Market Research

UK-Booked Assets Hit Record High In 2016 - Report

A new report shows that overseas investors took advantage of the UK's weaker currency following its vote to divorce the European Union in June 2016.

Assets on UK fund managers’ books reached a record £8.1 trillion

($11.5 trillion) in 2016, as overseas investors took advantage of

a weakened sterling following the Brexit referendum, new data

shows.

The data revealed that over a third (37 per cent) of funds

under management – a record £2.6 trillion - in the UK were

managed on behalf of overseas clients, making the nation a global

leader by this measure.

UK-based fund managers contributed £3.3 billion to the country’s

economy in 2016, employed 52,000 people and formed a “critical

part” of the wider UK business ecosystem in areas such as

pensions, insurance and business investment, the report, compiled

by TheCityUK, a

financial services lobby group, stated.

“The UK government is not taking the success of the industry for

granted and has given an explicit long-term commitment to the

fund management sector through its investment management strategy

in 2013, which was upgraded… in December 2017,” the report

stated. The new strategy focuses on tax, skills and innovation in

fund management, among other areas.

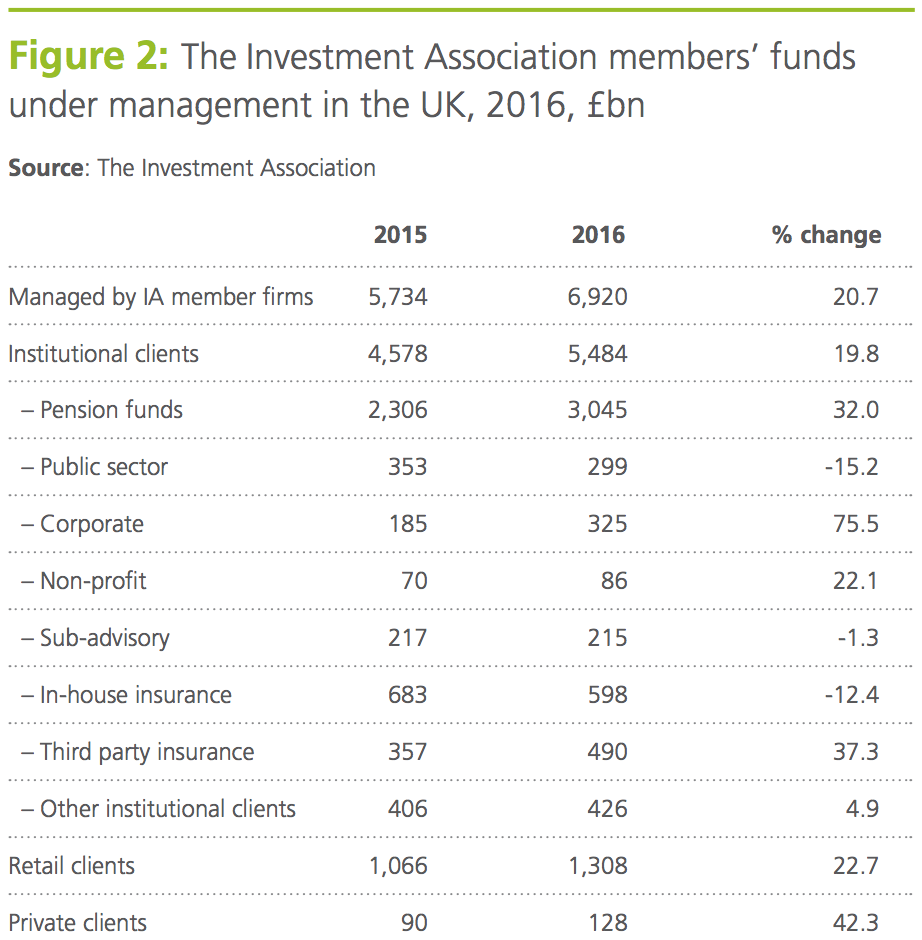

Institutional assets under management dominated the UK market in

2016, as they accounted for around two-thirds of the total

figure. In comparison, private clients’ assets totalled £607

billion and retail equivalents £1.3 trillion. Alternative funds,

including hedge funds, property funds, private equity funds and

sovereign wealth funds, oversaw £1 trillion in assets.

London was “essential” to the UK’s strong international position,

the report said, as funds headquartered in the capital city

accounted for over two-thirds of the total figure. Outside

London, major asset management hubs included Aberdeen, Edinburgh,

Glasgow, Birmingham, Bristol, Cambridge, Liverpool, Manchester

and Oxford, the report said.

The UK was the fifth-largest fund domicile in Europe, according

to the report, accounting for 10.4 per cent of European assets

under management. Luxembourg took the largest share (26.2 per

cent), followed by Ireland (14.7 per cent), France (13.3 per

cent) and Germany (12.6 per cent).