Fund Management

Allfunds' Market Data Illuminates Professional, Retail Investors' Mentality

.jpg)

The gap between the way that professional investors and those on the retail side manage money, treat market changes and policy shifts is dramatically illustrated by figures from Allfunds.

With all the gyrations in markets in recent weeks, a firm with a

finger on the pulse of investor sentiment, so it appears, is

Allfunds.

The fund distribution platform, which originated in Spain, has

been able to break down the flows into and out of funds by

professional investors and the wider public. The difference

between these two cohorts is at times startling.

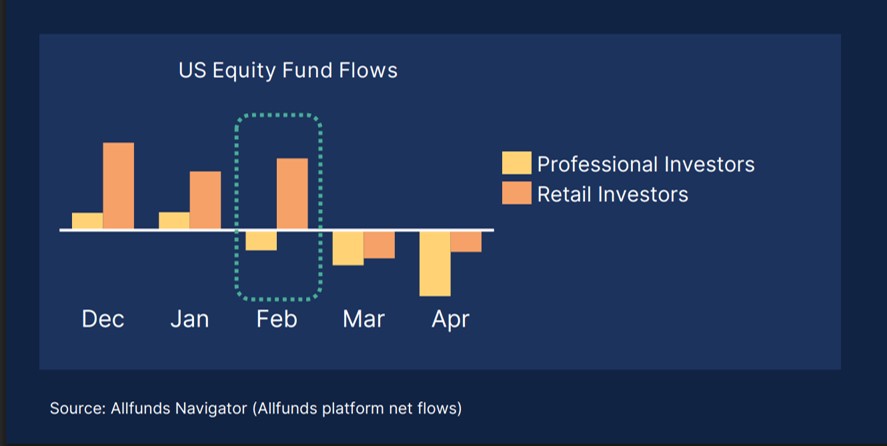

For example, a bar chart of US equity fund flows, starting from

December 2024 – just after the post-US election market

bounce – showed retail investors leading the way, far ahead

of their professional peers in putting money into the market. The

pattern continued in January this year. And then in February,

professional investors started to take their chips off the table,

but the retail investor remained as keen on US funds as ever.

When the reality of tariffs, and disturbances such as China’s

DeepSeek AI offering took hold, both retail and professional

investors retreated. In April, after President Donald Trump’s

“Liberation Day” tariff announcement, the professionals were far

more negative than the retail side.

While this data is not necessarily going to affect investment

behaviour, what is the benefit of having this kind of data that

comes from the direct transactions in the funds market?

A value in this information is that fund managers running a

distribution strategy, for example, have a clearer idea of how to

position their business, Rodolfo Crespo, market insights manager

at Allfunds, told WealthBriefing in a call.

“This [data] says a lot about product strategy,” he said. For

example, Allfunds’ data reveals a considerable amount of inflow

into active exchange-traded funds.

Crucially, all the data that Allfunds compiles is acquired at the

fund buyer level; it does get such information from

estimates.

Data also shows that in April, for example, there were flows to

European equity value flows, as these funds took on a safe-haven

appeal amidst the US tariff fallout.

According to Juan de Palacios, chief product and strategy

officer, “Allfunds Navigator data shows a continuation in the

reduction of exposure to US assets – US equities in particular –

going into Q2. While this rotation first emerged during Q1

amongst institutional fund buyers such us fund-of-funds and

insurers, it has now spanned across retail distribution channels

too, with European-focused strategies being a key beneficiary of

this shift in investor allocations.”

So it appears that the retail and professional investor cohorts

do narrow the gap in their behaviour, albeit after a lag.

Private equity, which had been through a difficult time amidst

the post-pandemic spike to central bank interest rates, is an

investor's darling again: it was the top choice for

alternative investment allocations for most of the world’s

regions in the first quarter of this year.

WealthBriefing also asked Allfunds about the impact of

AI on its business. The firm’s Allfunds Navigator is an AI

powered tool that provides investors with actionable insights

derived from more than €4.5 trillion ($5.14 trillion) of data. In

total, Allfunds has around €1.5 trillion of assets under

administration.

“AI is used in the data collection process allowing for more

efficiencies and reduction of manual procedures, whilst

delivering precise insights making it easier for the user to gain

meaningful data with a seamless customer experience,” the firm

said. “The robust data collection from the AI also allows users

to anticipate shifts and trends in investor behaviour in real

time, making the Allfunds Navigator a game changer for the

industry.”

“Fund houses use it [AI] to uncover hidden distribution opportunities through real-time intelligence, to optimise their sales and distribution strategies, and to boost efficiency in their sales process,” it said.

This week, Allfunds said it had appointed Veronique Uzan as French head. See an interview with the UK side of Allfunds' business, here.