Fund Management

Where Investment Alpha Is Lost And Found

This article identifies factors most commonly associated with alpha generation and destruction by equity fund managers. It gets to the heart of the debate about how or whether active fund management can add value, and if it is worth the money.

The end of a decade-long bull market in equities, followed by

this year’s coronavirus-induced declines, is an auspicious time

to review a long-standing quest: where do above-market returns –

“alpha” – come from? How can managers find consistent ways to

achieve superior returns? A firm that takes a look at this is

Essentia

Analytics and we have a guest op-ed article from Chris

Woodcock, who leads the research and product teams. This news

service also recently spoke to Woodcock’s colleague, Clare Flynn

Levy, the chief executive, who explained why Woodcock’s insights

are so important: “Every fund manager has behavioural patterns

related to whether they generate alpha or not. If you don’t look

at these, you are at a disadvantage. There are patterns and it is

possible to identify them.”

WealthBriefing is pleased to share these insights and invite

responses. The usual editorial disclaimers apply, and readers are

welcome to jump into debate. Email tom.burroughes@wealthbriefing.com

and jackie.bennion@clearviewpublishing.com

Managers who generate enough alpha to beat the returns of low-fee

index funds by more than their own fees demonstrate that active

fund management can - and does, in these circumstances -

represent a better value than passive index investing.

But like the holy grail, alpha is elusive. It is difficult to

generate in the first place, and even more challenging to

reliably replicate. In fact, while it’s easy to measure a

portfolio’s overall alpha, no one has systematically identified

where in the manager’s decision-making process that alpha is

actually originating.

The source of alpha - the single most important determinant of

successful active portfolio management - has been shrouded in

mystery.

Until now.

The Essentia research team has concluded a three-month

examination of the origins of portfolio alpha - where in the

myriad decisions made and actions taken by portfolio managers it

tends to be generated or destroyed.

Our results were twofold. First, we found very few common sources

of alpha across portfolios. With a handful of exceptions - which

we’ll discuss below - most portfolios have their own unique

fingerprint of what leads to the alpha they create (or lose).

Second, and most importantly: in 100 per cent of the portfolios

we studied, we identified at least one factor - or 'categorizer',

in our terminology - that significantly impacted alpha, for

better or for worse. This has profound implications for all

active portfolio managers. Our work shows that it is possible for

managers to identify where in their decision-making process they

tend to create or destroy alpha - and once that is known, the

door is open for them to expand or enhance what adds alpha, and

correct what diminishes it.

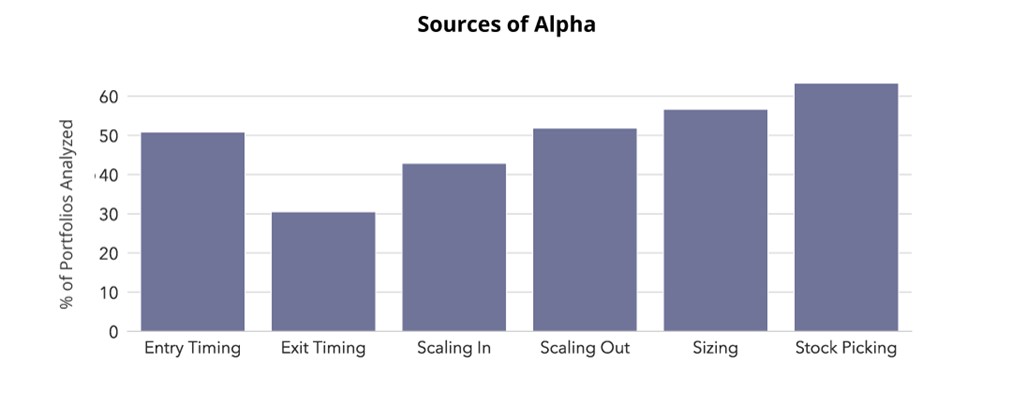

Our study analysed 60 portfolios over 14 years and identified

distinct areas of manager decision-making directly tied to the

alpha generated (or lost) within each portfolio. We tracked 24

categorizers - ranging from equity sector to holding period to

decision day of the week - across six broad investment decision

categories, or skills: stock picking, size adjusting, entry

timing, exit timing, scaling in and scaling out.

Sources of alpha were found in varying degrees across six key investment skills among the portfolios we analysed. This chart shows the percentage of the portfolios in our study that contained at least one significant factor within a given skill.

In all 60 portfolios we analysed, we found at least one factor

that was significantly associated with the generation of alpha.

Very few of those were common across the portfolios, but we did

find that for a majority of managers (63 per cent), alpha was

associated with at least one factor within stock picking, most

notably:

-- Conviction level: A significant number of managers

demonstrated skill in picking stocks where they had strong

conviction: namely, those in their top quintile of positions by

maximum money invested. By contrast, a significant number of

managers showed negative skill in the middle quintile of

positions on this metric. This reinforces what we see in managers

every day: positions that are neither proactively large nor small

often lead to alpha destruction - it’s a common “alpha leak.” In

our analysis, these lower-conviction stock picks tended to

destroy alpha at an average rate of 2.1 per cent per investment.

-- Exit price momentum: For 37 per cent of managers in our

sample, exit price momentum was strongly correlated with stock

picking alpha. On average, we found that exiting stocks into

negative momentum (a falling price, for a long position, or a

rising price, for a short position) destroyed 6.2 per cent of

alpha at the portfolio level, per investment. In contrast, stocks

exited into positive momentum added 5.1 per cent of alpha at the

portfolio level before the manager closed the position. So these

managers had a marked tendency to finish a profitable episode on

a high note, and an unprofitable one on a low note.

-- Open vs. closed positions: Portfolios often showed a

stark difference between alpha generated by stock picking

decisions in open positions vs closed ones: on average, we found

that open positions were contributing 13 per cent of alpha at the

portfolio level at the time of the analysis - while closed

positions had generated -4.7 per cent of alpha. While more

investigation is required to interpret this result, we find this

particularly interesting in light of our work into the lifecycle

of alpha: in some managers it may be evidence of the “round

tripper” effect (in which managers hold their stocks too long and

sell only after all alpha has been exhausted) we identified in

that research. (Alternatively, in others, it could be a

successful inversion of the disposition effect.)

-- Holding period: For a subset of portfolios (20 per cent),

holding period was an important variable in alpha generation. On

average, these fund managers pick stocks that rise by 7.5 per

cent in their longest-held quintile of positions. This far

outperforms other holding period quintiles, which all had

negative average returns. Except, that is, for the very

shortest-held 20 per cent of positions, where picks generated 1.7

per cent of alpha! Again, there are several possible

interpretations of these results. That middle 60 per cent of

positions, for instance, may simply represent the positions that

didn’t work out; an acceptable cost of business. Our experience,

however, tells us that this middle ground is a source of lost

alpha, and that more often than not, managers had the opportunity

to take remedial action sooner.

Our hypothesis going into this project was that we were going to

find a short list of “alpha leaks” that active managers in

general tend to suffer. But that wasn’t the case. We found,

instead, a wide array of factors that affect alpha both

positively and negatively, and very little consistency across the

portfolios.

But we were able to identify sources of alpha generation and/or

destruction in all portfolios - within a set of factors that are

consistent, identifiable and measurable in every case. We think

these are incredibly encouraging findings for active managers;

once identified in their own portfolio, these can be corrected

and optimised, with potentially significant benefits to their

returns.

About the author

Chris Woodcock leads the research and product teams for Essentia

Analytics. Prior to joining Essentia, Chris was a technology

analyst at GAM Investment Management and a hedge fund analyst at

GAM Multi Manager in London. Before his career in financial

services, Chris was a professional footballer with Newcastle

United.