Statistics

Private Client Portfolios Repair Some Damage – ARC

Not all of the damage inflicted in 2022 appears to have been repaired, but rising markets in 2023 have partly erased (some) of the pain.

Recoveries in equity and bond markets during 2023

have partly erased (some) of the pain of the 2022 rout as

far as private client investors are concerned, data this week

from Asset Risk

Consultants showed.

In general, 2023 gains have not fully compensated for the

bloodletting of the previous year, however.

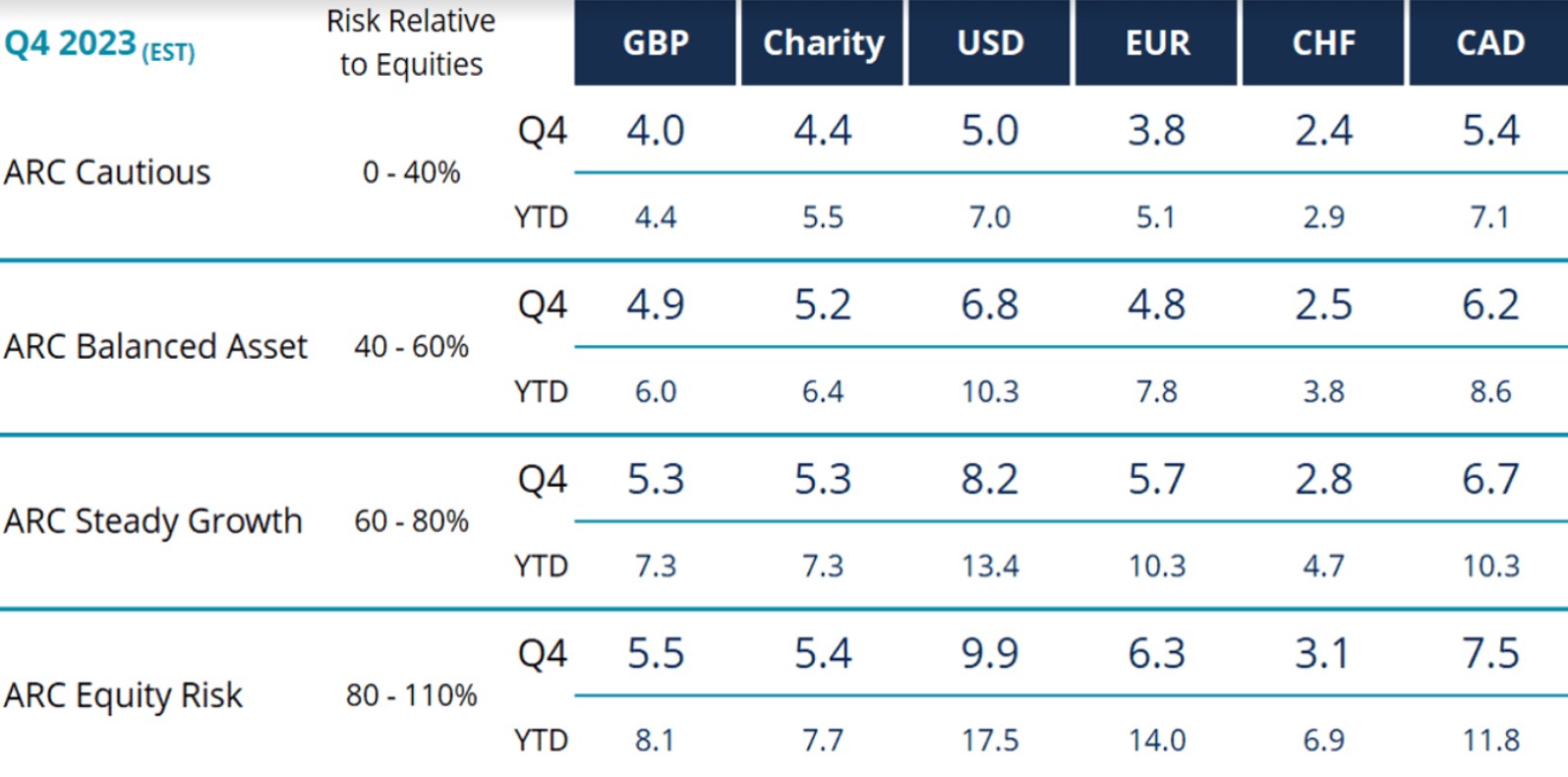

Nominal returns for private client investors were a little above

average, ARC said. The table below sets out the estimated returns

for private client portfolios across the five PCI currencies and

four PCI risk categories.

ARC’s Indices compare performance data from all of the

contributing firms taking account of the risk of the portfolios

and comparing the net of fee outcomes received by investors.

Indices collect performance of more than 350,000 investment

portfolios, net of fees, supplied by more than 140

investment managers to establish the actual returns being seen

by clients. Managers include Barclays Wealth, Brewin

Dolphin, Investec, Rathbones and UBS.

The need for end clients, and their advisors to receive

unconflicted, clear and understandable data on how well firms

perform is not a new requirement. The pitfalls of simply

comparing performance against a market benchmark, or focusing on

whether a portfolio is “top-quartile” or “best-in-class” or some

other metric are well known. That said, comparisons of some kind

are necessary.

This news service interviewed

ARC back in October 2022 about its approach and the importance of

such figures for wealth managers handling tasks such as preparing

for the UK’s new Consumer Duty regime (now in force).

The data shows that in local currency terms, gains were highest

for dollar investors. However, when adjusted for currency moves,

returns for private clients in the same risk category were

similar regardless of reference currency.

“After the painful normalisation of interest rates in 2022, bond

markets seemed to offer reasonable value and, despite tighter

monetary policy and the threat of recession, company profits

proved resilient,” ARC said.

The breadth of equity market gains was “extremely

narrow,” ARC said, noting that the rise in the world equity

market index being driven by the 10 largest US-listed “mega-cap”

stocks (Alphabet, Amazon, Apple, Berkshire Hathaway, Broadcom, JP

Morgan, Meta, Microsoft, Nvidia, and Tesla). In 2023, these

stocks were up, on average, about 90 per cent and up around 85

per cent on a market capitalisation-weighted basis, with the

other 490 stocks making up the S&P 500 on average delivering

a return of zero.

For investors in sectors such as emerging market hedge funds,

meanwhile, recent figures showed that they have enjoyed, on

average, a strong year of gains across most strategies (with a

few notable exceptions). See

here. In October 2022 this

news organisation spoke to Performance

Watcher by IBO, a Swiss organisation, about the demands of

providing trustworthy and unconflicted data on wealth management

portfolios.