Surveys

UK Investor Sentiment Continues To Weaken - Private Bank Survey

A study of investor sentiment by the private banking arm of Lloyds Banking Group shows that the glum mood of late last year hasn’t yet lifted.

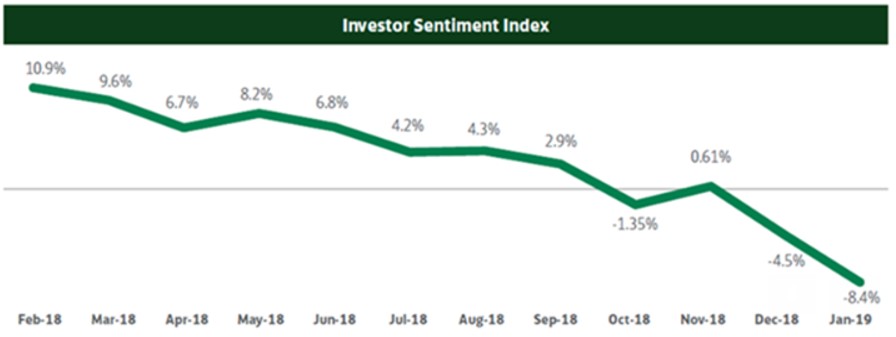

Investor sentiment has reached a new low of -8.4 per cent

following the biggest year-on-year fall on record (of 20.7 per

cent), according to research by Lloyds

Bank Private Banking.

The bank’s latest Investor Sentiment Index shows that the biggest

loss of confidence in January is in US shares – down by 23.4 per

cent – overtaking UK assets which saw the biggest fall last

month. With the murmurs of a US recession growing louder, this is

the largest month-on-month drop on record, reaching the asset

class’s lowest level since the index began in 2013.

“In the early weeks of 2019, equity and commodity markets are

walking on feet of clay. The hefty price fluctuations since

October 2018 and the fall in oil prices have wreaked havoc on

investor sentiment, leaving some confused,” Markus Stadlmann,

chief investment officer at Lloyds Bank Private Banking,

said.

“There is some help on the way. Market action and liquidity

injections by central banks have begun during recent weeks, led

by the People’s Bank of China. Fed chair, Jerome Powell,

indicated a moderation of interest rate hikes and the government

of China has facilitated an increase in infrastructure spending

in a bid to help turn around national income. Investors should

feel reassured by these moves to aid the potential return of

global economic stability and growth,” he added.

The mood has been hit by uncertainties about what sort of exit

the UK will achieve from the European Union, coupled with

concerns about US-China protectionism, rising US interest rates

and the fact that the global stock bull market cycle is in its

latter stages.

Confidence in UK shares dropped by 2.1 per cent from -27.1 per

cent in last month’s research and surpassing December 2018’s

record low. Since January 2018, sentiment for UK shares has

dropped by 41.5 per cent. UK corporate bonds have also reached a

new all-time low, falling a further 2.6 per cent in sentiment

compared with last month.

Optimism in UK property has recovered slightly, bouncing back

from the record low of -21.7 per cent last month, with an

increase of 4.7 per cent. Despite this, the research shows that

confidence is still 31.7 per cent down on this time last year.

Downward slope

Rest of the world

It is not only the US and UK markets that have seen a decline in

sentiment this month, as confidence in the outlook for eurozone

shares has also fallen, by 9.7 per cent. Sentiment towards

Japanese shares has fallen by 8 per cent and emerging market

shares confidence has dipped by 3.2 per cent.

UK asset classes continue to perform ahead of international

shares

Looking at performance, the only increase in value since last

month is from UK government bonds (+0.8 per cent), UK corporate

bonds (+0.7 per cent), gold (+4.5 per cent) and cash (+0.1 per

cent). Despite the slight uptick in investor sentiment towards UK

property this month, its value remains 20.3 per cent lower than

January 2018. Even gold, which can be perceived as a safe haven

asset - which has seen sentiment increase by 8.9 per cent

compared with last year - has actually fallen in value over the

last 12 months, declining by 2.7 per cent.

All figures, unless otherwise stated, are from YouGov. Total sample size was 4,278 adults, of which 1,089 were investors.