Investment Strategies

Weathering Credit Market Storms, Capturing Precious Alpha

In the second article of a three-part series, the US-headquartered investment firm takes another look at the credit market, the ingredients for investor success and composure.

Here is the second article in a series from BNY Investments.

This particular item addresses credit markets and how to assemble

and guide portfolios, for example, navigating market volatility.

(To see the first article in this three-part series,

click here.)

The editors are pleased to share this material; the usual

editorial disclaimers apply to views from outside contributors.

To comment, email tom.burroughes@wealthbriefing.com

and amanda.cheesley@clearviewpublishing.com

Building on the resilience and diversification of global

credit

Having the freedom to access worldwide credit markets offers

ample opportunities for active managers to target diversified

investment opportunities with an eye to achieving outperformance

and building resilience over time. This strengthens the case for

incorporating an active approach to global credit within an

investor’s portfolio.

A global approach can help weather extreme

volatility

The broader opportunity set in a global mandate can offer greater

resilience in a financial storm, when compared with a regional

allocation.

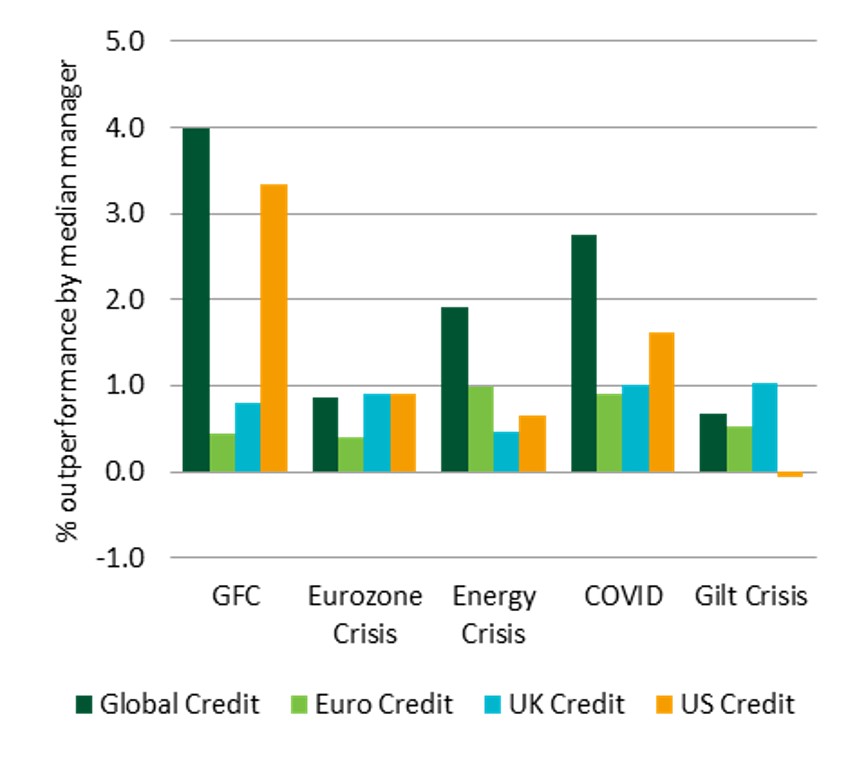

Looking at the outcomes of various crises that have affected bond

markets in the last 20 years, global managers have typically

performed comparatively well in the wake of such crises, when

compared with regions individually.

Figure 1: A global approach to credit has been more resilient

when global crises hit (1)

Following the global financial crisis, the 2015-16 energy crisis

during which oil prices fell substantially, and the 2020 Covid

crisis, the median global manager generally achieved equivalent

or better performance relative to their peers than did the median

managers of regionally focused (US, euro and sterling)

strategies. The exception was the 2022 gilt crisis, where a

global approach was only bettered by sterling credit market

specialist approaches.

Broadening access to other sectors and ways that can

improve diversification and make the most of the

market

Adopting an active approach to global credit, which extends

flexibility to a manager so that they have the freedom to access

markets and asset classes beyond a traditional global benchmark,

can provide clear benefits. Investing in asset classes such as

high yield, emerging markets, asset-backed securities, or loans,

can open up extra options for garnering additional alpha for

portfolios. It also enables a portfolio manager to spread the

risk they are taking more widely, potentially allowing them to

achieve a performance objective but with the risk taken being

more diversified.

Enable active positioning to deliver

outperformance

To BNY Investments, the potential benefits of active management

are clear, but how might a global credit manager actually achieve

these benefits? There are a number of different approaches for

applying active strategies.

First, one can apply credit strategy, including managing

portfolio beta. Active managers flex the credit risk in the

portfolio relative to the benchmark index. That credit strategy

decision may be influenced by where in the credit cycle the

market is perceived to be, or what its valuation appears to be

relative to history.

Second, credit asset allocation decisions may be driven by

considering the macro relative value of related markets, such as

positioning in one geographic market versus another. Others may

include considering high yield over investment grade, emerging

markets over developed markets, or identifying that synthetic

markets (such as credit default swaps) appear to be priced

differently from physical bonds.

Third, we believe great added value can be achieved through

sector strategy. Here, whole industry sectors can sometimes have

valuations that do not reflect the current or future strength or

weakness of their constituent companies. This is often due to the

sector experiencing a slightly differentiated economic cycle than

the broader market. Additionally, some industry sectors may

become over-leveraged relative to others, making them less

attractive to active managers. Importantly, unlike a passive

approach, active managers have the flexibility to avoid investing

in sectors where they believe the outlook is concerning.

Fourth, in our view, security selection can be a key driver of

success in active credit management. Seeking to pick the winners,

as we see them, in regions/sectors and avoiding the laggards by

applying diligent and detailed fundamental credit analysis. That

process aims to identify securities whose valuations do not

accurately reflect the company's current and future fundamental

strength or weakness. When selecting an issuer's securities, it

is crucial to choose those with robust balance sheets and easy

access to money markets. Additionally, issuers may need to be

stress tested for risks such as litigation, new regulations,

environmental or social factors, and potential mergers or

acquisitions.

Last, it may be possible to add value through duration and yield

curve strategies, or through applying active currency views.

Managers can strategically position their portfolios based on

their outlook for market yields. If they anticipate a decline in

yields, they might add longer-maturity issues, which are expected

to benefit the most from such a scenario. More sophisticated

strategies may involve targeting specific segments of the yield

curve or varying investments across different maturities. A

manager may also believe that a currency is unjustifiably

undervalued and wish to apply some active risk through that

channel.

We believe that taking an active approach can be a superior

approach over the long term. It seeks to identify where there is

excess value that can be captured, or where the expected returns

are insufficient given the apparent risks.

We would maintain that the key to achieving consistent

outperformance would be to focus on successfully applying credit

strategy decisions sector/security selection, where having a

well-resourced, experienced, and dedicated credit research team

may be able to provide a competitive advantage.

Footnotes

1, Source: Bloomberg. As at 31 May 2025. Recovery is measured as the median manager relative performance in the six-month period ending in: GFC: June 2009, Eurozone Crisis: April 2012, Energy Crisis: August 2016, COVID: September 2020 and Gilt Crisis: April 2023.

Investment managers are appointed by BNY Mellon Investment

Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management

(Luxembourg) SA (BNY MFML) or affiliated fund operating companies

to undertake portfolio management activities in relation to

contracts for products and services entered into by clients with

BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

Important information

For professional clients only. This is a financial promotion.

Any views and opinions are those of the investment manager,

unless otherwise noted. This is not investment research or a

research recommendation for regulatory purposes.

For further information visit http://www.bnymellonim.com.

Document ID: 2524000. EXP: 25 December 2025.