Client demand for liquidity has come to the fore, while "hyper-personalisation" of service is now a watchword for how wealth management is delivered, according to industry leaders discussing findings of the ’s annual 2020 World Wealth Report, released yesteday.

This news service listened into a panel of speakers (as described here) talk about the annual report, which shows that North America took the global top spot, recording 11 per cent growth, and outpacing Asia for the first time since 2012. Global growth overall grew by almost 9 per cent reaching $74 trillion in 2019. This comes in spite of slowing economies, the UK's Brexit decision, unresolved trade wars, and Latin America and Hong Kong seeing unrest. Sustainability was pegged as a bright spot, and technology flagged as simply too big to ignore.

The report covers 71 countries by market that make up roughly 98 per cent of global gross national income and 99 per cent of world market capitalization, making it a showcase for major global wealth movements for 2019.

Besides broad trends in terms of numbers, the report examined trends such as how digital technology is gaining ground, accelerated rapidly by COVID-19. Firms that were not sufficiently digitalised prior to the pandemic will have struggled to serve clients through it. At base, wealth management is a service industry and there have been signs that some clients aren't happy and have shifted business, Jeremy Balkin, head of Innovation, HSBC, said in the panel discussion. "Services are everything....we are in a services world," he said.

Other parts of yesterday's Live Linkedin presentations running alongside the report discussed matters such as open banking and wealth management models; how established players should work with third-party disruptors to build digital offerings; the need to embrace new ideas on financial planning; managing entrepreneurs' wealth, and the continuing demand for environmental, social and governence (ESG)-themed investment.

"Unless the financial sector quickly catches up with digital capabilities, Big Tech is going to take over....We believe wealth management firms are at the right time to transform themselves...and offer the best experience," Elias Ghanem, global head, market intelligence for financial services at Capgemini, said.

The panellists said that a subject which perhaps understandably arises in a time of financial stress is liquidity. "Access to liquidity is extremely important in this respect," Anna Brugnoli, co-head of wealth planning, UBS, said.

Entering the picture

Although the economic consequences of the health crisis are still too hard to pin down, COVID-19 is part of the narrative. The consultancy firm expects the global economy to shrink by roughly 5 per cent in 2020, and indicated that global wealth is already down by between 6 and 8 per cent up to April 2020 compared with April 2019.

The report echoes warnings put out by the in its 2020 industry report that the pandemic, in all its impact, is a wakeup call for wealth management to put high-touch models in place and not to delay making tough decisions. Both reports have shown how resilient wealth growth has been globally while industry profits have stalled. BCG put profits at $135 billion in 2019 - little change from a decade ago.

By region

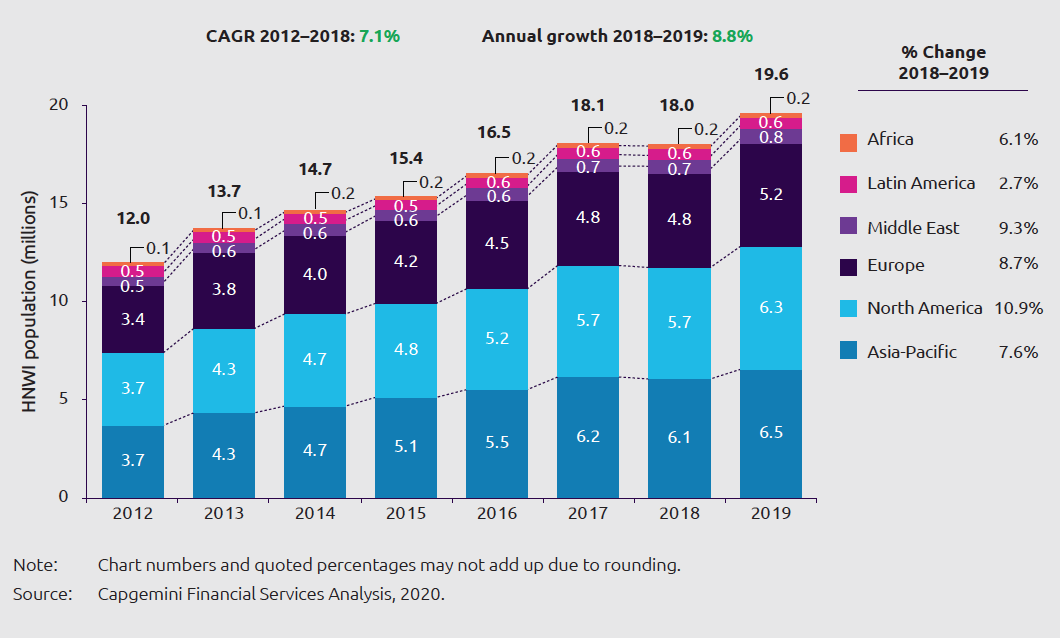

In the wealth picture regionally this year, Capgemini found developed markets again leading on growth. North America's 11 per cent hike (adding $2.2 trillion) was far stronger than the 1 per cent it registered in the consultancy firm's 2018 reckoning. Growth breakdown by region is shown here:

Europe outperformed Asia-Pacific and Latin America, growing its HNW population by almost 9 per cent. The Middle East registered the second highest HNW growth jumping to $2 trillion in assets shared between 800,000 individuals. And, in spite of Brexit, the UK also performed well, growing its population of HNWs and wealth by more than 6 per cent for the year.

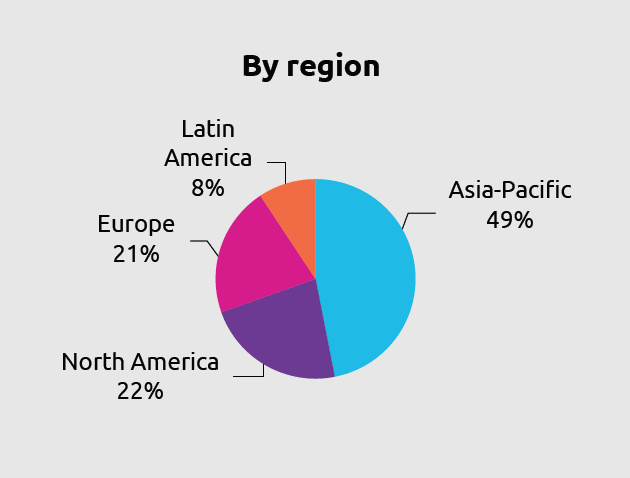

Even with strong individual performances from certain Asian countries, APAC fell behind the overall 9 per cent global average, expanding by 8 per cent. But it dominates as a region with roughly half of global wealth. See chart.

Regional standouts were Hong Kong, China, and Taiwan, all seeing double-digit HNW population and wealth growth; this was somewhat reflected in China’s CSI 300 stock index performance and the government's strong commitment to Chinese domestic growth. (High net worth is defined by assets of $1 million or more.)

Wealth was also more evenly distributed this year between the upper, middle, and lower-tier wealth bands. In 2019, the population of ultra-wealthy, those defined by assets of $30 million or more, grew but the asset pool did not. The report suggested that this higher band tends to invest beyond equity markets which can be unstable in uncertain times. Their bias towards owning local stocks may also have constrained their wealth growth.

Numbers for India, South Korea, and the wealth hub of Singapore were all down on the previous year, based on weaker currencies and economies.

Generally 2019 was a good year for wealth managers

North America shone for the sector, with the region accounting for more than a third of global HNWI population and wealth gains worth $22 trillion. With measures pre-dating COVID-19, the report highlighted a strong Q4 for US equities and a September boost when the Fed pumped billions into the system. Tech also generated market optimism and US wellbeing, with Microsoft and Apple accounting for nearly 15 per cent of S&P gains.

Also a factor is the growing sustainability story and its value-add for wealth managers. HNWs across the board are now paying attention to environmental risks, giving firms “a high-potential product opportunity,” the report said. For ultra-HNWIs in particular, 40 per cent of this group wants to pour cash into sustainable funds.

And wealth managers are ready. “Firms have recognised the trend and are prepared to meet the demand – 80 per cent now offer SI options,” the report said.

Calling socially responsible investing “a rare bright spot in 2020,” the report found investors still expecting financial value. Just a quarter cited a desire to give back to society as s reason for investing sustainably, while 40 per cent expected higher returns for doing so.

Top countries

The US, Japan, Germany, China and France retained their top-five ranking has home to the highest populations of HNWIs in 2019, with the top four impressively responsible for just over two thirds of global HNW population growth. How the top-25 rank is shown here:

In the world's leading HNW markets, the report singled out Sweden for gaining more than 10 per cent HNWI growth, up to 23rd place, and the Netherlands, a beneficiary of Brexit fragmentation, moving into the top 10. Notable in Asia, Indonesia, often described as the next Asian wealth powerhouse, dropped two places, while Thailand moved up two. Switzerland remained 7th but recorded the largest growth in HNWs for the year at 14 per cent.

A caution to wealth managers

Fee complaints are not going away. This year's report found HNWs increasingly critical of fees, with a third unhappy with what they paid in 2019. Given business and market uncertainty, this is likely to get worse and eat into client retention.

One in five HNWIs are considering switching firms in the next year because of dissatisfaction over fees, the report found. Most want to pay on performance and service not on assets.

If managers haven't reacted already, digital capabilities have become critical for the ultra-wealthy who want hyper-personalised offerings powered by AI, analytics and other technologies. Capgemini put most emphasis on managers providing:

Bespoke risk profiles – leveraging behaviour sciences and sentiment analysis to interpret clients’ risk profiles

Personalised portfolio construction and tailored advice – data analytics and machine learning to create customised portfolios, assess client behaviour to provide tailored advice

Customised client reporting – use APIs and multiple data sources to create a comprehensive view of client investments.

The biggest investor complaints pre-COVID were poor experiences accessing information about new wealth offerings or general market information. HNWs aged 50-59 were the most dissatisfied with accessing value-added services.

The report stresses the value that clients are placing on experience. More than 40 per cent of HNWs told the consutlancy that good experiences profoundly affect their overall impression of a firm, which will only increase as a result of COVID-19.

Big tech encroaching

This has become a looming red flag. As big tech entities gain ground in financial services, “wealth management firms have little choice but to enhance digital customer engagement, and quickly,” the report said.

HNWs now see big techs as capable of outperforming incumbents on both information access and value-added services. Three-quarters of HNWs are now willing to consider big tech offerings, and 94 per cent among those are contemplating switching their primary wealth management firm in the next 12 months. This sentiment was strongest among the wealthy living in Latin America and Asia-Pacific (excluding Japan). The under-40 wealthy were not surprisingly the most inclined.

“In the face of today’s extraordinary uncertainty, firms must build resilient and agile business and operating models,” said Anirban Bose, CEO of financial services and strategic business at Capgemini.

“This unpredictable period may also present opportunities to reach underserved or new investors, as demand for advice tends to increase during periods of market turbulence and the strategic case for sustainable investment advances,” he said.

The report advised that firms need a two-pronged strategy based on Open X principles that will allow wealth managers to quickly and cost-effectively improve capabilities across the value chain. This involves investing in tech to build in-house services and collaborating with wealthtech partners for other capabilities.

“Wealth managers need to use events in 2020 to determine which critical capabilities have the biggest potential to boost profit and improve customer experience,” Bose added.