Statistics

UK Investors Cut US Equity Exposure Amid Protectionism Worries

Lloyds Private Bank released its investor sentiment index for April, and it seems the trade row between China and the US is souring the mood of UK investors.

US investors have turned more downbeat on US equities because of

worries about rising protectionism noises between the US and

China. A Lloyds Private

Bank measure of investment mood for April showed sentiment on

US stocks slid by 12.2 per cent month-on-month to minus 2.3 per

cent. This is the largest monthly fall since 2013.

Fears of a trade war between the US and China

have escalated, and markets have become volatile; the US is

proposing to slap tariffs on hundreds of Chinese products. China

said it will retaliate with tariffs on various US items.

According to Lloyds PB, US equities were down 2.4 per cent

although they were still 11.7 per cent higher than a year

before. Despite the escalating trade row, sentiment toward

emerging market shares, which include those of China, remained

positive at 20.2 per cent. This remained the highest amongst

global equities.

UK equities

UK shares saw the second largest drop in sentiment, falling 5.0

per cent to 0.6 per cent. Brexit uncertainty continues to

cloud the outlook for UK shares. UK government

bonds saw an increase in positive sentiment (up 2.6 per

cent). Lloyds PB said that gilts benefited from a “flight to

safety amid market turbulence since the start of the

year”.

Japan

Sentiment towards Japanese equities declined by 2.6 per cent in

April, mirroring the 2.7 per cent drop in Japanese

equities.

Overall sentiment towards Japanese investments

remained positive at 11.1 per cent. Lloyds PB

said Japan is a good area of investment, as the Japanese

economy is in robust health and Japanese companies are beginning

to return more of their earnings to shareholders.

“The current political backdrop is unsurprisingly impacting on

global equity markets,” said Markus Stadlmann, chief investment

at Lloyds Bank Private Banking. “A fall in sentiment reflects

investor concerns about the impact of a trade dispute between the

world’s two largest economies, the United States and China. This

uncertainty has caused a repeat of the correction we saw in

February and a flight to safety causing bond prices to stabilise

following declines earlier in 2018. However we believe this

stabilisation will only be temporary and the outlook for bonds

moving forward remains bearish.”

Stadlmann added: “Despite this, most of the world’s economies are

experiencing good growth than we have seen since the financial

crisis of 2008.The recent correction has led to lower share

prices, leading to some attractive opportunities for long term

investors in equity markets and inflation continues to grow

modestly in most developed nations; subsequently the overall

sentiment remains positive."

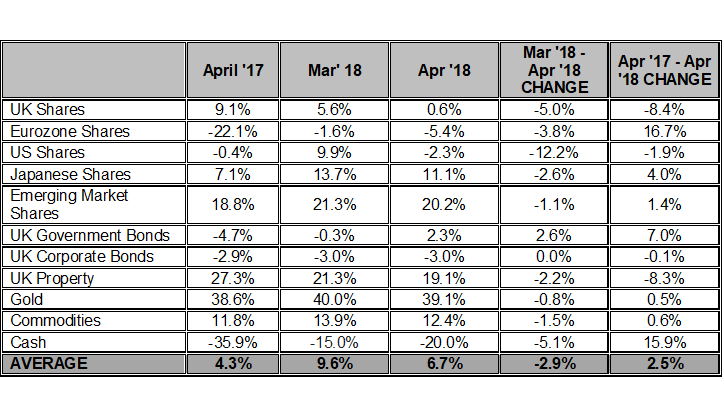

Source: Lloyds Private Bank Table 1: Net

Sentiment