Strategy

When Fraud Detection Fails: How Banks Must Rebuild Trust In Payments Infrastructure

There’s a saying that it is hard to put a broken vase together after it has been damaged, and reputations for trust and efficiency can suffer hard-to-fix reputational damage. But there are ways to handle the task, the author of this article says.

The following commentary, which speaks to concerns about cybersecurity, fraud and other problems that banks and wealth managers face, comes from Roman Eloshvili (pictured below), who is founder of XData Group, a business-to-business development company, focused on the European sector.

Roman Eloshvili

Recently, it was reported that German banks froze over

€10 billion in PayPal payments amid suspected fraud triggered by

failures in PayPal’s own detection systems. So, when fraud

detection fails, how can banks rebuild trust in their payment

infrastructure?

The editors are pleased to share these views; the usual editorial

disclaimers apply to views of guest writers. To comment, email

tom.burroughes@wealthbriefing.com

and amanda.cheesley@clearviewpublishing.com

In our society filled with hacks, phishing schemes, DDoS attacks,

and relentless fraud attempts, we can’t just depend on automation

anymore. Sure, smarter KYC processes help, but let’s be real:

payments are more than just machines communicating with each

other – they’re about people putting their trust in other

people. And when a false flag locks a customer out, it’s not the

protocol that keeps them loyal; it’s how the bank treats them at

that moment.

Fraud alerts will always need to be quick, but speed without a

touch of empathy can feel cold. Sometimes, the real chance to

shine during a crisis is to genuinely show that you care, not

just that your system is functioning properly.

Transparency and collaboration: A mutual

contract

Trusting that money is secure – whether it’s in banks,

fintech, or the entire financial system – isn’t something

you can just demand. It’s something you must earn, and that

process can be slow and, at times, quite painful. When negligence

creeps in, it leads to frustration. And once that frustration

takes hold, companies begin to lose their grip on clients

– gradually, but inevitably.

From my perspective, this is a bit of a taboo topic. Very few of

us are comfortable admitting that silence can be far more

frightening than receiving bad news. Stepping away from the theme

of fraud detection, in everyday life, a quick and coordinated

response – even if it’s not flawless – can provide

relief and help maintain trust. Ultimately, transparency is the

foundation of any healthy relationship, whether it’s with your

customers, partners, or even your own employees.

The deluge

I can still picture late August 2025. German banks suddenly hit

the brakes on over €10 billion ($11,755) in payments linked to

PayPal after a wave of “suspicious” debits came through. On the

surface, it seemed like just another blip. But if you were even

slightly connected to the industry, you could feel the tremors

– trust was shaken.

Payments are meant to be the reliable backbone of fintech. When

that foundation wobbles, no amount of carefully crafted apologies

are going to fix it. I know a few people who found

themselves in the thick of it, and what they shared wasn’t just

frustration with the technology – it was a deep sense of

disappointment. That incident made me rethink the fundamentals:

how we assess risk, how we build solid partnerships, and how we

safeguard customers without stifling them. These concens go

beyond just fixing code; they’re all about maintaining

credibility.

AI-powered anomaly detection: From reactive to

proactive

Take Feedzai’s collaboration with UK banks as a prime example:

their machine learning tools are revealing patterns that human

analysts might overlook. Sometimes, all it takes is a simple

phone call, a clear explanation, or even just saying, “We messed

up.” That touch of humanity can make all the difference between

losing a client for good or keeping them around for another

decade.

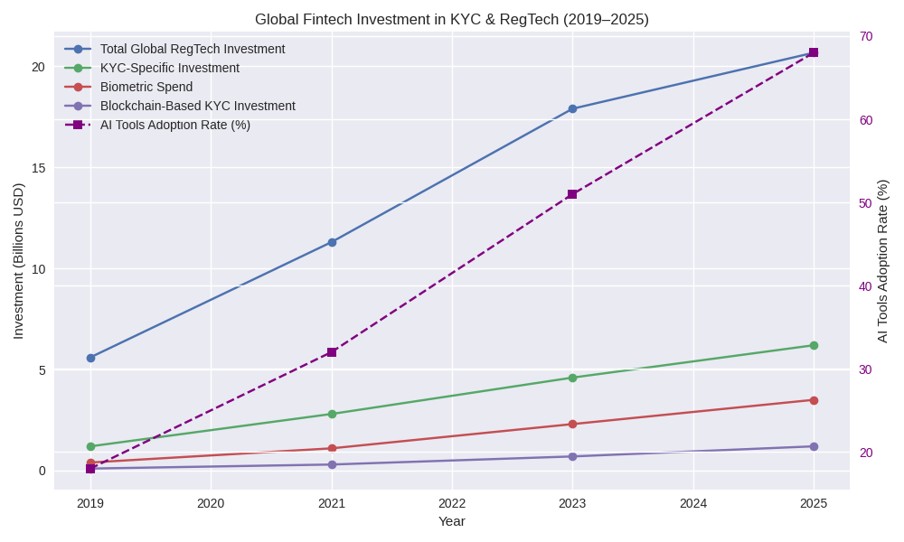

Chart 1. KYC is no longer a checkbox – it’s a capital priority. As AI, biometrics, and blockchain reshape compliance, fintechs are pouring billions into smarter, faster, and more resilient identity infrastructure. Source: https://kpmg.com/xx/en/what-we-do/industries/financial-services/pulse-of-fintech.html)

Oversight: Internal and external

I’ve never really been on board with outsourcing compliance. It

tends to stretch accountability thin and leaves regulators

peering into confusing black boxes. So, what’s a better way? It’s

all about finding the right balance between innovation and

resilience. Take a look at the UK’s Department for Work and

Pensions – they set a great example in 2023. They managed to

block £1 billion ($1.35 billion) in incorrect Universal Credit

payments before any money was disbursed. That’s being proactive,

not just reactive.

Far too often, banks only step in after things have gone south.

But real trust is built by preventing those messes from happening

in the first place.

The risk of overcompliance

Fraud doesn’t typically make a grand entrance. What we usually

see is its quiet slippage through side doors and even through

those little cracks in the wall that you might have overlooked.

That’s why relying on just one, even the most

popular tool such as SAS Fraud Management or FICO

Falcon, isn’t enough. You need a whole arsenal: behaviour checks,

device fingerprints, velocity limits, biometrics – each one

needs to be tested individually.

This isn’t just a theory. According to UK Finance, banks managed

to prevent £1.25 billion in unauthorised fraud in 2023

– that’s about 64 pence saved for every £1 that was

attempted. That’s how layered defences are supposed to work.

But here’s the catch: fraudsters are always evolving. If our

defences don’t keep up, they’ll eventually find a way to outsmart

us.

Towards a resilient payments future

The PayPal freeze wasn’t a one-off. In January 2025, the US

Consumer Financial Protection Bureau hit Block (more precisely, a

famous Jack Dorsey’s Cash App) with $175 million in fines for

weak fraud controls. In India, regulators repeatedly flagged

Paytm and UPI apps for loose KYC, sometimes forcing temporary

shutdowns. All these cases keep bothering me more. Although I

can’t provide any straightforward unambiguous remedy at this

point, I offer to open a broader discussion on how to effectively

implement preventive fraud detection without compromising trust.