Asset Management

When, Where And How Investors Should "Go Active"

.jpg)

At what point and in what fashion should investors go for a more active approach to handling their assets? The author of this article examines a never-ending debate that rolls on in wealth management.

Almost like the passing of the seasons, a change in market conditions appears to shift the amount of noise behind the case for or against “active” versus “passive” investing (even though many practitioners dislike the word “passive”, full stop). With markets having turned more volatile after a bull run in equities that has lasted the best part of a decade, the thinking appears to be that the time to reconsider the case for active investing is at hand. But such considerations are never simple. In this article, Lori M Heinel, deputy global chief investment officer, State Street Global Advisors, considers the terrain.

The editors of this publication are happy to share these

thoughts; they don’t necessarily share views of guest

contributors and invite readers to respond. Email tom.burroughes@wealthbriefing.com

Without a doubt, much of the past decade has been challenging for active managers. Since the financial crisis, historically low interest rates and policy-fueled liquidity have sent equity market indices ever higher, pushing correlations across asset classes up (see Figure 1) and pulling dispersion and volatility down. Widespread gains in nearly all sectors have made it difficult for active managers to outperform the markets.

Despite these challenges, we think that reports of active management’s demise have been greatly exaggerated. Actively managed assets still dwarf index strategies and exchange-traded funds (ETFs) by nearly three to one, and for every dollar flowing from active into passive, $2.5 move between active managers. (1 - see footnote below.)

As more assets flow into index and ETF strategies, there may be more market mis-pricings for active managers to exploit. And as we move away from extraordinary monetary accommodation, lower correlations are likely to create more conducive market conditions for active managers.

But regardless of the prevailing macro environment, we believe that skilled active managers can identify pockets of opportunity from three distinct vantage points: asset class, investment process and asset allocation.

Go active in more inefficient and less liquid asset

classes

Some asset classes or markets provide opportunities for active

management because of their inherent inefficiencies. For example,

fewer analysts cover small cap and emerging market companies,

leading to information asymmetries. Research on smaller firms was

already curtailed by Markets in Financial Instruments Directive I

(MiFID I) in 2007 and will be further constrained by the rollout

of MiFID II this year. (2 - see footnote below.) These

markets also tend to be less liquid, with trading constraints and

higher transaction costs resulting in more frequent mis-pricings.

Managers looking for alpha-rich hunting grounds could also consider the degree of return dispersion between the best and worst performers, and the share of retail investors participating in the market, as their investment flows tend to be more variable.

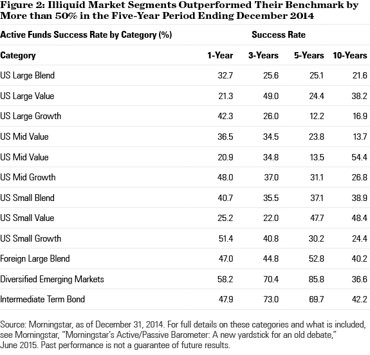

We can assess which markets have been better places for active

management by looking at Morningstar’s Active/Passive Barometer,

which compares the annual performance of active US mutual funds

with their passive counterparts (see Figure 2). According to this

analysis, over 50% of active emerging markets equity,

intermediate-term bond and international equity funds

outperformed their respective indices during the five-year period

through December 2014.

Focus on processes with high conviction, breadth and risk

mitigation

While every active manager claims to have a unique investment

process, not every process will be able to generate sustainable

alpha. Let’s consider three important characteristics to look for

when evaluating active managers:

Conviction. Markets tend to undervalue a company’s ability to deliver persistent earnings growth. Active managers with conviction in their insights into future growth prospects could extend their time horizons to exploit these mis-pricings in the markets. By incorporating growth and value opportunities overlooked by the markets, such high-conviction managers can build portfolios with high active share relative to their benchmarks.

Breadth. For active quantitative managers in particular, a systematic process with substantial breadth can be an advantage. Their stock-selection models have identified certain attributes that tend to enhance return and minimize risk, and these managers are able to sift through broad universes to find securities that display exactly those characteristics.

Risk Mitigation. In the later stages of equity bull markets, active managers can take a more selective approach, helping them to avoid securities or sectors at lofty valuations that may be more prone to mean reversion. Other ways that active managers can mitigate risk in their equity portfolios include trimming allocations to highly volatile stocks and increasing exposures to more defensive kinds of securities.

Allocate assets using tactical overlays and factor

efficiencies

Going active at the asset allocation level may help investors

boost performance, manage risk better and improve the overall

capital efficiency of their portfolios. Tactical overlays, for

example, can target incremental return while reducing drawdown

risk. And looking through a factor lens at allocations to active

managers could show investors which managers have generated

security-specific risk - separating them from others who

have only provided the kind of factor risk that could be obtained

from less costly smart beta approaches.

As we see it, "active vs. passive" is a false dichotomy. In a

muted return environment, we believe investors need both active

and index strategies to achieve their goals. Using this framework

may help investors identify when, where and how active management

can add more value to their portfolios.

Footnotes:

1,Source: Morgan Stanley Research, Oliver Wyman Blue Paper,

"The World Turned Upside Down," March 2017.

2 Financial Times, “MiFID II Caution Hits Small Business

Research” by Owen Walker, January 21, 2018. The Markets in

Financial Instruments Directive (MiFID) is the European Union

(EU) legislation that regulates firms who provide services to

clients linked to shares, bonds, units in collective investment

schemes and derivatives, and the venues where those instruments

are traded.

About the author

Lori is deputy global chief investment officer for State

Street Global Advisors. Prior to this role, she was chief

portfolio strategist, leading a team of professionals responsible

for helping advisors,. Before joining State Street Global

Advisors, Lori was chief investment strategist and head of

investment products for OppenheimerFunds. She has also worked at

Citi Private Bank and SEI Investments.