Surveys

Family-Owned Businesses Withstand COVID Assaults

Credit Suisse Research Institute has published its latest findings on the resilience of family-owned companies across global territories, and how they have performed against their non-family counterparts in these testing times.

The business narrative of this pandemic has been if/when staff will return to their corporate offices and, for smaller firms, whether they will survive. The response to the latter perhaps is "stop worrying."

A report this week from the Credit Suisse Research Institute describes the SME sector as being robust, especially those long-established family-owned businesses rooted in community values. (The institute is a thinktank run by Credit Suisse.)

In its report Credit Suisse Family 1000: Post the Pandemic, the firm found that family-owned businesses outperformed their non-family-owned peers in every region and sector and were remarkably resilient to COVID-19’s effects.

Using a proprietary database of more than 1,000 publicly listed family - or founder-owned companies - the Swiss wealth manager has found that since it began monitoring in 2006, the overall “Family 1000” has outperformed non-family-owned companies by an annual average of 370 basis points. Results in Asia-Pacific, excluding Japan, have seen the most impressive headway, with compound returns of more than 500 basis points a year, followed by Europe at 470 basis points.

“Our research to date highlights that family-owned businesses pursue a longer-time horizon in their investment strategy, delivering more stable and superior through-cycle profitability, and ultimately driving significant excess returns for all shareholders,” the report said, in an old-fashioned nod to cutting your cloth according to your means.

Family-run businesses, although overshadowed by large cap citadels that grab attention, are the backbone of most national economies, and a macro view of how they are navigating this difficult year is a good indicator of how economies as a whole are going to emerge from the pandemic.

“We found that the traditionally more conservative financial model of family-owned companies built on lower leverage and stronger cash-flow generation has proven to be an asset. They have notably relied less on government employment support to furlough their workforce, implicitly reflecting their own social responsibilities,” Eugène Klerk, head of global ESG research product at Credit Suisse, said.

Family-run Asian businesses dominate

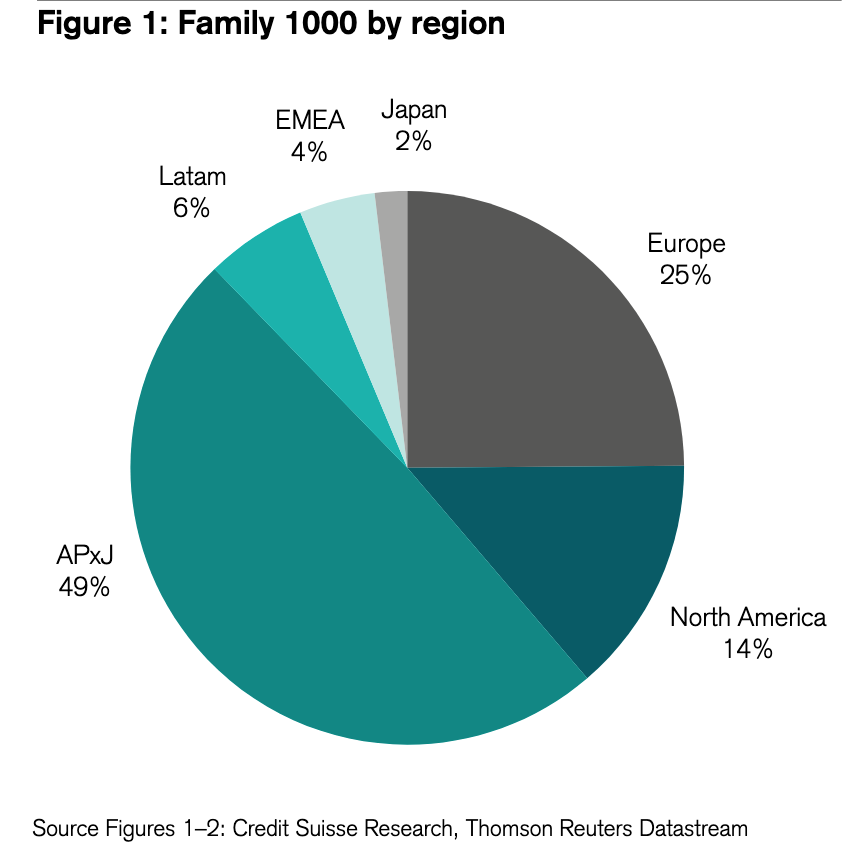

As the chart above shows, around 50 per cent of companies on the

database are in Asia. Across 12 markets, including Japan, APAC

holds a 51 per cent share of all businesses, comprising 540

companies that contribute $5.56 trillion in the region.

Breaking this down further, there are 159 family-owned companies in China (worth $2.48 trillion); 71 in Hong Kong (worth $505.1 billion), and 111 in India that make up the top three jurisdictions and 70 per cent of APAC market share, with a combined market cap of $3.9 trillion.

Highlights In Brief

Higher growth and profits

Family-owned companies typically perform 200 basis points higher

than non-family-owned companies for both smaller and larger

companies. They also tend to be more profitable, with superior

returns seen across all regions globally.

“When talking to investors about family-owned companies, we often hear that they outperform because of a perceived longer-term investment focus compared to non-family-owned companies. Our analysis suggests that this is indeed the case,” Klerk said.

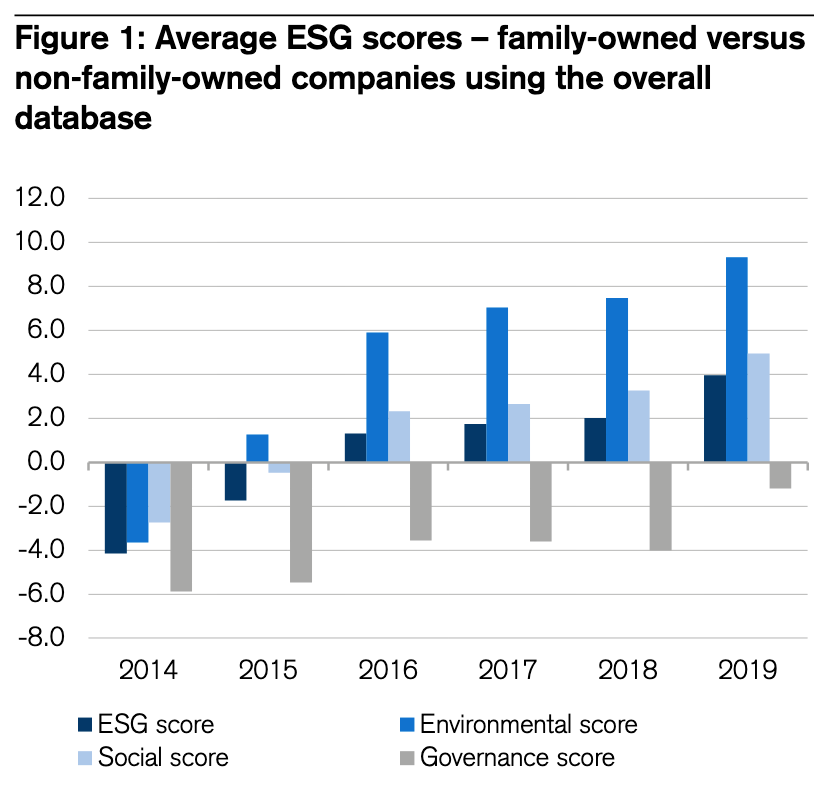

Performing better on ESG

On average, family-owned companies tend to have slightly better

ESG scores than non-family-owned, leading on “E”

environmental and “S” social scores but lagging on “G“

governance as this chart shows.

Beginning to match European standards

Not surprsingly, European family-owned companies shine in this

area, scoring the highest for ESG of any region. But data

suggests that APAC (ex-Japan) family businesses are scoring

better on ESG than their US counterparts and rapidly closing the

gap with Europe.

Older companies score better on ESG than younger

ones

This is another interesting revelation, which the report suggests

is down to older family-run companies having more established

processes that allow them to address issues not tied directly to

the bottom line but still relevant for business sustainability.

It is also likely that younger businesses striving to establish a

foothold are pushing back on sustainability issues, from supply

chain operations to labour practices, seeing compliance in these

areas as costly near-term burdens.

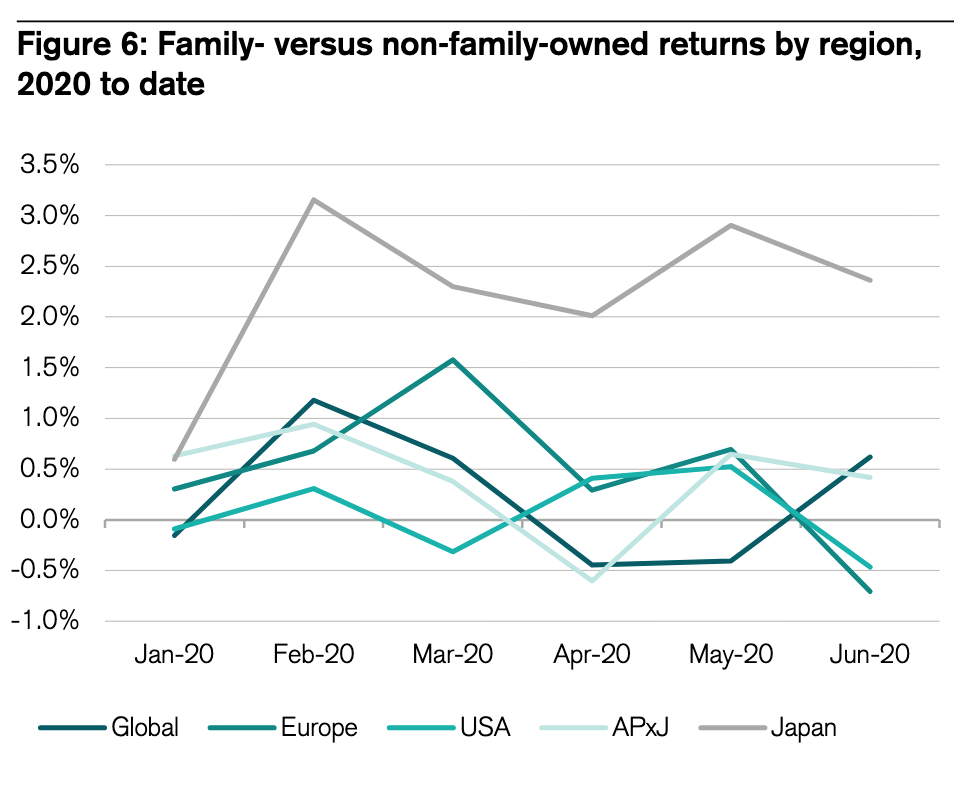

Returns of family-owned vs. non-family-owned companies

COVID-19 impact on the sector

This year, the report also delved into the exceptional

circumstances thrown up by the pandemic. Eyes are particularly

looking at how different regions have managed disruptions, and

what the economic and social shocks have done for ESG uptake as

the new byword for business resilience. Reports on how well Asia

has been integrating ESG into investment processes and company

practices have been mixed.

Credit Suisse reckons that in spite of the pandemic putting more emphasis on social aspects, research found that family-owned companies trail their non-family-owned peers on a host of ESG measures, most noticeably on human rights and modern slavery-related policies. On average, they also have less diverse management boards. Fewer of them have support groups for the lesbian, gay, bisexual and trans (LGBT), black, and Asian and minority ethnic (BAME) communities, or have made any public statements related to United Nation principles.

Again, looking at how roughly 300 individual companies have ridden the COVID-19 crisis, the report found little difference in approaches. Even though both sets suffered revenue losses, family-owned companies were slightly less worried about their future than non-family owned. They were also less likely to furlough staff (46 per cent versus 55 per cent) and more likely to have put support programmes in place, more so than businesses in Europe or the US. Although this may be because the US and European governments have pumped in massive support packages.

As these schemes unwind, it raises the question of whether Asian companies, already less reliant on state intervention, are going to bounce back more vigorously than other markets.

Even though family-owned companies are known for "sticking to what they know," both groups said that operations are likely to change, with 60 per cent of non-family-owned and 48 per cent of family-owned companies believing that they will shift to a more flexible rather than a full-time workforce in a post-COVID world.