Alt Investments

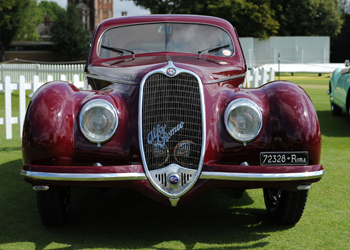

Vroom! Car Owners Using Their Machines For Loan Deals; Mixed Picture In Classic Car Market

Tapping into recent strong price growth in the classic car market, the UK asset-backed lender Borro argues that owners of Ferraris, Aston Martins and other gleaming beasts of the highway are being used successfully as collateral for loans.

Tapping into recent strong price growth in the classic car

market, the UK asset-backed lender Borro argues that owners of

Ferraris, Aston Martins and other gleaming beasts of the highway

are being used successfully as collateral for loans.

The UK firm, launched in 2008, gives the example of one car owner

who borrowed £140,000 ($224,900) against a Ferrari GTB 4, while

another car enthusiast borrowed £50,000 against a Bentley

Continental S3. Another example is that of how a person used an

Aston Martin Vanquish to secure a £137,000 loan.

“In the case of the supercars we see, the clients who come to us

with these types of high-performance vehicles often own another

car for everyday use, whilst their supercar is kept in storage so

it makes sense to use it as security for a loan,” Paul Aiken,

founder and chief executive of Borro, said.

The phenomenon of using such items as collateral is an example of

the kind of specialist lending that has developed in countries

such as the UK in recent years, sometimes dubbed as part of the

“shadow banking” system and sometimes, rather more luridly, as a

form of “posh pawn” (a play on the word pawnbroker). With gold,

jewellery, classic cars, fine wine and art getting a boost as

safe-haven assets amid economic uncertainties, the market has

developed. (For a related article on the issue, click here.) In Borro’s case, it provides loans of up to

£1,200,000 against assets including fine art, antiques, prestige

cars, luxury watches, diamond jewellery, gold, yachts, fine wine

other high-value assets.

As for trends in the class car market itself, prices for certain

marques have shown a mixed trend recently, says Historic

Automobile Group International, or HAGI, a UK-based firm tracking

the sector. Its HAGI Top benchmark Index for rare classic cars

rose 2.50 points (0.96 per cent) to a price of 263.53, reaching a

new all time high. Third-quarter performance stands,

year-to-date, at a gain of 12.12 per cent, which is less than

half of last year's gain through September.

Positive moves came from the HAGI P Index (classic Porsche)

advancing another (3.64 per cent with gains of 24.15 per cent for

the year so far and the HAGI F (classic Ferrari) gaining 2.82 per

cent for the month alone.

An issue for the classic car market, along with other luxury/rare items, is one of forgery. TÜV Rheinland Group, a testing firm based in Germany, that carries out tests on so-called “classic” cars that in fact might turn out to be replicas. According to a recent Bloomberg report the problem of such forgeries is growing, fuelled by the kind of eye-popping prices some of these cars can fetch.

In a separate announcement this week, Borro said it has reached the lending milestone of £100 million in funded loans to individuals and small businesses. The firm said its lending has achieved consistent 90 per cent growth in each of the last four years. As a result of average loan values increasing to £15,000 from £7,000 this time last year Borro has decided to discontinue loans of less than £3,000. The business also continues to see a huge demand for its services from the self-employed and SMEs who currently represent 65 per cent of its loan book.