Wealth management firms talk often of how digital technology and other approaches can boost advisors’ productivity and ability to find and keep clients, but the annual that track the ebb and flow of HNW wealth and the industry that serves this market.

For the purpose of this report, “high net worth” individuals have at least $1 million of investable assets; affluent persons have at least $250,000. (This news service has remarked on how inflation affects the parameters of what counts as being “rich”.)

Some 67 per cent of relationship manager time is spent on administrative, non-core activities, and 18 per cent of affluent segment investors are satisfied with their wealth management service provider, the report said.

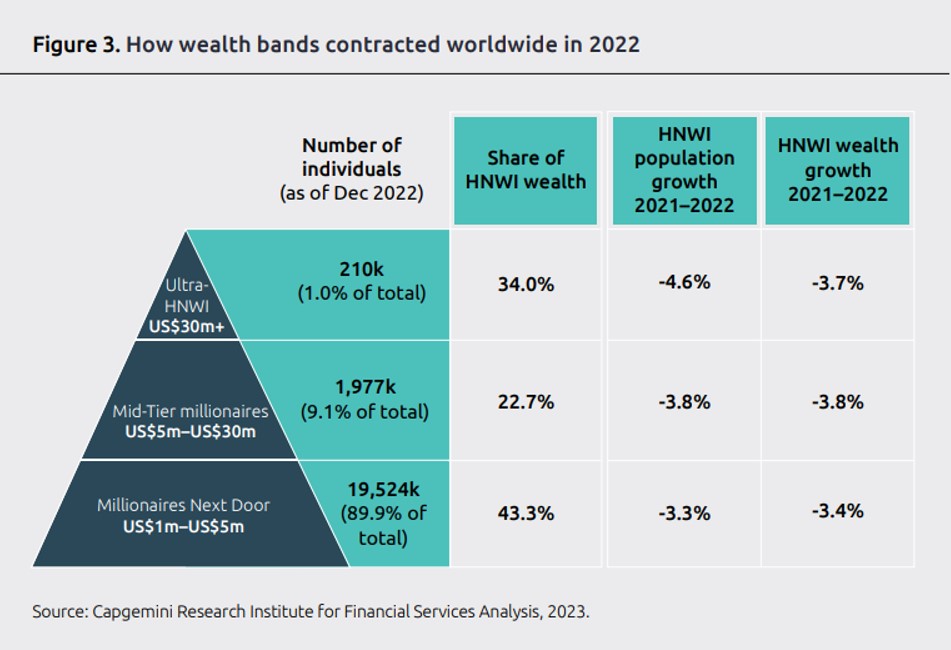

The global HNW individual population dropped by 3.3 per cent to 21.7 million in 2022, while the value of its wealth fell by 3.6 per cent to $83 trillion. According to the report, this marks the steepest drop in 10 years (2013 to 2022) triggered by events such as Russia’s invasion of Ukraine in February 2022, the rises in global interest rates, and concerns over China’s relations with the West, among other factors. In all, the equity market slump cost HNW individuals a total of $3 trillion in 2022. For example, the US S&P 500 Index of equities dropped almost 20 per cent in 2022.

Affluent appeal

The report said that wealth firms must grasp how the affluent segment of individuals outnumbers their HNW peers by 2.5 per cent, and they oversee almost $27 trillion (or 32 per cent of total HNW wealth), representing a big growth opportunity. But wealth firms don’t serve 95 per cent of the affluent segment and 34 per cent don’t plan to do so because they are worried about profitability.

The study said that as HNW populations get squeezed, the affluent segment offers a “unique opportunity to create value” by serving a “highly digitised setup” and concentrating on high digital maturity across the wealth management value chain. They can also build “wealth-as-a-service" capabilities and use retail banks to connect and serve the affluent segment.

Capgemini gave this relatively downbeat prediction and accompanying words of advice in its executive summary: “Wealth management firms will likely face sluggish economic growth, low return potential from many assets, and an evolving competitive landscape for the foreseeable future.” It added: “Careful cost management, new value pools, investment in new technologies and relationship manager productivity, and a recalibration of the customer mix through new segments like the affluent will all be required to enable and sustain long-term growth.”

Elsewhere in the 44-page report, it notes that while HNW individuals remain interested in ESG ideas (see an article that notes some reluctance in certain quarters here), wealth managers need more data on impact to assure clients. Falls in markets during 2022, and the gains in certain energy stocks (such as of firms involved in fossil fuel use) have caused controversy in countries such as the US over whether ESG can be at odds with fiduciary duties. (See an article here.)

Some 41 per cent of HNW survey respondents said investing for ESG impact was a top priority and 63 per cent of them said they had sought ESG scores for their assets. However, not many wealth management firms said they regarded ESG data analysis (52 per cent) and traceability (31 per cent) as a top priority. Of the relationship managers surveyed, 40 per cent said they required more data to understand ESG impact, and nearly one in two said they need more ESG information to engage effectively with clients.

Give firms the tools or they're fired

The report said a lack of digital tools constrains relationship managers from delivering timely financial advice and value-added expertise. It also hurt the bottom line. On average, only one in three executives ranked their firm’s end-to-end digital maturity as “high.” Furthermore, 45 per cent said the cost per relationship manager is rising, driven primarily by wealth value chain inefficiencies.

The report finds that lagging digital readiness and poor omni-channel platforms increased the relationship managers’ time spent on non-core activities, leaving only a third of their time available for pre-sales efforts and client interaction. The strain is being felt on all sides. Some 56 per cent of HNW individual respondents said value-added services influenced what wealth management firm they would choose. Only one in two of them said they were satisfied with their relationship manager’s ability to deliver on what was promised. Strikingly, almost a third (31 per cent) said they’d probably switch providers in the next 12 months.

Wealth management firms must arm relationship managers with an integrated one-stop-shop interface and create a superior client experience if they want more revenues and happier clients. “Wealth management firms are at a critical inflection point as the macro-environment is forcing a shift in mindset and business models to drive sustainable revenue growth. Agility and adaptability are going to be key for high net worth individuals as their attention gears towards wealth preservation,” Nilesh Vaidya, global head of banking and capital markets, Capgemini, said.

Affluent appeal

Capgemini said the affluent segment was a “new frontier” because this population continued to grow in size and financial weight. Regionally, North America (46 per cent) and Asia-Pacific (32 per cent) held the largest share of global affluents in wealth value and population size. Despite holding nearly $27 trillion in assets (almost 32 per cent of total HNW wealth), 34 per cent of firms are not exploring this segment.

Affluents are heavily (71 per cent) interested in seeking wealth advisory services from their banks in the next 12 months.