are far outpacing industry inflows into traditional non-ESG exposures for the year-to-date. This figure stood at about $3.3 billion to the end of May.

“Investors increasingly want to understand the impact of

sustainability on their fixed income sleeve. Despite growing

investor caution on fixed income as an asset class in recent

months, the trend of switching out of traditional or non-ESG

funds and actively transitioning into sustainable exposures is

accelerating,” he said.

UCITS fixed income sustainable ETF flows

The search for yield

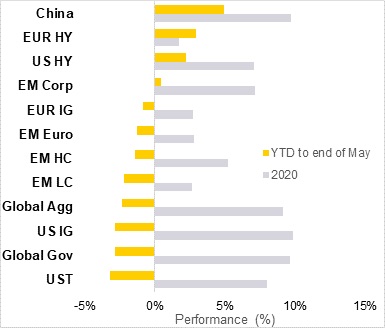

The extraordinary level of recent stimulus has pushed interest

rates lower making the search for yield increasingly tough.

BlackRock reported that high yield continues to be favoured by investors in 2021. HY ETFs attracted $2 billion of inflows to the end of May, with a strong preference for USD HY exposures supported by lower EUR/USD hedging costs. This was coupled with higher exposure to energy names.

“HY has traditionally been viewed through a lens of requiring specialist knowledge and expertise in order to ‘pick and choose’ between the best names in the sector. However, as the ongoing hunt for yield continues, HY debt may benefit from inflationary pressures as investors may prefer the shorter duration exposures that HY offers versus investment grade debt,” Oslen said.

Looking at the portion of the fixed income market that yields over 2.5 per cent, more than half is made up of China bonds, with “investors increasingly taking note,” he added.

BlackRock points to the five-year China government bond yield running at 3 per cent compared with the equivalent five-year US Treasury yield running at just 0.9 per cent.

Comparing returns across asset classes

“The inclusion of onshore bonds into global indices provides a structural tailwind and low correlation with other major markets, and attractive to investors looking to build resilience against market volatility, Olsen said.

The result is that China onshore bond ETFs gathered more than $4 billion inflows to the end of May 2021, according to BlackRock data. They were used mainly for strategic asset allocation purposes, among a diverse set of investors across asset owners, managers and wealth and in multiple regions, Oslen said.