Statistics

Wealth Growth Far Outpaced UK Earnings Over Past 10 Years

The claim that wealth – either in financial securities, investments, or in the form of physical property – has risen much faster than earnings is not a new one. New figures in the UK show how large the gap in growth has been. Whether that persists if rates continue to rise is another matter.

If wealth managers want to be reminded why their industry

sometimes attracts unwelcome political attention – not

necessarily with any justice – UK figures from

Handelsbanken Wealth & Asset Management will do the

trick.

The firm has crunched data and found that the growth in average

wealth from assets including property and investments has been

three times higher than the growth in average earnings over the

past decade. It compared the period 2008 to 2010

with 2018 to 2020.

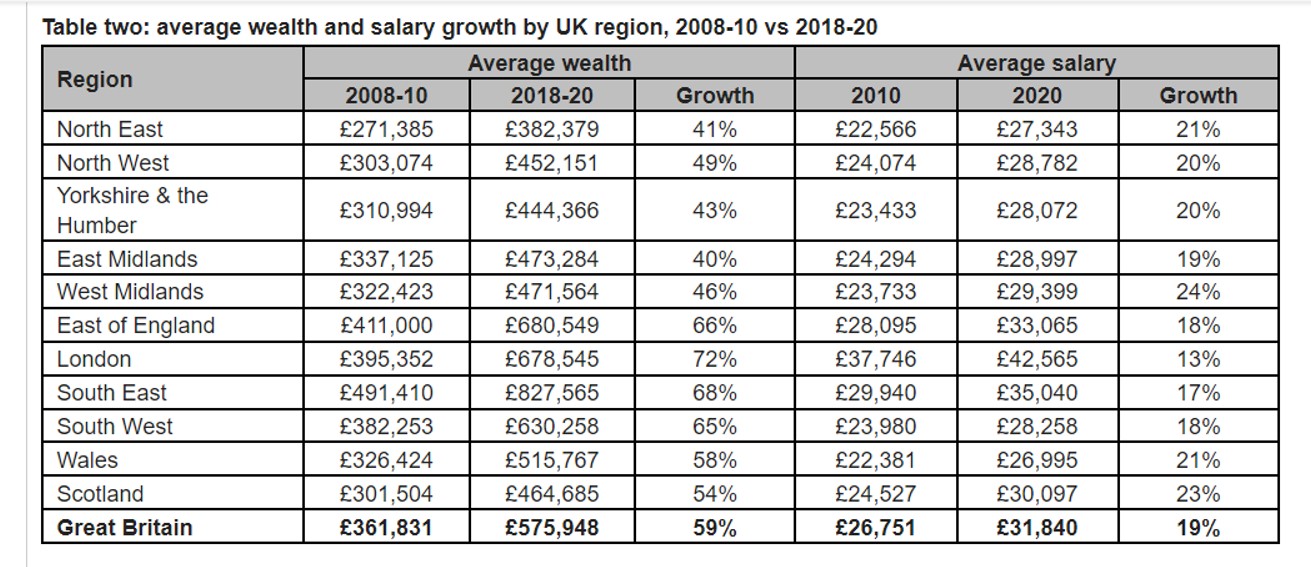

Average wealth has risen 59 per cent over the past 10 years, far

outstripping the 19 per cent salary growth level over the same

period. (Of course, it is important to point out that wealth,

such as in the form of listed securities, physical property and

stakes in companies, is not to be conflated with earnings.)

Drawing on official UK statistics, the bank noted that average

wealth for Britons is estimated at £575,948 ($686,368) after a

decade of growth from £361,831, with house price rises as well as

pensions, investments and physical wealth including possessions

all appreciating in value since 2010. By contrast, average

earnings have only increased to £31,840.

Such figures also highlight why so many more Britons – often to

their alarm – have been dragged into the inheritance tax bracket

(the IHT threshold is £325,000) because of surging property and

equity valuations. (The average UK house price is £278,000 – such

a figure covers a wide variation.) Rising asset values, fueled by

a decade of ultra-low central bank interest rates, have put

housing out of reach of millions of younger adults, setting up

inter-generational political conflicts and frustrations. French

academic Thomas Piketty in 2013 published Capital In the 21st

Century, which claimed that the average return on capital

exceeds the rate of economic growth and that without active

government measures, such as capital taxes, a small number of

asset owners will control an entire economy and prompt political

pushback. Piketty’s argument is debatable because, critics say,

he ignores investment risks, diminishing returns on invested

capital, break-ups of family wealth, and the fact that much of

the recent trend has been caused by governments not capitalism

per se (central bank quantitative easing, etc).

The data

For the wealthiest upper quartile of the population, the growth

in assets has been rapid. This cohort of the population owns

wealth estimated at £733,800 compared with £447,900 a decade ago.

They have seen their wealth increase 34 per cent faster than the

British average, while their salaries have increased 22 per cent

faster.

The figures show that the pattern of wealth holdings is uneven

across the UK. The wealthiest people in London have seen their

wealth grow by 77 per cent over the period to an average

£902,400, compared with £495,200 in 2010. The top 25 per cent

wealthiest in the North East have only seen growth of 30 per cent

during the same period, taking them to an average £459,500, which

equates to an increase of £105,300. Growth among the top quartile

of wealthiest people in the South East was 77 per cent during the

same period, compared with 69 per cent in the East of England and

66 per cent in the South and Wales. The North West saw growth of

45 per cent.

The figures:

Source: Handelsbanken Wealth & Asset Management