Strategy

Wealth Management Is More than Just Managing Investments - EPAM

Much has been recently written about the evolution of wealth management, from the disruption posed by new entrants, such as robo-advisors through to changing behaviours, demographics and expectations of clients, and the replication of digital experiences that are commonplace in people’s daily lives.

Along the way, the wealth management business has become more complex, more cost-conscious and more regulated. Advisors struggle to keep pace with real-time expectations, personalised investments and a need to serve more clients.

It is not as easy to find practical examples of change, leaving some fundamental questions unanswered. For instance, how is it possible to make a high-touch ultra-high net worth personal advisory relationship seem unique and valuable when conducted entirely over a mobile device? How is an advisor to cope with the demands of personalisation, of serving increasing numbers of clients and the need not just to monitor but proactively to respond to markets, client preference and regulatory complexity across every jurisdiction in real time?

Focus

There is of course a huge variety of features that can be

implemented across the spectrum of bank and client activity, but

we focus here on three examples to show how the following

high-level concepts could be applied:

1. Personalisation – it starts with knowing and

understanding a client and their preferences; it starts even

before becoming a client; “onboarding” should be a memorable

talking point for all the right reasons.

2. Social – sharing, discussion and second opinion are

almost anathema to the wealth management relationship; outside of

a few investment specialists or close family, privacy is

traditionally strictly enforced; this approach is fundamentally

at odds with the changing social behaviour of modern clients.

3. Actionable – an unfortunate consequence of easy modern

communication is the volume; we are bombarded with information

but only a tiny fraction of it actually answers the question “So

what?”. To stand out, communication should provide value,

suggesting or informing a course of action or material change. An

advisor will benefit most from not from having more screens, but

from having specific, actionable and relevant recommendations

displayed on those screens.

Onboarding and personalisation

For too many banks, the customer prospecting and acquisition

process is a lengthy and painful exercise that starts with the

best possible presentation of the bank’s expertise, credentials

and commitment to the client, revolving around wood-panelled

meeting rooms, expensive lunches and other events. This

unfortunately descends very quickly into a drawn-out process of

physical document exchange, repetitive and intrusive questioning

and opaque delays for the completion of internal “processes”.

There is a sense of relief at the conclusion and all the golden promises of personalised investment service, advice beyond banking, goals and other benefits are sidelined and forgotten during a period of recovery.

We think there is a better way. At every step of this journey, from the very first interaction with a prospect, the bank is acquiring information. Current situation and goals are almost the first thing that will be discussed, informally at first, but where does data go? Through all the interactions that precede a formal decision to begin onboarding a wealth of relevant data is shared – ad-hoc, anecdotally, in conversation, or even formally; this is all relevant either to completing the formal onboarding checks required for compliance, or to inform the bank's view of the client and to drive future interaction, recommendations and advice.

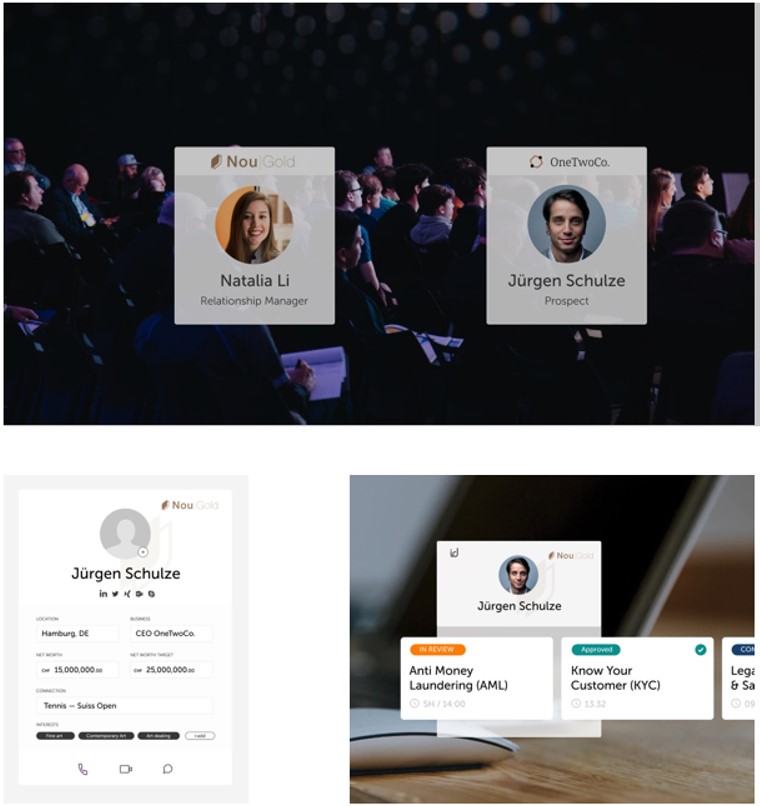

Advisor and prospect both access online tools for collaboration and transparency during onboarding.

This data should be captured, in real time or through subsequent input by an advisor, in whatever form is relevant. This can be audio, image (especially to record documentation), notes and even video. Where possible and permitted, KYC and other mandatory client checks could start on day one, rather than waiting for a symbolic “Go” decision to start. When that does eventually come, all data that has already been captured should be used to prevent a client ever having to provide a piece of information twice. The resulting significant reduction in onboarding time, coupled with very simple techniques aiding transparency and to highlight progress can provide enormous benefit in customer satisfaction.

In many (if not all) banks there is a reticence, driven by history and industry practice, to probe, record and use clients’ data; however, many of the biggest firms on the planet have built their entire business models on the acquisition and monetisation of client data. There is a huge gap between the current state of client profiling and personalisation in banking and the industrialised processes employed by these technology giants, and a long way that banks could go towards using the data they have to improve personalisation applying well understood and tested techniques. This can be done within the constraints of necessary banking privacy and regulatory data protection, sensitive to client sentiment and subject to explicit consent. It is worth bearing in mind that concepts of trust and expectations over privacy and the use of personal information are very different in modern digital natives than in their predecessors.

Investment circles and social banking

In almost every modern digital experience in which users interact

daily, there is a social dimension – either as the basis of the

entire experience (Facebook, WhatsApp, Instagram, …) or as a

critical tool in forming opinion, rating services or providing

advice (too many to name!)

And yet, in banking this is not the case. In what is almost the most critical service that any client will consume, their financial health and wellbeing is often entrusted entirely to a single entity with no systematic access to second opinion, diverse input or any kind of alternative assessment at all.

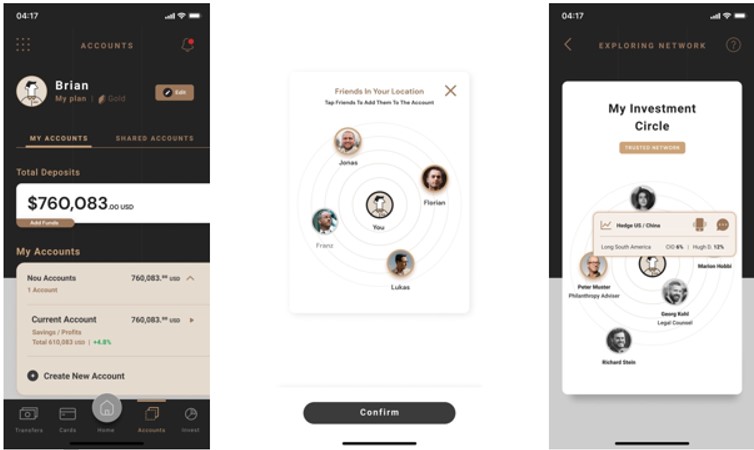

Our work with a wide variety of clients has shown that there are numerous cases where a group has a valid part to play in collaborating on financial matters from UHNW investments to payment wallets for children, with everything in between.

We have concentrated on two diverse scenarios to visualise how a set of basic financial products could be integrated with a social activity and group collaboration on shared accounts with feedback, interaction and advice built into the interaction:

1) Nou Gold – Superyacht rental with social interaction on shared deposits, subsidiary accounts, spending oversight; investment integration and group interaction for advice. A shared deposit account is established and initially funded by a group who wish to organise the trip; group members share access and are visible to each other through the banking app. Supplementary accounts and cards (basic pre-paid “wallets”) are issued to crew members who are empowered to spend within certain limits. The environmental impact could be monitored and offset using appropriate investments, linked together in a single holistic banking experience;

Social elements in Wealth Management context

2) Nou Family – taking the exact same products and concepts, the experience could also be applied to a family’s accounts with parents having individual and joint accounts, children being issued with basic savings and spending accounts and cards, social interaction between family members and advice via bank-authorised “influencers” and environment and social responsibility made transparent via spending analysis and evaluation of the family’s carbon footprint. Investments and education are also linked into the combined experience.

Advisor tools and actionable events

The typical advisor has a fragmented landscape of tools and with

overlapping features, disconnected interfaces and an often manual

process environment. Many applications and duplicate data entry

are common, leading to delays, operational risk and both direct

and indirect client impact.

At the same time, the advisor is buried with data from which personalised client insight and recommendations must be drawn but lacks the capacity to do this reliably at scale. What is needed are tools that support he advisory process, automating manual processes and robotic decision-making while analysing the constant stream of data to identify and propagate actionable events requiring advisor attention.

Advisor tools and actionable events

Our work with many different clients has informed our view that

all content presented to clients and advisors should have value –

and where action is required, that action should be supported in

context with a relevant call to action.

It is clear that not every bank is able to replace their entire technology landscape to support a new interaction paradigm – and nor should they be required to do so. The technologies exist today to allow the required insight to be drawn from most applications. What is needed is a deep understanding of what has value and will contribute to efficiency, transparency and a reduction in complexity. The organisation can focus on the relevant integrations and experience in an iterative way, incrementally driving true transformation of the advisory process.

Conclusion

Digital transformation of the client experience, advisor tools

and core processing platforms is clearly a major undertaking for

any bank, whatever the starting point. It can feel like boiling

the ocean and almost that nothing is done until everything is

done.

We believe, though, that the experience of all users – client and advisor – can be gradually improved by a series of individual changes. What is needed is a clear understanding of what is working and what is not in the current state; what are the pain points and friction areas? It is useful to have an “ideal” target state in mind and to identify and prioritise small improvements against their potential to move in this direction.

The transformation journey can then begin as a series of small, practical and achievable steps, allowing for adjustment along the way, rather than a monolithic roadmap that must be defined in its entirety at the start.