Investment Strategies

Compelling Yield Without Compromising Quality

This article examines the credit universe, what it consists of, its place in portfolios and behaviour across time.

The following article from BNY Investments, which examines the world’s credit market, argues that global credit should be a core part of a portfolio. The editors are pleased to share this material; the usual editorial disclaimers apply to views from outside contributors. To comment, email tom.burroughes@wealthbriefing.com and amanda.cheesley@clearviewpublishing.com

At BNY Investments, we believe that global credit is endowed with

a number of favourable qualities, compared with other financial

asset classes. It includes thousands of issuers with good credit

quality, diversity and depth in the investable universe, and

yield with the potential for income streams relative to history.

In our view, these features create a compelling case for

considering a core global credit allocation.

Let’s look at them in turn.

Investment grade at its core, worldwide in its

spread

A global credit universe will typically consist of high-quality

securities, across the investment grade spectrum, from the

highest AAA rating, through to BBB-. The Bloomberg Global Agg

Credit Index (the “Index”) is a common benchmark for global

credit managers and, as of March 2025, contains more than 20,000

securities, from more than 2,600 issuers, demonstrating the

breadth and depth potential opportunities within the market. Its

geographical coverage ranges worldwide rather than being confined

to single discrete markets. It consists of borrowers from around

the developed and developing worlds and in a number of

currencies, with the dollar being dominant.

Corporate issuers and more besides

The bulk of the global credit world is made up of issues from

corporate borrowers, covering the breadth of the economic

landscape. They range from industrial sectors to utilities and

financials. Industrials include sectors such as automotives,

pharmaceuticals, energy, telecoms, and technology, while

financials capture sectors such as banks, insurers, and real

estate investment trusts (REITs). Utilities are typically a

smaller sector covering electricity and gas providers.

However, the credit universe is broader than the corporate

universe as it also includes issues from a collective of

government-related, or non-corporate, entities. In general, they

have stronger average credit ratings than the corporate issues in

the universe and come from four key sources.

Supranational entities, such as the European Investment Bank and

International Bank for Reconstruction and Development, make up

about a tenth of the Index and are mostly highly rated (AAA).

They have maturities across a wide spectrum, having been out more

than 30 years in some cases.

Two further categories are government agencies and local

authorities, such as the Export Import Bank of Korea and the

province of British Columbia in Canada. Last, it includes some

sovereign issues by governments borrowing in a currency other

than their own, with examples such as dollar bonds issued by

Mexico, or euro issues from Poland, or Italy borrowing in

sterling.

Yield levels create an appealing draw for inflows to the

asset class

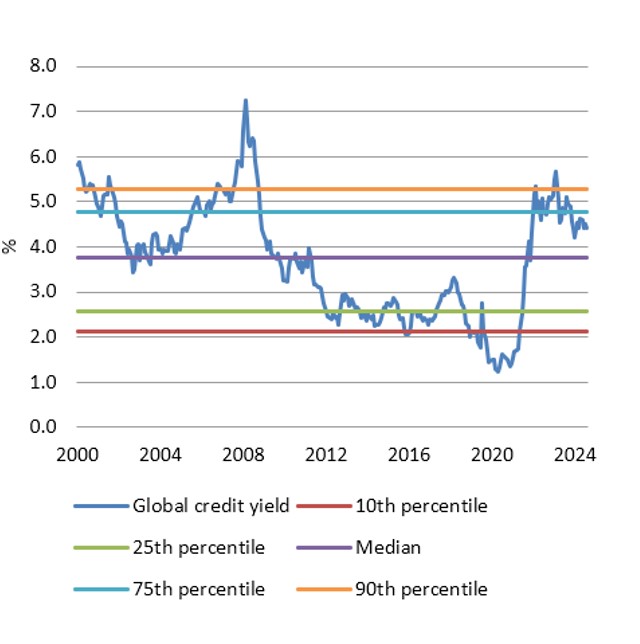

The level of yield available in the global credit market has

varied greatly over the last 25 years (see Figure 1). Today, they

are at attractive levels relative to the last 15 years or so.

Figure 1: Yields on global credit at attractive levels (1)

In the 2000s, prior to the global financial crisis, the average

yield on of the Index ranged between approximately 4 per cent and

6 per cent. (2) During that period credit spreads over

government bond yields tightened to the narrowest they had been.

Spreads remained tight for most of the period from 2004 to 2007,

with the increase in the overall yield during that time stemming

primarily from higher government bond yields.

The global financial crisis in 2008 to 2009 created a sharp spike

higher in spreads, which took investment grade credit yields to

new highs, briefly exceeding 7 per cent, despite underlying

government bond yields falling at the time. The ensuing economic

decline and the extensive economic and market support measures

that governments and central banks implemented, brought about a

rapid decline in spreads and with that, yields. Though spread

levels remained volatile for much of the next decade, yields

trended lower and lower. Yields fell below 2 per cent just prior

to the Covid-19 pandemic, which may have brought the attractions

of global credit into question, but even then, spread levels did

not appear uncomfortably tight as the alternative, yields on

government bonds and cash deposits were close to or in some

cases, below zero.

Yield levels on credit rose sharply in 2021 and 2022 as inflation

took hold and as central banks sought to combat rising prices by

rapidly increasing official interest rates. In a short space of

time, credit yields rose above 5 per cent for the first time

in more than a decade.

Spread levels have also risen in recent months, pushed higher by

an increase in economic uncertainty to a point that is much

closer to what we see is fair value.

Current attractions of global credit: protection and

potential

Higher yields and spreads appeal in two important ways. First,

higher yield levels can provide some form of protection, with

higher ongoing income insulating investors who may be concerned

about the possibility for future capital losses. Second, the

higher yields are, the greater is the potential for them to

decline and generate capital gains.

Markets are in a position where lower yields could come from two

sources: either underlying government bond yields could decline,

as may occur if inflation concerns continue to ease; or credit

spreads could tighten, which may result if economic concerns

dissipate.

Only recently, investors would likely have had to take on greater

risk in high yield markets to have been able to achieve the

levels of yield that investment grade markets currently offer.

They have seen that as an attractive opportunity. Now that

investment grade markets offer attractive yields alongside lower

risk, we believe that global credit will be attractive for many

investors.

Footnotes

1, Source: Insight and Bloomberg. As at 30 April 2025.

Bloomberg Global Agg Credit Index yield to worst.

2, Source for all yield data: Insight and Bloomberg. As at

30 April 2025

Disclaimer

Investment managers are appointed by BNY Mellon Investment

Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management

(Luxembourg) S.A. (BNY MFML) or affiliated fund operating

companies to undertake portfolio management activities in

relation to contracts for products and services entered into by

clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

Important information

For professional clients only. This is a financial promotion.

Any views and opinions are those of the investment manager,

unless otherwise noted. This is not investment research or a

research recommendation for regulatory purposes.